2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3 Consolidated<br />

PAGE 106<br />

fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

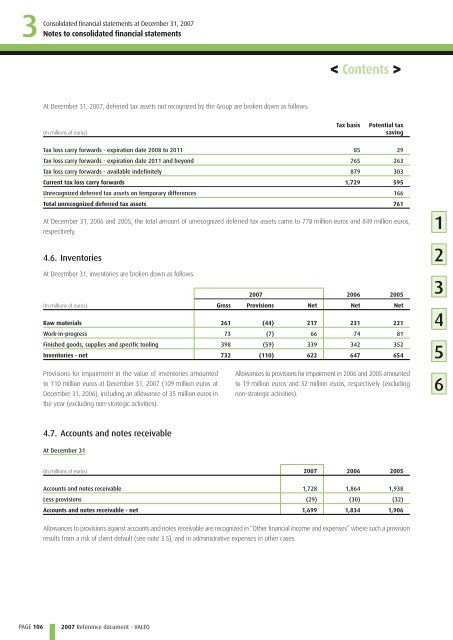

At December 31, <strong>2007</strong>, deferred tax assets not recognized by the Group are broken down as follows:<br />

(In millions of euros)<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

Tax basis Potential tax<br />

saving<br />

Tax loss carry forwards - expiration date 2008 to 2011 85 29<br />

Tax loss carry forwards - expiration date 2011 and beyond 765 263<br />

Tax loss carry forwards - available indefinitely 879 303<br />

Current tax loss carry forwards 1,729 595<br />

Unrecognized deferred tax assets on temporary differences 166<br />

Total unrecognized deferred tax assets 761<br />

At December 31, 2006 and 2005, the total amount of unrecognized deferred tax assets came to 778 million euros and 849 million euros,<br />

respectively.<br />

4.6. Inventories<br />

At December 31 , inventories are broken down as follows:<br />

(In millions of euros)<br />

<strong>2007</strong> 2006 2005<br />

Gross Provisions Net Net Net<br />

Raw materials 261 (44) 217 231 221<br />

Work-in-progress 73 (7) 66 74 81<br />

Finished goods, supplies and specific tooling 398 (59) 339 342 352<br />

Inventories - net 732 (110) 622 647 654<br />

Provisions for impairment in the value of inventories amounted<br />

to 110 million euros at December 31, <strong>2007</strong> (109 million euros at<br />

December 31, 2006), including an allowance of 35 million euros in<br />

the year (excluding non-strategic activities).<br />

4.7. Accounts and notes receivable<br />

At December 31<br />

< Contents ><br />

Allowances to provisions for impairment in 2006 and 2005 amounted<br />

to 19 million euros and 32 million euros, respectively (excluding<br />

non-strategic activities).<br />

(In millions of euros) <strong>2007</strong> 2006 2005<br />

Accounts and notes receivable 1,728 1,864 1,938<br />

Less provisions (29) (30) (32)<br />

Accounts and notes receivable - net 1,699 1,834 1,906<br />

Allowances to provisions against accounts and notes receivable are recognized in “Other financial income and expenses” where such a provision<br />

results from a risk of client default (see note 3.5), and in administrative expenses in other cases.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6