2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

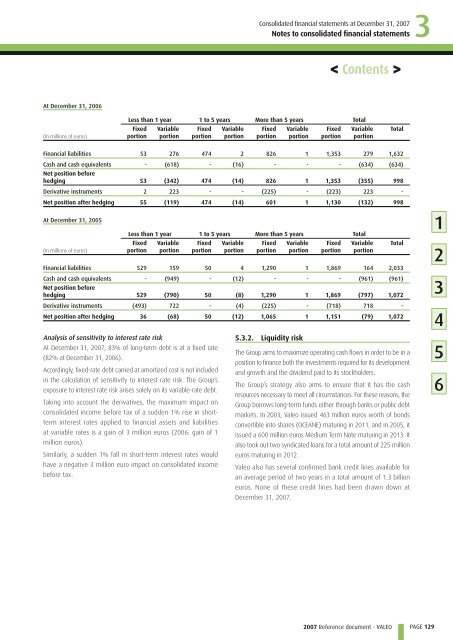

At December 31, 2006<br />

(In millions of euros)<br />

Analysis of sensitivity to interest rate risk<br />

At December 31, <strong>2007</strong>, 83% of long-term debt is at a fixed rate<br />

(82% at December 31, 2006).<br />

Accordingly, fixed-rate debt carried at amortized cost is not included<br />

in the calculation of sensitivity to interest rate risk. The Group’s<br />

exposure to interest rate risk arises solely on its variable-rate debt.<br />

Taking into account the derivatives, the maximum impact on<br />

consolidated income before tax of a sudden 1% rise in shortterm<br />

interest rates applied to financial assets and liabilities<br />

at variable rates is a gain of 3 million euros (2006: gain of 1<br />

million euros).<br />

Similarly, a sudden 1% fall in short-term interest rates would<br />

have a negative 3 million euro impact on consolidated income<br />

before tax.<br />

Consolidated fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

Less than 1 year 1 to 5 years More than 5 years Total<br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

5.3.2. Liquidity risk<br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

Financial liabilities 53 276 474 2 826 1 1,353 279 1,632<br />

Cash and cash equivalents<br />

Net position before<br />

- (618) - (16) - - - (634) (634)<br />

hedging 53 (342) 474 (14) 826 1 1,353 (355) 998<br />

Derivative instruments 2 223 - - (225) - (223) 223 -<br />

Net position after hedging 55 (119) 474 (14) 601 1 1,130 (132) 998<br />

At December 31, 2005<br />

(In millions of euros)<br />

Less than 1 year 1 to 5 years More than 5 years Total<br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

< Contents ><br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

Financial liabilities 529 159 50 4 1,290 1 1,869 164 2,033<br />

Cash and cash equivalents<br />

Net position before<br />

- (949) - (12) - - - (961) (961)<br />

hedging 529 (790) 50 (8) 1,290 1 1,869 (797) 1,072<br />

Derivative instruments (493) 722 - (4) (225) - (718) 718 -<br />

Net position after hedging 36 (68) 50 (12) 1,065 1 1,151 (79) 1,072<br />

The Group aims to maximize operating cash flows in order to be in a<br />

position to finance both the investments required for its development<br />

and growth and the dividend paid to its stockholders.<br />

The Group’s strategy also aims to ensure that it has the cash<br />

resources necessary to meet all circumstances. For these reasons, the<br />

Group borrows long-term funds either through banks or public debt<br />

markets. In 2003, <strong>Valeo</strong> issued 463 million euros worth of bonds<br />

convertible into shares (OCEANE) maturing in 2011, and in 2005, it<br />

issued a 600 million euros Medium Term Note maturing in 2013. It<br />

also took out two syndicated loans for a total amount of 225 million<br />

euros maturing in 2012.<br />

<strong>Valeo</strong> also has several confirmed bank credit lines available for<br />

an average period of two years in a total amount of 1.3 billion<br />

euros. None of these credit lines had been drawn down at<br />

December 31, <strong>2007</strong>.<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

Total<br />

Total<br />

3<br />

PAGE 129<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6