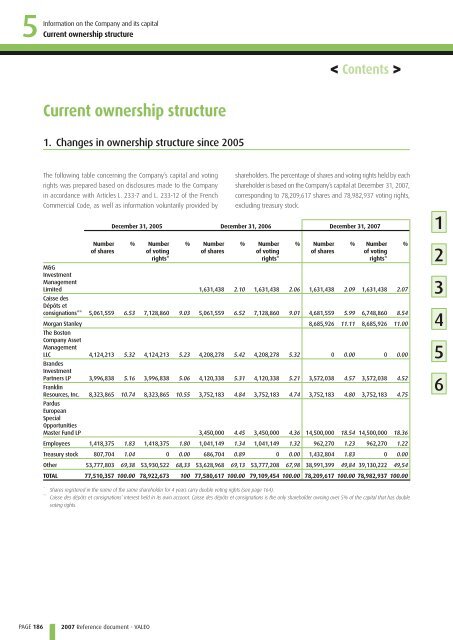

5 Information PAGE 186 on the Company and its capital Current ownership structure Current ownership structure 1. Changes in ownership structure since 2005 The following table concerning the Company’s capital and voting rights was prepared based on disclosures made to the Company in accordance with Articles L. 233-7 and L. 233-12 of the French Commercial Code, as well as information voluntarily provided by Number of shares <strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO shareholders. The percentage of shares and voting rights held by each shareholder is based on the Company’s capital at December 31, <strong>2007</strong>, corresponding to 78,209,617 shares and 78,982,937 voting rights, excluding treasury stock. December 31, 2005 December 31, 2006 December 31, <strong>2007</strong> % Number of voting rights* % Number of shares % Number of voting rights* % Number of shares % Number of voting rights* M&G Investment Management Limited Caisse des Dépôts et 1,631,438 2 .10 1,631,438 2 .06 1,631,438 2.09 1,631,438 2.07 consignations** 5,061,559 6.53 7,128,860 9.03 5,061,559 6.52 7,128,860 9.01 4,681,559 5.99 6,748,860 8.54 Morgan Stanley The Boston Company Asset Management 8,685,926 11.11 8,685,926 11.00 LLC Brandes Investment 4,124,213 5.32 4,124,213 5.23 4,208,278 5.42 4,208,278 5.32 0 0.00 0 0.00 Partners LP Franklin 3,996,838 5.16 3,996,838 5.06 4,120,338 5.31 4,120,338 5.21 3,572,038 4.57 3,572,038 4.52 Resources, Inc. Pardus European Special Opportunities 8,323,865 10.74 8,323,865 10.55 3,752,183 4.84 3,752,183 4.74 3,752,183 4.80 3,752,183 4.75 Master Fund LP 3,450,000 4.45 3,450,000 4.36 14,500,000 18.54 14,500,000 18.36 Employees 1,418,375 1.83 1,418,375 1.80 1,041,149 1.34 1,041,149 1.32 962,270 1.23 962,270 1.22 Treasury stock 807,704 1.04 0 0.00 686,704 0.89 0 0.00 1,432,804 1.83 0 0.00 Other 53,777,803 69,38 53,930,522 68,33 53,628,968 69,13 53,777,208 67,98 38,991,399 49,84 39,130,222 49,54 TOTAL 77,510,357 100.00 78,922,673 100 77,580,617 100.00 79,109,454 100.00 78,209,617 100.00 78,982,937 100.00 * Shares registered in the name of the same shareholder for 4 years carry double voting rights (see page 164 ). ** Caisse des dépôts et consignations’ interest held in its own account. Caisse des dépôts et consignations is the only shareholder owning over 5% of the capital that has double voting rights. < Contents > % 1 2 3 4 5 6

