Blazing New Trails - Connexions

Blazing New Trails - Connexions

Blazing New Trails - Connexions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

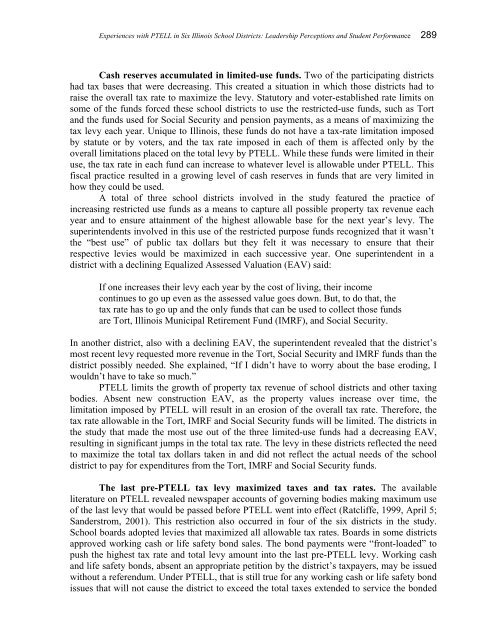

Experiences with PTELL in Six Illinois School Districts: Leadership Perceptions and Student Performance 289<br />

Cash reserves accumulated in limited-use funds. Two of the participating districts<br />

had tax bases that were decreasing. This created a situation in which those districts had to<br />

raise the overall tax rate to maximize the levy. Statutory and voter-established rate limits on<br />

some of the funds forced these school districts to use the restricted-use funds, such as Tort<br />

and the funds used for Social Security and pension payments, as a means of maximizing the<br />

tax levy each year. Unique to Illinois, these funds do not have a tax-rate limitation imposed<br />

by statute or by voters, and the tax rate imposed in each of them is affected only by the<br />

overall limitations placed on the total levy by PTELL. While these funds were limited in their<br />

use, the tax rate in each fund can increase to whatever level is allowable under PTELL. This<br />

fiscal practice resulted in a growing level of cash reserves in funds that are very limited in<br />

how they could be used.<br />

A total of three school districts involved in the study featured the practice of<br />

increasing restricted use funds as a means to capture all possible property tax revenue each<br />

year and to ensure attainment of the highest allowable base for the next year’s levy. The<br />

superintendents involved in this use of the restricted purpose funds recognized that it wasn’t<br />

the “best use” of public tax dollars but they felt it was necessary to ensure that their<br />

respective levies would be maximized in each successive year. One superintendent in a<br />

district with a declining Equalized Assessed Valuation (EAV) said:<br />

If one increases their levy each year by the cost of living, their income<br />

continues to go up even as the assessed value goes down. But, to do that, the<br />

tax rate has to go up and the only funds that can be used to collect those funds<br />

are Tort, Illinois Municipal Retirement Fund (IMRF), and Social Security.<br />

In another district, also with a declining EAV, the superintendent revealed that the district’s<br />

most recent levy requested more revenue in the Tort, Social Security and IMRF funds than the<br />

district possibly needed. She explained, “If I didn’t have to worry about the base eroding, I<br />

wouldn’t have to take so much.”<br />

PTELL limits the growth of property tax revenue of school districts and other taxing<br />

bodies. Absent new construction EAV, as the property values increase over time, the<br />

limitation imposed by PTELL will result in an erosion of the overall tax rate. Therefore, the<br />

tax rate allowable in the Tort, IMRF and Social Security funds will be limited. The districts in<br />

the study that made the most use out of the three limited-use funds had a decreasing EAV,<br />

resulting in significant jumps in the total tax rate. The levy in these districts reflected the need<br />

to maximize the total tax dollars taken in and did not reflect the actual needs of the school<br />

district to pay for expenditures from the Tort, IMRF and Social Security funds.<br />

The last pre-PTELL tax levy maximized taxes and tax rates. The available<br />

literature on PTELL revealed newspaper accounts of governing bodies making maximum use<br />

of the last levy that would be passed before PTELL went into effect (Ratcliffe, 1999, April 5;<br />

Sanderstrom, 2001). This restriction also occurred in four of the six districts in the study.<br />

School boards adopted levies that maximized all allowable tax rates. Boards in some districts<br />

approved working cash or life safety bond sales. The bond payments were “front-loaded” to<br />

push the highest tax rate and total levy amount into the last pre-PTELL levy. Working cash<br />

and life safety bonds, absent an appropriate petition by the district’s taxpayers, may be issued<br />

without a referendum. Under PTELL, that is still true for any working cash or life safety bond<br />

issues that will not cause the district to exceed the total taxes extended to service the bonded