2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fixed compensation and benefits-in-kind<br />

The total gross fixed compensation paid to Thierry Morin for <strong>2007</strong><br />

amounted to 1,577,590 euros (including travel expenses), and<br />

19,543 euros in benefits-in-kind.<br />

Exceptional bonus<br />

Thierry Morin did not receive any exceptional compensation in <strong>2007</strong><br />

for 2006.<br />

At its meeting of March 7, <strong>2007</strong>, in accordance with recommendations<br />

made by the Nomination and Remuneration Committee, the Board<br />

of Directors decided that any exceptional bonus to be awarded<br />

to the Chairman and Chief Executive Officer for <strong>2007</strong> would be<br />

exclusively contingent on the level of gross margin and operating<br />

margin achieved by the Group, and would be capped by the Board<br />

based on recommendations by the Nomination and Remuneration<br />

Committee.<br />

Attendance fees<br />

In <strong>2007</strong>, Thierry Morin received 20,000 euros in attendance fees in<br />

his capacity as a Director of <strong>Valeo</strong>.<br />

Compensation paid by companies controlled by <strong>Valeo</strong><br />

Thierry Morin received gross compensation of 45,750 euros from<br />

companies controlled by <strong>Valeo</strong> (as defined in Article L. 233-16 of the<br />

French Commercial Code), corresponding to attendance fees.<br />

Stock options<br />

In <strong>2007</strong>, the Board of Directors granted Thierry Morin 200,000 stock<br />

options at its meeting of March 7 and 150,000 options at its meeting<br />

of November 15. These options are subject to the following terms<br />

and conditions:<br />

■<br />

at its meeting of March 7, <strong>2007</strong> the Board set the purchase price<br />

for the 200,000 shares underlying the stock options at 36.97 euros,<br />

it being specified that (i) 50% of the options are exercisable from<br />

March 7, 2009, and all of the options from March 7, 2010, and<br />

that the shares obtained upon exercise of the options may not<br />

be sold before March 7, 2011; and (ii) any unexercised options<br />

will be forfeited on March 6, 2015. Thierry Morin shall continue<br />

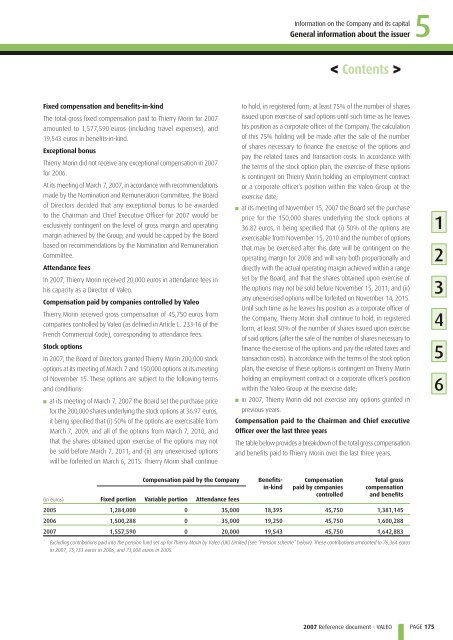

(in euros)<br />

Compensation paid by the Company Benefitsin-kind<br />

Fixed portion Variable portion Attendance fees<br />

Information on the Company and its capital<br />

General information about the issuer<br />

to hold, in registered form, at least 75% of the number of shares<br />

issued upon exercise of said options until such time as he leaves<br />

his position as a corporate officer of the Company. The calculation<br />

of this 75% holding will be made after the sale of the number<br />

of shares necessary to finance the exercise of the options and<br />

pay the related taxes and transaction costs. In accordance with<br />

the terms of the stock option plan, the exercise of these options<br />

is contingent on Thierry Morin holding an employment contract<br />

or a corporate officer’s position within the <strong>Valeo</strong> Group at the<br />

exercise date;<br />

■ at its meeting of November 15, <strong>2007</strong> the Board set the purchase<br />

price for the 150,000 shares underlying the stock options at<br />

36.82 euros, it being specified that (i) 50% of the options are<br />

exercisable from November 15, 2010 and the number of options<br />

that may be exercised after this date will be contingent on the<br />

operating margin for 2008 and will vary both proportionally and<br />

directly with the actual operating margin achieved within a range<br />

set by the Board, and that the shares obtained upon exercise of<br />

the options may not be sold before November 15, 2011; and (ii)<br />

any unexercised options will be forfeited on November 14, 2015.<br />

Until such time as he leaves his position as a corporate officer of<br />

the Company, Thierry Morin shall continue to hold, in registered<br />

form, at least 50% of the number of shares issued upon exercise<br />

of said options (after the sale of the number of shares necessary to<br />

finance the exercise of the options and pay the related taxes and<br />

transaction costs). In accordance with the terms of the stock option<br />

plan, the exercise of these options is contingent on Thierry Morin<br />

holding an employment contract or a corporate officer’s position<br />

within the <strong>Valeo</strong> Group at the exercise date;<br />

■ in <strong>2007</strong>, Thierry Morin did not exercise any options granted in<br />

previous years.<br />

Compensation paid to the Chairman and Chief executive<br />

Officer over the last three years<br />

The table below provides a breakdown of the total gross compensation<br />

and benefits paid to Thierry Morin over the last three years.<br />

Compensation<br />

paid by companies<br />

controlled<br />

Total gross<br />

compensation<br />

and benefits<br />

2005 1,284,000 0 35,000 18,395 45,750 1,381,145<br />

2006 1,500,288 0 35,000 19,250 45,750 1,600,288<br />

<strong>2007</strong> 1,557,590 0 20,000 19,543 45,750 1,642,883<br />

* Excluding contributions paid into the pension fund set up for Thierry Morin by <strong>Valeo</strong> (UK) Limited (see “Pension scheme” below). These contributions amounted to 76,364 euros<br />

in <strong>2007</strong>, 75,133 euros in 2006, and 73,008 euros in 2005.<br />

< Contents ><br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

5<br />

PAGE 175<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6