1.1. Major shareholders To the best of the Company’s knowledge, the only shareholders directly or indirectly holding 5% or more of the Company’s capital or voting rights at December 31, <strong>2007</strong> were Pardus European Special Opportunities Master Fund LP, Morgan Stanley and Caisse des dépôts et consignations. As far as the Company is aware, the only shareholders directly or indirectly holding 2% or more of the Company’s capital or voting rights at December 31, <strong>2007</strong> were Pardus European Special Opportunities Master Fund LP, Morgan Stanley, Caisse des dépôts et consignations, Franklin Resources, Inc., Brandes Investment Partners LP and M&G Investment Management Limited. On April 19, <strong>2007</strong> Brandes Investment Partners declared that it had reduced its interest to below the statutory 5% disclosure threshold and that it held 4.6% of the Company’s capital and 4.5% of the voting rights on April 13, <strong>2007</strong>. On June 19, <strong>2007</strong> the Société Générale group disclosed that as part of its trading operations, on June 15, <strong>2007</strong> it had reduced its interest to below the statutory 5% disclosure threshold and that it held 4.7% of the Company’s capital and 4.6% of the voting rights. The Société Générale group subsequently informed the Company that at December 28, <strong>2007</strong> it held only 0.8% of <strong>Valeo</strong>’s capital and voting rights. On June 20, <strong>2007</strong> Natixis disclosed that as part of its trading operations, on June 15, <strong>2007</strong> it had reduced its interest to below the statutory 5% disclosure threshold and that it held 2.9% of the Company’s capital and 2.8% of the voting rights. Natixis subsequently informed the Company that at December 31, <strong>2007</strong> it no longer held a significant percentage of <strong>Valeo</strong>’s capital or voting rights. On January 10, February 21 and May 25, <strong>2007</strong>, Pardus European Special Opportunities Master Fund LP raised its interests to above the statutory disclosure thresholds of 5%, 10% and 15% respectively. In its statement of intention dated February 26, <strong>2007</strong>, drawn up in accordance with Article L. 233-7 VII of the French Commercial Code, Pardus European Special Opportunities Master Fund LP declared that at that date it was not acting in concert with any third party and that it had no immediate plans to take over control of <strong>Valeo</strong> although it did reserve the right to continue to purchase or sell <strong>Valeo</strong> shares based on market opportunities and to request the appointment of one or more persons of its choosing as members of <strong>Valeo</strong>’s Board of Directors. In a subsequent letter dated August 8, <strong>2007</strong> sent to the C ompany, Pardus European Special Opportunities Master Fund LP disclosed that it had raised its interest in the Company’s capital and voting rights to above the threshold of18% set down by the Company’s by laws. In a letter dated November 22, <strong>2007</strong>, Morgan Stanley disclosed that it had raised its interest to above the statutory 5% disclosure threshold and that it held 5.2% of the Company’s capital and 5.1% Information on the Company and its capital Current ownership structure of the voting rights on November 16, <strong>2007</strong>. On December 27, <strong>2007</strong>, Morgan Stanley disclosed that it had increased its interest to above the 10% disclosure threshold and that it held 11.1% of the Company’s capital and 10.9% of the voting rights. It also declared that it was acting individually and that it did not intend to take over control of <strong>Valeo</strong> or request the appointment of any of its representatives on <strong>Valeo</strong>’s Board of Directors. On February 7, 2008, Franklin Resources, Inc. has informed the C ompany that through its affiliates they manage a position equivalent to 3.15% of capital and 3.14% of voting rights as of March 31, 2008. 1.2. Treasury stock < Contents > At December 31, <strong>2007</strong>, <strong>Valeo</strong> directly or indirectly held 1,432,804 of its own shares, representing 1.83% of the Company’s share capital, with a value of 34.115 euros per share based on their purchase price. At December 31, 2006, <strong>Valeo</strong> held 686,704 of its own shares (0.89% of the share capital). Out of the total number of treasury shares held at December 31, <strong>2007</strong>, 993,017 were earmarked for allocation on the exercise of stock options, compared with 617,704 at December 31, 2006. This increase reflects: (i) 448,325 shares acquired on November 5, <strong>2007</strong> to cover the implementation of the agreement for partial management of its share buyback program entered into with an investment services provider on August 31, <strong>2007</strong>; and (ii) the exercise of 72,234 stock options by Group employees granting entitlement to 73,012 shares. The shares acquired in <strong>2007</strong> were purchased at a price of 38.06 euros each. Trading fees for these transactions as well as the fees relating to the management agreement entered into with the investment services provider totaled 20,400 euros. All of these shares have been earmarked (i) for allocation on the exercise of stock options; and (ii) for award to employees by way of profit-sharing bonuses and in connection with company savings plans in accordance with the objectives set out in the share buyback program authorized by the General Shareholders’ Meeting of May 21, <strong>2007</strong>. The remaining treasury shares held (439,787 at December 31, <strong>2007</strong> versus 69,000 at December 31, 2006) are earmarked for use under a liquidity agreement that complies with the Code of Ethics issued by the French Association of Investment Companies (Association Française des Entreprises d’Investissement), signed with an investment services provider on April 22, 2004. The total resources allocated for implementing the liquidity agreement represented 439,787 shares and 1,665,696 euros at December 31, <strong>2007</strong>, compared with 69,000 shares and 13,039,863 euros one year earlier. On the date the liquidity agreement was signed, 220,000 <strong>Valeo</strong> shares and a sum of 6,600,000 euros were allocated to its implementation. <strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO 5 PAGE 187 1 2 3 4 5 6

