2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3 Consolidated<br />

PAGE 126<br />

fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

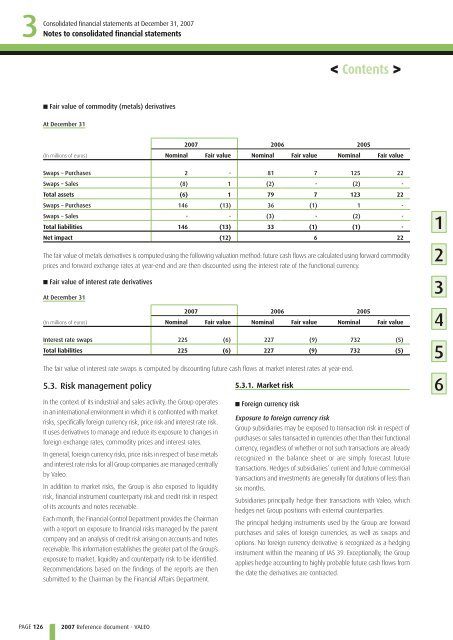

■ Fair value of c ommodity (metals) derivatives<br />

At December 31<br />

(In millions of euros)<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

<strong>2007</strong> 2006 2005<br />

Nominal Fair value Nominal Fair value Nominal Fair value<br />

Swaps – Purchases 2 - 81 7 125 22<br />

Swaps – Sales (8) 1 (2) - (2) -<br />

Total assets (6) 1 79 7 123 22<br />

Swaps – Purchases 146 (13) 36 (1) 1 -<br />

Swaps – Sales - - (3) - (2) -<br />

Total liabilities 146 (13) 33 (1) (1) -<br />

Net impact (12) 6 22<br />

The fair value of metals derivatives is computed using the following valuation method: future cash flows are calculated using forward commodity<br />

prices and forward exchange rates at year-end and are then discounted using the interest rate of the functional currency.<br />

■ Fair value of i nterest rate derivatives<br />

At December 31<br />

(In millions of euros)<br />

<strong>2007</strong> 2006 2005<br />

Nominal Fair value Nominal Fair value Nominal Fair value<br />

Interest rate swaps 225 (6) 227 (9) 732 (5)<br />

Total liabilities 225 (6) 227 (9) 732 (5)<br />

The fair value of interest rate swaps is computed by discounting future cash flows at market interest rates at year-end.<br />

5.3. Risk management policy<br />

In the context of its industrial and sales activity, the Group operates<br />

in an international environment in which it is confronted with market<br />

risks, specifically foreign currency risk, price risk and interest rate risk.<br />

It uses derivatives to manage and reduce its exposure to changes in<br />

foreign exchange rates, commodity prices and interest rates.<br />

In general, foreign currency risks, price risks in respect of base metals<br />

and interest rate risks for all Group companies are managed centrally<br />

by <strong>Valeo</strong>.<br />

In addition to market risks, the Group is also exposed to liquidity<br />

risk, financial instrument counterparty risk and credit risk in respect<br />

of its accounts and notes receivable.<br />

Each month, the Financial Control Department provides the Chairman<br />

with a report on exposure to financial risks managed by the parent<br />

company and an analysis of credit risk arising on accounts and notes<br />

receivable. This information establishes the greater part of the Group’s<br />

exposure to market, liquidity and counterparty risk to be identified.<br />

Recommendations based on the findings of the reports are then<br />

submitted to the Chairman by the Financial Affairs Department.<br />

5.3.1. Market risk<br />

■ Foreign currency risk<br />

< Contents ><br />

Exposure to foreign currency risk<br />

Group subsidiaries may be exposed to transaction risk in respect of<br />

purchases or sales transacted in currencies other than their functional<br />

currency, regardless of whether or not such transactions are already<br />

recognized in the balance sheet or are simply forecast future<br />

transactions. Hedges of subsidiaries’ current and future commercial<br />

transactions and investments are generally for durations of less than<br />

six months.<br />

Subsidiaries principally hedge their transactions with <strong>Valeo</strong>, which<br />

hedges net Group positions with external counterparties.<br />

The principal hedging instruments used by the Group are forward<br />

purchases and sales of foreign currencies, as well as swaps and<br />

options. No foreign currency derivative is recognized as a hedging<br />

instrument within the meaning of IAS 39. Exceptionally, the Group<br />

applies hedge accounting to highly probable future cash flows from<br />

the date the derivatives are contracted.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6