2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3 Consolidated<br />

PAGE 124<br />

fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

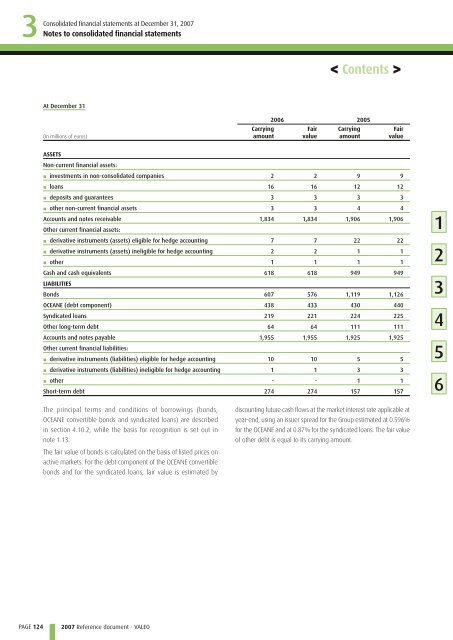

At December 31<br />

(In millions of euros)<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

Carrying<br />

amount<br />

2006 2005<br />

Fair<br />

value<br />

Carrying<br />

amount<br />

ASSETS<br />

Non-current financial assets:<br />

▪ i nvestments in non-consolidated companies<br />

2 2 9 9<br />

▪ l oans<br />

16 16 12 12<br />

▪ d eposits and guarantees<br />

3 3 3 3<br />

▪ o ther non-current financial assets<br />

3 3 4 4<br />

Accounts and notes receivable<br />

Other current financial assets:<br />

1,834 1,834 1,906 1,906<br />

▪ d erivative instruments (assets) eligible for hedge accounting<br />

7 7 22 22<br />

▪ d erivative instruments (assets) ineligible for hedge accounting<br />

2 2 1 1<br />

▪ o ther<br />

1 1 1 1<br />

Cash and cash equivalents<br />

LIABILITIES<br />

618 618 949 949<br />

Bonds 607 576 1,119 1,126<br />

OCEANE (debt component) 438 433 430 440<br />

Syndicated loans 219 221 224 225<br />

Other long-term debt 64 64 111 111<br />

Accounts and notes payable<br />

Other current financial liabilities:<br />

1,955 1,955 1,925 1,925<br />

▪ d erivative instruments (liabilities) eligible for hedge accounting<br />

10 10 5 5<br />

▪ d erivative instruments (liabilities) ineligible for hedge accounting<br />

1 1 3 3<br />

▪ o ther<br />

- - 1 1<br />

Short-term debt 274 274 157 157<br />

The principal terms and conditions of borrowings (bonds,<br />

OCEANE convertible bonds and syndicated loans) are described<br />

in section 4.10.2, while the basis for recognition is set out in<br />

note 1.13.<br />

The fair value of bonds is calculated on the basis of listed prices on<br />

active markets. For the debt component of the OCEANE convertible<br />

bonds and for the syndicated loans, fair value is estimated by<br />

< Contents ><br />

Fair<br />

value<br />

discounting future cash flows at the market interest rate applicable at<br />

year-end, using an issuer spread for the Group estimated at 0.596%<br />

for the OCEANE and at 0.87% for the syndicated loans. The fair value<br />

of other debt is equal to its carrying amount.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6