2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

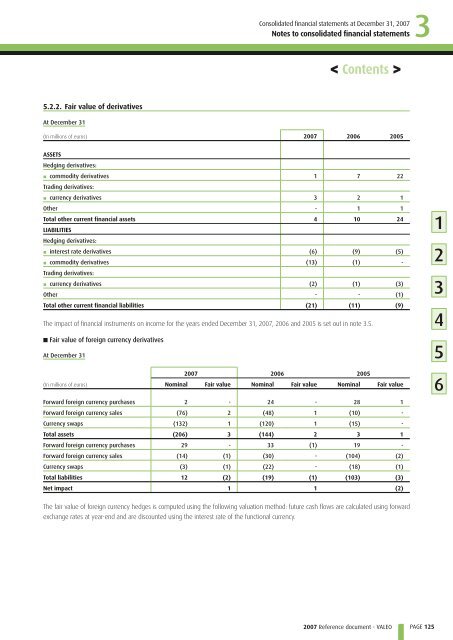

5.2.2. Fair value of derivatives<br />

At December 31<br />

Consolidated fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

(In millions of euros) <strong>2007</strong> 2006 2005<br />

ASSETS<br />

Hedging derivatives:<br />

▪ c ommodity derivatives<br />

1 7 22<br />

Trading derivatives:<br />

▪ c urrency derivatives<br />

3 2 1<br />

Other - 1 1<br />

Total other current financial assets<br />

LIABILITIES<br />

Hedging derivatives:<br />

4 10 24<br />

▪ i nterest rate derivatives<br />

(6) (9) (5)<br />

▪ c ommodity derivatives<br />

(13) (1) -<br />

Trading derivatives:<br />

▪ c urrency derivatives<br />

(2) (1) (3)<br />

Other - - (1)<br />

Total other current financial liabilities (21) (11) (9)<br />

The impact of financial instruments on income for the years ended December 31, <strong>2007</strong>, 2006 and 2005 is set out in note 3.5.<br />

■ Fair value of f oreign currency derivatives<br />

At December 31<br />

(In millions of euros)<br />

< Contents ><br />

<strong>2007</strong> 2006 2005<br />

Nominal Fair value Nominal Fair value Nominal Fair value<br />

Forward foreign currency purchases 2 - 24 - 28 1<br />

Forward foreign currency sales (76) 2 (48) 1 (10) -<br />

Currency swaps (132) 1 (120) 1 (15) -<br />

Total assets (206) 3 (144) 2 3 1<br />

Forward foreign currency purchases 29 - 33 (1) 19 -<br />

Forward foreign currency sales (14) (1) (30) - (104) (2)<br />

Currency swaps (3) (1) (22) - (18) (1)<br />

Total liabilities 12 (2) (19) (1) (103) (3)<br />

Net impact 1 1 (2)<br />

The fair value of foreign currency hedges is computed using the following valuation method: future cash flows are calculated using forward<br />

exchange rates at year-end and are discounted using the interest rate of the functional currency.<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

3<br />

PAGE 125<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6