2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3 Consolidated<br />

PAGE 108<br />

fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

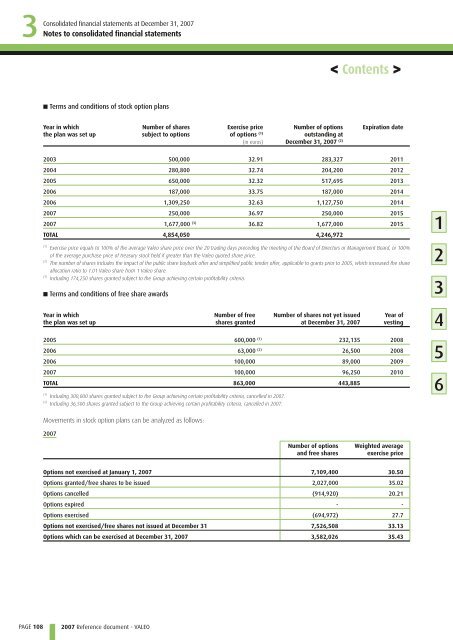

■ Terms and conditions of stock option plans<br />

Year in which<br />

the plan was set up<br />

■ Terms and conditions of free share awards<br />

Movements in stock option plans can be analyzed as follows:<br />

<strong>2007</strong><br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

Number of shares<br />

subject to options<br />

Exercise price<br />

of options (1)<br />

(in euros)<br />

Number of options<br />

outstanding at<br />

December 31, <strong>2007</strong> (2)<br />

Number of options<br />

and free shares<br />

Expiration date<br />

2003 500,000 32.91 283,327 2011<br />

2004 280,800 32.74 204,200 2012<br />

2005 650,000 32.32 517,695 2013<br />

2006 187,000 33.75 187,000 2014<br />

2006 1,309,250 32.63 1,127,750 2014<br />

<strong>2007</strong> 250,000 36.97 250,000 2015<br />

<strong>2007</strong> 1,677,000 (3) 36.82 1,677,000 2015<br />

TOTAL 4,854,050 4,246,972<br />

(1)<br />

Exercise price equals to 100% of the average <strong>Valeo</strong> share price over the 20 trading days preceding the meeting of the Board of Directors or Management Board, or 100%<br />

of the average purchase price of treasury stock held if greater than the <strong>Valeo</strong> quoted share price.<br />

(2)<br />

The number of shares includes the impact of the public share buyback offer and simplified public tender offer, applicable to grants prior to 2005, which increased the share<br />

allocation ratio to 1.01 <strong>Valeo</strong> share from 1 <strong>Valeo</strong> share.<br />

(3)<br />

Including 174,250 shares granted subject to the Group achieving certain profitability criteria.<br />

Year in which<br />

the plan was set up<br />

Number of free<br />

shares granted<br />

Number of shares not yet issued<br />

at December 31, <strong>2007</strong><br />

Year of<br />

vesting<br />

2005 600,000 (1) 232,135 2008<br />

2006 63,000 (2) 26,500 2008<br />

2006 100,000 89,000 2009<br />

<strong>2007</strong> 100,000 96,250 2010<br />

TOTAL 863,000 443,885<br />

(1) Including 300,000 shares granted subject to the Group achieving certain profitability criteria, cancelled in <strong>2007</strong>.<br />

(2) Including 36,500 shares granted subject to the Group achieving certain profitability criteria, cancelled in <strong>2007</strong>.<br />

< Contents ><br />

Weighted average<br />

exercise price<br />

Options not exercised at January 1, <strong>2007</strong> 7,109,400 30.50<br />

Options granted/free shares to be issued 2,027,000 35.02<br />

Options cancelled (914,920) 20.21<br />

Options expired - -<br />

Options exercised (694,972) 27.7<br />

Options not exercised/free shares not issued at December 31 7,526,508 33.13<br />

Options which can be exercised at December 31, <strong>2007</strong> 3,582,026 35.43<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6