2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4.8. Stockholders’ equity<br />

4.8.1. Share capital<br />

At December 31, <strong>2007</strong>, <strong>Valeo</strong>’s share capital totaled 235 million<br />

euros, comprising 78,209,617 shares of common stock with a par<br />

value of 3 euros, all fully paid-up, excluding treasury stock - see<br />

note 4.8.6. Shares that have been registered in the name of the<br />

same holder for at least four years carry double voting rights<br />

(2,206,124 shares at December 31, <strong>2007</strong>).<br />

<strong>Valeo</strong>’s potential share capital would amount to 274 million euros,<br />

representing 91,184,612 shares, in the event of:<br />

■<br />

■<br />

the exercise of stock subscription options granted to <strong>Valeo</strong> Group<br />

employees;<br />

the conversion of bonds issued as part of the OCEANE program<br />

into new shares (see note 4.10.2).<br />

Consolidated fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

The Group seeks to maintain a solid capital base in order to retain the<br />

confidence of investors, creditors and the market, and to secure its<br />

future development. Its policy is to strike a balance between levels of<br />

debt and equity, and in particular to prevent net debt from exceeding<br />

100% of stockholders’ equity for any prolonged period of time.<br />

Employee-shareholders currently represent 1% of the Group’s share<br />

capital. The Group aims to increase this percentage by regularly<br />

implementing company savings plans and by extending stock option<br />

plans and free share awards to a broader section of the workforce.<br />

The Group buys back treasury stock on the market to cover its<br />

obligations with regard to stock option plans and free share awards,<br />

as well as the company savings awards and liquidity contract (see<br />

section 4.2.2 of the Management Report).<br />

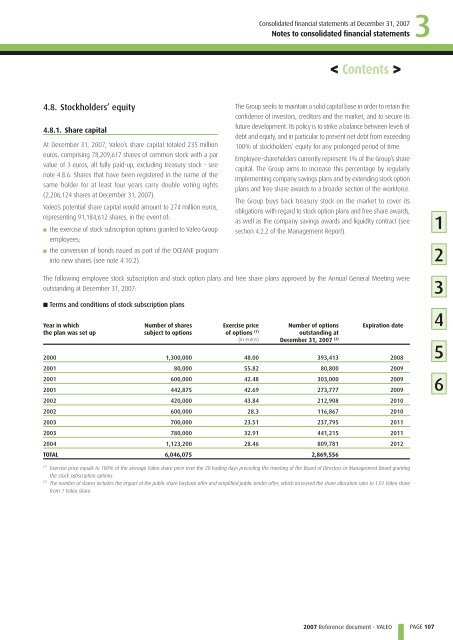

The following employee stock subscription and stock option plans and free share plans approved by the Annual General Meeting were<br />

outstanding at December 31, <strong>2007</strong>:<br />

■ Terms and conditions of stock subscription plans<br />

Year in which<br />

the plan was set up<br />

Number of shares<br />

subject to options<br />

Exercise price<br />

of options (1)<br />

(in euros)<br />

Number of options<br />

outstanding at<br />

December 31, <strong>2007</strong> (2)<br />

< Contents ><br />

Expiration date<br />

2000 1,300,000 48.00 393,413 2008<br />

2001 80,000 55.82 80,800 2009<br />

2001 600,000 42.48 303,000 2009<br />

2001 442,875 42.69 273,777 2009<br />

2002 420,000 43.84 212,908 2010<br />

2002 600,000 28.3 116,867 2010<br />

2003 700,000 23.51 237,795 2011<br />

2003 780,000 32.91 441,215 2011<br />

2004 1,123,200 28.46 809,781 2012<br />

TOTAL 6,046,075 2,869,556<br />

(1)<br />

Exercise price equals to 100% of the average <strong>Valeo</strong> share price over the 20 trading days preceding the meeting of the Board of Directors or Management Board granting<br />

the stock subscription options.<br />

(2)<br />

The number of shares includes the impact of the public share buyback offer and simplified public tender offer, which increased the share allocation ratio to 1.01 <strong>Valeo</strong> share<br />

from 1 <strong>Valeo</strong> share.<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

3<br />

PAGE 107<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6