Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

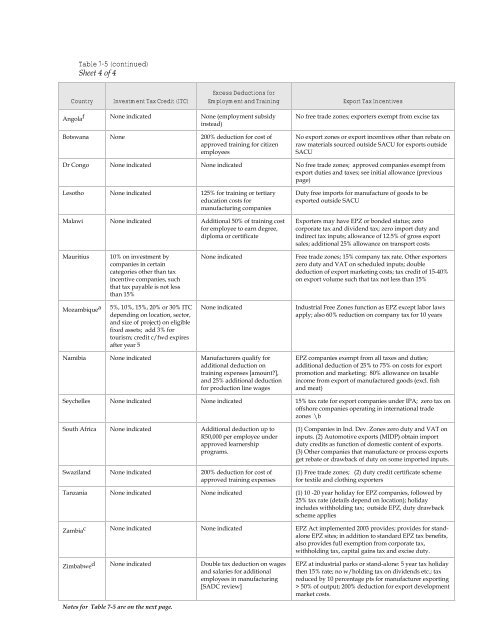

Table 7-5 (cont<strong>in</strong>ued)<br />

Sheet 4 <strong>of</strong> 4<br />

Country Investment <strong>Tax</strong> Credit (ITC)<br />

Angola f None <strong>in</strong>dicated None (employment subsidy<br />

<strong>in</strong>stead)<br />

Botswana None 200% deduction for cost <strong>of</strong><br />

approved tra<strong>in</strong><strong>in</strong>g for citizen<br />

employees<br />

Excess Deductions for<br />

Employment <strong>and</strong> Tra<strong>in</strong><strong>in</strong>g Export <strong>Tax</strong> <strong>Incentives</strong><br />

No free trade zones; exporters exempt from excise tax<br />

No export zones or export <strong>in</strong>centives o<strong>the</strong>r than rebate on<br />

raw materials sourced outside SACU for exports outside<br />

SACU<br />

Dr Congo None <strong>in</strong>dicated None <strong>in</strong>dicated No free trade zones; approved companies exempt from<br />

export duties <strong>and</strong> taxes; see <strong>in</strong>itial allowance (previous<br />

page)<br />

Lesotho None <strong>in</strong>dicated 125% for tra<strong>in</strong><strong>in</strong>g or tertiary<br />

education costs for<br />

manufactur<strong>in</strong>g companies<br />

Malawi None <strong>in</strong>dicated Additional 50% <strong>of</strong> tra<strong>in</strong><strong>in</strong>g cost<br />

for employee to earn degree,<br />

diploma or certificate<br />

Mauritius 10% on <strong>in</strong>vestment by<br />

companies <strong>in</strong> certa<strong>in</strong><br />

categories o<strong>the</strong>r than tax<br />

<strong>in</strong>centive companies, such<br />

that tax payable is not less<br />

than 15%<br />

Mozambique a 5%, 10%, 15%, 20% or 30% ITC<br />

depend<strong>in</strong>g on location, sector,<br />

<strong>and</strong> size <strong>of</strong> project) on eligible<br />

fixed assets; add 3% for<br />

tourism; credit c/fwd expires<br />

after year 5<br />

Namibia None <strong>in</strong>dicated Manufacturers qualify for<br />

additional deduction on<br />

tra<strong>in</strong><strong>in</strong>g expenses [amount?],<br />

<strong>and</strong> 25% additional deduction<br />

for production l<strong>in</strong>e wages<br />

Duty free imports for manufacture <strong>of</strong> goods to be<br />

exported outside SACU<br />

Exporters may have EPZ or bonded status; zero<br />

corporate tax <strong>and</strong> dividend tax; zero import duty <strong>and</strong><br />

<strong>in</strong>direct tax <strong>in</strong>puts; allowance <strong>of</strong> 12.5% <strong>of</strong> gross export<br />

sales; additional 25% allowance on transport costs<br />

None <strong>in</strong>dicated Free trade zones; 15% company tax rate. O<strong>the</strong>r exporters<br />

zero duty <strong>and</strong> VAT on scheduled <strong>in</strong>puts; double<br />

deduction <strong>of</strong> export market<strong>in</strong>g costs; tax credit <strong>of</strong> 15-40%<br />

on export volume such that tax not less than 15%<br />

None <strong>in</strong>dicated Industrial Free Zones function as EPZ except labor laws<br />

apply; also 60% reduction on company tax for 10 years<br />

EPZ companies exempt from all taxes <strong>and</strong> duties;<br />

additional deduction <strong>of</strong> 25% to 75% on costs for export<br />

promotion <strong>and</strong> market<strong>in</strong>g; 80% allowance on taxable<br />

<strong>in</strong>come from export <strong>of</strong> manufactured goods (excl. fish<br />

<strong>and</strong> meat)<br />

Seychelles None <strong>in</strong>dicated None <strong>in</strong>dicated 15% tax rate for export companies under IPA; zero tax on<br />

<strong>of</strong>fshore companies operat<strong>in</strong>g <strong>in</strong> <strong>in</strong>ternational trade<br />

zones \b<br />

South Africa None <strong>in</strong>dicated Additional deduction up to<br />

R50,000 per employee under<br />

approved learnership<br />

programs.<br />

Swazil<strong>and</strong> None <strong>in</strong>dicated 200% deduction for cost <strong>of</strong><br />

approved tra<strong>in</strong><strong>in</strong>g expenses<br />

(1) Companies <strong>in</strong> Ind. Dev. Zones zero duty <strong>and</strong> VAT on<br />

<strong>in</strong>puts. (2) Automotive exports (MIDP) obta<strong>in</strong> import<br />

duty credits as function <strong>of</strong> domestic content <strong>of</strong> exports.<br />

(3) O<strong>the</strong>r companies that manufacture or process exports<br />

get rebate or drawback <strong>of</strong> duty on some imported <strong>in</strong>puts.<br />

(1) Free trade zones; (2) duty credit certificate scheme<br />

for textile <strong>and</strong> cloth<strong>in</strong>g exporters<br />

Tanzania None <strong>in</strong>dicated None <strong>in</strong>dicated (1) 10 -20 year holiday for EPZ companies, followed by<br />

25% tax rate (details depend on location); holiday<br />

<strong>in</strong>cludes withhold<strong>in</strong>g tax; outside EPZ, duty drawback<br />

scheme applies<br />

Zambia c None <strong>in</strong>dicated None <strong>in</strong>dicated EPZ Act implemented 2003 provides; provides for st<strong>and</strong>alone<br />

EPZ sites; <strong>in</strong> addition to st<strong>and</strong>ard EPZ tax benefits,<br />

also provides full exemption from corporate tax,<br />

withhold<strong>in</strong>g tax, capital ga<strong>in</strong>s tax <strong>and</strong> excise duty.<br />

Zimbabwe d None <strong>in</strong>dicated Double tax deduction on wages<br />

<strong>and</strong> salaries for additional<br />

employees <strong>in</strong> manufactur<strong>in</strong>g<br />

[<strong>SADC</strong> review]<br />

Notes for Table 7-5 are on <strong>the</strong> next page.<br />

EPZ at <strong>in</strong>dustrial parks or st<strong>and</strong>-alone: 5 year tax holiday<br />

<strong>the</strong>n 15% rate; no w/hold<strong>in</strong>g tax on dividends etc.; tax<br />

reduced by 10 percentage pts for manufacturer export<strong>in</strong>g<br />

> 50% <strong>of</strong> output; 200% deduction for export development<br />

market costs.