2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

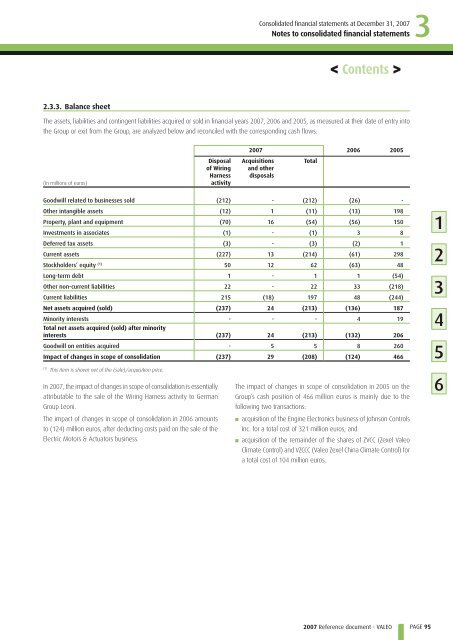

2.3.3. Balance sheet<br />

Consolidated fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

The assets, liabilities and contingent liabilities acquired or sold in financial years <strong>2007</strong>, 2006 and 2005, as measured at their date of entry into<br />

the Group or exit from the Group, are analyzed below and reconciled with the corresponding cash flows:<br />

(In millions of euros)<br />

Disposal<br />

of Wiring<br />

Harness<br />

activity<br />

<strong>2007</strong> 2006 2005<br />

Acquisitions<br />

and other<br />

disposals<br />

Goodwill related to businesses sold (212) - (212) (26) -<br />

Other intangible assets (12) 1 (11) (13) 198<br />

Property, plant and equipment (70) 16 (54) (56) 150<br />

Investments in associates (1) - (1) 3 8<br />

Deferred tax assets (3) - (3) (2) 1<br />

Current assets (227) 13 (214) (61) 298<br />

Stockholders’ equity (1) 50 12 62 (63) 48<br />

Long-term debt 1 - 1 1 (54)<br />

Other non-current liabilities 22 - 22 33 (218)<br />

Current liabilities 215 (18) 197 48 (244)<br />

Net assets acquired (sold) (237) 24 (213) (136) 187<br />

Minority interests - - - 4 19<br />

Total net assets acquired (sold) after minority<br />

interests (237) 24 (213) (132) 206<br />

Goodwill on entities acquired - 5 5 8 260<br />

Impact of changes in scope of consolidation (237) 29 (208) (124) 466<br />

(1) This item is shown net of the (sale)/acquisition price.<br />

In <strong>2007</strong>, the impact of changes in scope of consolidation is essentially<br />

attributable to the sale of the Wiring H arness activity to German<br />

Group Leoni.<br />

The impact of changes in scope of consolidation in 2006 amounts<br />

to (124) million euros, after deducting costs paid on the sale of the<br />

Electric Motors & Actuators business.<br />

Total<br />

The impact of changes in scope of consolidation in 2005 on the<br />

Group’s cash position of 466 million euros is mainly due to the<br />

following two transactions:<br />

■<br />

■<br />

< Contents ><br />

acquisition of the Engine Electronics business of Johnson Controls<br />

Inc. for a total cost of 321 million euros; and<br />

acquisition of the remainder of the shares of ZVCC (Zexel <strong>Valeo</strong><br />

Climate Control) and VZCCC (<strong>Valeo</strong> Zexel China Climate Control) for<br />

a total cost of 104 million euros.<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

3<br />

PAGE 95<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6