- Page 1 and 2:

2007 Reference document

- Page 3 and 4:

Group profile 2007 Valeo is an inde

- Page 5 and 6:

Gross margin In % of net sales Oper

- Page 7 and 8:

Basic earnings per share for the ye

- Page 9 and 10:

valeo added TM < Contents > 1 Activ

- Page 11 and 12:

1998 ■ Acquisition of the Electri

- Page 13 and 14:

The Group 1. Description and organi

- Page 15 and 16:

■ ■ ■ ignition components; in

- Page 17 and 18:

■ LED front and rear lighting and

- Page 19 and 20:

Valeo Climate Control has four prod

- Page 21 and 22:

4.1.1.2. Internal mobility and indi

- Page 23 and 24:

4.2.2. Environment Environmental pr

- Page 25 and 26:

4.3.1. Purchasing The role of Valeo

- Page 27 and 28:

4.3.4. Projects The Projects Depart

- Page 29 and 30:

Geographical presence The Group opt

- Page 31 and 32:

■ In a world first, the Volkswage

- Page 33 and 34:

Other contributions from Valeo Prod

- Page 35 and 36:

■ ■ The Group also continued to

- Page 37 and 38:

valeo added TM Accounting methods 3

- Page 39 and 40:

production (source: J.D. Power). In

- Page 41 and 42:

Change in stockholders’ equity 1.

- Page 43 and 44:

Provisions The balance sheet at Dec

- Page 45 and 46:

At the Board of Directors meeting h

- Page 47 and 48:

1.2. Environmental risks In the var

- Page 49 and 50:

4.3. Credit risk Valeo is exposed t

- Page 51 and 52:

Outlook In 2008, Valeo is aiming to

- Page 53 and 54:

Valeo addresses these challenges th

- Page 55 and 56:

Percentage of ISO 14001 and OHSAS 1

- Page 57 and 58:

The 2007 reporting scope excludes s

- Page 59 and 60:

The increase in the ratio of energy

- Page 61 and 62:

Overall, Valeo used higher tonnages

- Page 63 and 64:

All Valeo Group sites will be certi

- Page 65 and 66:

2.6. Reducing all types of pollutio

- Page 67 and 68:

Social indicators This social indic

- Page 69 and 70:

1.2.1. Permanent contracts Number o

- Page 71 and 72:

Breakdown of 2007 departures by geo

- Page 73 and 74:

3. Equality between men and women i

- Page 75 and 76:

Valeo’s “Well-being and effecti

- Page 77 and 78:

At December 31, 2007, 11,738 employ

- Page 79 and 80:

8. Disabled employees Valeo amended

- Page 81 and 82:

valeo added TM 3 < Contents > Conso

- Page 83 and 84:

