2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3 Consolidated<br />

PAGE 110<br />

fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

Free shares and stock<br />

options<br />

2006<br />

March November<br />

Free shares and stock<br />

options<br />

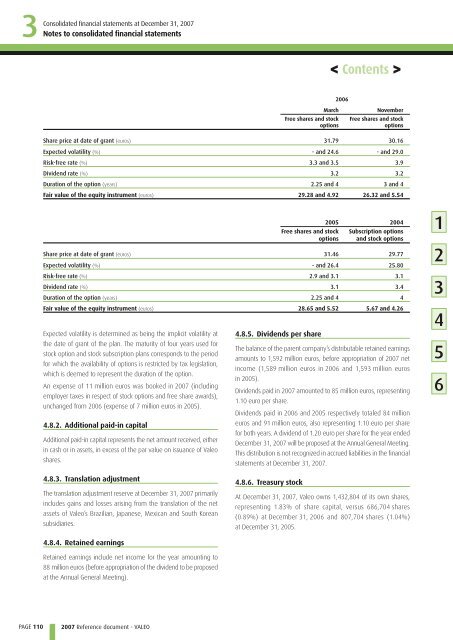

Share price at date of grant (euros) 31.79 30.16<br />

Expected volatility (%) - and 24.6 - and 29.0<br />

Risk-free rate (%) 3.3 and 3.5 3.9<br />

Dividend rate (%) 3.2 3.2<br />

Duration of the option (years) 2.25 and 4 3 and 4<br />

Fair value of the equity instrument (euros) 29.28 and 4.92 26.32 and 5.54<br />

Free shares and stock<br />

options<br />

2005 2004<br />

Subscription options<br />

and stock options<br />

Share price at date of grant (euros) 31.46 29.77<br />

Expected volatility (%) - and 26.4 25.80<br />

Risk-free rate (%) 2.9 and 3.1 3.1<br />

Dividend rate (%) 3.1 3.4<br />

Duration of the option (years) 2.25 and 4 4<br />

Fair value of the equity instrument (euros) 28.65 and 5.52 5.67 and 4.26<br />

Expected volatility is determined as being the implicit volatility at<br />

the date of grant of the plan. The maturity of four years used for<br />

stock option and stock subscription plans corresponds to the period<br />

for which the availability of options is restricted by tax legislation,<br />

which is deemed to represent the duration of the option.<br />

An expense of 11 million euros was booked in <strong>2007</strong> (including<br />

employer taxes in respect of stock options and free share awards),<br />

unchanged from 2006 (expense of 7 million euros in 2005).<br />

4.8.2. Additional paid-in capital<br />

Additional paid-in capital represents the net amount received, either<br />

in cash or in assets, in excess of the par value on issuance of <strong>Valeo</strong><br />

shares.<br />

4.8.3. Translation adjustment<br />

The translation adjustment reserve at December 31, <strong>2007</strong> primarily<br />

includes gains and losses arising from the translation of the net<br />

assets of <strong>Valeo</strong>’s Brazilian, Japanese, Mexican and South Korean<br />

subsidiaries.<br />

4.8.4. Retained earnings<br />

Retained earnings include net income for the year amounting to<br />

88 million euros (before appropriation of the dividend to be proposed<br />

at the Annual General Meeting).<br />

4.8.5. Dividends per share<br />

The balance of the parent company’s distributable retained earnings<br />

amounts to 1,592 million euros, before appropriation of <strong>2007</strong> net<br />

income (1,589 million euros in 2006 and 1,593 million euros<br />

in 2005).<br />

Dividends paid in <strong>2007</strong> amounted to 85 million euros, representing<br />

1.10 euro per share.<br />

Dividends paid in 2006 and 2005 respectively totaled 84 million<br />

euros and 91 million euros, also representing 1.10 euro per share<br />

for both years. A dividend of 1.20 euro per share for the year ended<br />

December 31, <strong>2007</strong> will be proposed at the Annual General Meeting.<br />

This distribution is not recognized in accrued liabilities in the financial<br />

statements at December 31, <strong>2007</strong>.<br />

4.8.6. Treasury stock<br />

< Contents ><br />

At December 31, <strong>2007</strong>, <strong>Valeo</strong> owns 1,432,804 of its own shares,<br />

representing 1.83% of share capital, versus 686,704 shares<br />

(0.89%) at December 31, 2006 and 807,704 shares (1.04%)<br />

at December 31, 2005.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6