Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TAX SYSTEMS AND INCENTIVES IN THE <strong>SADC</strong> REGION 7-3<br />

Namibia, <strong>and</strong> Seychelles do not tax <strong>the</strong>se dividends, while Malawi <strong>and</strong> Swazil<strong>and</strong> charge 10<br />

percent. On <strong>the</strong> high end, Zimbabwe <strong>and</strong> DRC impose a 20 percent tax, while <strong>in</strong> Zambia <strong>the</strong><br />

rate is 25 percent. Every <strong>SADC</strong> country uses withhold<strong>in</strong>g to collect tax on dividends, except<br />

Swazil<strong>and</strong>, which taxes dividends <strong>in</strong> <strong>the</strong> h<strong>and</strong>s <strong>of</strong> <strong>the</strong> recipients.<br />

With <strong>the</strong> exception <strong>of</strong> Botswana, <strong>the</strong> comb<strong>in</strong>ed statutory tax rate is derived from <strong>the</strong> formula:<br />

TT = TC + TD * (1 – TC), where TT, TC <strong>and</strong> TD are <strong>the</strong> total, company, <strong>and</strong> dividend tax rates,<br />

respectively. Botswana has an <strong>in</strong>tegrated tax system designed to avoid double taxation <strong>of</strong><br />

dividend <strong>in</strong>come. 93 The company tax rate <strong>of</strong> 25 percent consists <strong>of</strong> two elements: a 15 percent<br />

st<strong>and</strong>ard rate plus 10 percent additional company tax (ACT). The payment <strong>of</strong> ACT is <strong>of</strong>fset<br />

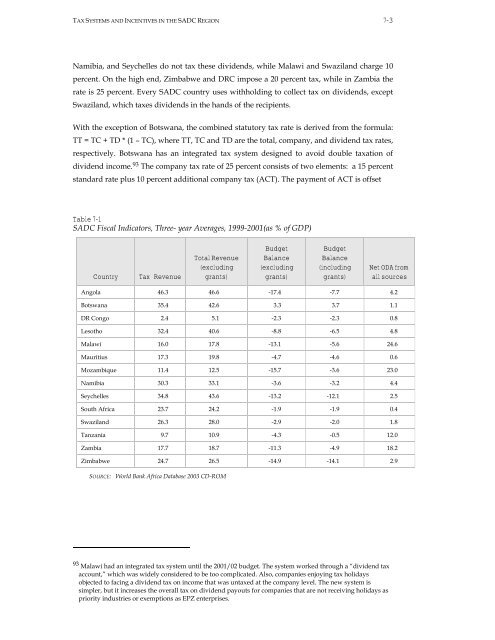

Table 7-1<br />

<strong>SADC</strong> Fiscal Indicators, Three- year Averages, 1999-2001(as % <strong>of</strong> GDP)<br />

Country <strong>Tax</strong> Revenue<br />

Total Revenue<br />

(exclud<strong>in</strong>g<br />

grants)<br />

Budget<br />

Balance<br />

(exclud<strong>in</strong>g<br />

grants)<br />

Budget<br />

Balance<br />

(<strong>in</strong>clud<strong>in</strong>g<br />

grants)<br />

Net ODA from<br />

all sources<br />

Angola 46.3 46.6 -17.4 -7.7 4.2<br />

Botswana 35.4 42.6 3.3 3.7 1.1<br />

DR Congo 2.4 5.1 -2.3 -2.3 0.8<br />

Lesotho 32.4 40.6 -8.8 -6.5 4.8<br />

Malawi 16.0 17.8 -13.1 -5.6 24.6<br />

Mauritius 17.3 19.8 -4.7 -4.6 0.6<br />

Mozambique 11.4 12.5 -15.7 -3.6 23.0<br />

Namibia 30.3 33.1 -3.6 -3.2 4.4<br />

Seychelles 34.8 43.6 -13.2 -12.1 2.5<br />

South Africa 23.7 24.2 -1.9 -1.9 0.4<br />

Swazil<strong>and</strong> 26.3 28.0 -2.9 -2.0 1.8<br />

Tanzania 9.7 10.9 -4.3 -0.5 12.0<br />

Zambia 17.7 18.7 -11.3 -4.9 18.2<br />

Zimbabwe 24.7 26.5 -14.9 -14.1 2.9<br />

SOURCE: World Bank Africa Database 2003 CD-ROM<br />

93 Malawi had an <strong>in</strong>tegrated tax system until <strong>the</strong> 2001/02 budget. The system worked through a “dividend tax<br />

account,” which was widely considered to be too complicated. Also, companies enjoy<strong>in</strong>g tax holidays<br />

objected to fac<strong>in</strong>g a dividend tax on <strong>in</strong>come that was untaxed at <strong>the</strong> company level. The new system is<br />

simpler, but it <strong>in</strong>creases <strong>the</strong> overall tax on dividend payouts for companies that are not receiv<strong>in</strong>g holidays as<br />

priority <strong>in</strong>dustries or exemptions as EPZ enterprises.