Consolidated statements of income (

- Page 85 and 86:

Consolidated statements of cash flo

- Page 87 and 88:

Consolidated statement of changes i

- Page 89 and 90:

The proportionate consolidation met

- Page 91 and 92:

1.11. Property, plant and equipment

- Page 93 and 94:

■ OCEANE bonds Bonds convertible

- Page 95 and 96:

2. Changes in the scope of consolid

- Page 97 and 98:

2.3.3. Balance sheet Consolidated f

- Page 99 and 100:

3.3.1. Claims and litigation In the

- Page 101 and 102:

3.6.2. Effective tax rate The effec

- Page 103 and 104:

4.2. Other intangible assets At Dec

- Page 105 and 106:

Changes in property, plant and equi

- Page 107 and 108:

Summarized financial data in respec

- Page 109 and 110:

4.8. Stockholders’ equity 4.8.1.

- Page 111 and 112:

2006 Consolidated fi nancial statem

- Page 113 and 114:

4.8.7. Minority interests Changes i

- Page 115 and 116:

■ Breakdown of obligations At Dec

- Page 117 and 118:

(In millions of euros) France Other

- Page 119 and 120:

Consolidated fi nancial statements

- Page 121 and 122:

4.10.3. Short-term debt At December

- Page 123 and 124:

5. Additional disclosures 5.1. Segm

- Page 125 and 126:

5.2. Financial instruments 5.2.1. F

- Page 127 and 128:

5.2.2. Fair value of derivatives At

- Page 129 and 130:

Consolidated fi nancial statements

- Page 131 and 132:

At December 31, 2006 (In millions o

- Page 133 and 134:

Consolidated fi nancial statements

- Page 135 and 136:

5.6. Contingent liabilities The Gro

- Page 137 and 138: 6. Restatement of prior year financ

- Page 139 and 140: Companies Countries % voting rights

- Page 141 and 142: Companies Countries % voting rights

- Page 143 and 144: Companies Countries % voting rights

- Page 145 and 146: Consolidated fi nancial statements

- Page 147 and 148: valeo added TM < Contents > 4 Corpo

- Page 149 and 150: appointed Gérard Blanc, Pascal Col

- Page 151 and 152: ■ to check that internal procedur

- Page 153 and 154: 1.10. General Management of the Com

- Page 155 and 156: 2. Internal control procedures 2.1.

- Page 157 and 158: 2.4. Review of work carried out in

- Page 159 and 160: Composition of the Board of Directo

- Page 161 and 162: Name First appointed Helle Kristoff

- Page 163 and 164: valeo added TM 5 < Contents > Infor

- Page 165 and 166: Auditors Statutory Auditors ■ −

- Page 167 and 168: Martin Haub Vice-President, Product

- Page 169 and 170: Name/business address Jérôme Cont

- Page 171 and 172: Name/business address Georges Pauge

- Page 173 and 174: Jérôme Contamine graduated from

- Page 175 and 176: Under these R ules, independent Dir

- Page 177 and 178: Fixed compensation and benefits-in-

- Page 179 and 180: compensation, 1,905,169 euros to va

- Page 181 and 182: Share grants to the ten employees r

- Page 183 and 184: Information on the Company and its

- Page 185 and 186: 2. Authorized, unissued capital Sec

- Page 187: Exercise date and conditions Nbre d

- Page 191 and 192: the relevant disclosure threshold h

- Page 193 and 194: 2. Dividends Dividends per share ov

- Page 195 and 196: 3. Ownership structure Primarily on

- Page 197 and 198: 8. Monthly trading volumes Informat

- Page 199 and 200: Information on the Company and its

- Page 201 and 202: valeo added TM 6 < Contents > Other

- Page 203 and 204: Annual information document Other i

- Page 205 and 206: Other i nformation Annual informati

- Page 207 and 208: November 2007 November 9, 2007 - Ex

- Page 209 and 210: Other i nformation Person responsib

- Page 211 and 212: The printer of this report is envir