Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

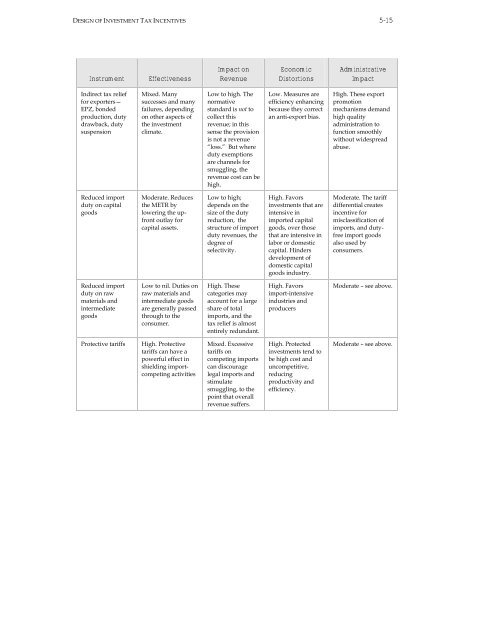

DESIGN OF INVESTMENT TAX INCENTIVES 5-15<br />

Instrument <strong>Effectiveness</strong><br />

Indirect tax relief<br />

for exporters—<br />

EPZ, bonded<br />

production, duty<br />

drawback, duty<br />

suspension<br />

Reduced import<br />

duty on capital<br />

goods<br />

Reduced import<br />

duty on raw<br />

materials <strong>and</strong><br />

<strong>in</strong>termediate<br />

goods<br />

Mixed. Many<br />

successes <strong>and</strong> many<br />

failures, depend<strong>in</strong>g<br />

on o<strong>the</strong>r aspects <strong>of</strong><br />

<strong>the</strong> <strong>in</strong>vestment<br />

climate.<br />

Moderate. Reduces<br />

<strong>the</strong> METR by<br />

lower<strong>in</strong>g <strong>the</strong> upfront<br />

outlay for<br />

capital assets.<br />

Low to nil. Duties on<br />

raw materials <strong>and</strong><br />

<strong>in</strong>termediate goods<br />

are generally passed<br />

through to <strong>the</strong><br />

consumer.<br />

Protective tariffs High. Protective<br />

tariffs can have a<br />

powerful effect <strong>in</strong><br />

shield<strong>in</strong>g importcompet<strong>in</strong>g<br />

activities<br />

<strong>Impact</strong> on<br />

Revenue<br />

Low to high. The<br />

normative<br />

st<strong>and</strong>ard is not to<br />

collect this<br />

revenue; <strong>in</strong> this<br />

sense <strong>the</strong> provision<br />

is not a revenue<br />

“loss.” But where<br />

duty exemptions<br />

are channels for<br />

smuggl<strong>in</strong>g, <strong>the</strong><br />

revenue cost can be<br />

high.<br />

Low to high;<br />

depends on <strong>the</strong><br />

size <strong>of</strong> <strong>the</strong> duty<br />

reduction, <strong>the</strong><br />

structure <strong>of</strong> import<br />

duty revenues, <strong>the</strong><br />

degree <strong>of</strong><br />

selectivity.<br />

High. These<br />

categories may<br />

account for a large<br />

share <strong>of</strong> total<br />

imports, <strong>and</strong> <strong>the</strong><br />

tax relief is almost<br />

entirely redundant.<br />

Mixed. Excessive<br />

tariffs on<br />

compet<strong>in</strong>g imports<br />

can discourage<br />

legal imports <strong>and</strong><br />

stimulate<br />

smuggl<strong>in</strong>g, to <strong>the</strong><br />

po<strong>in</strong>t that overall<br />

revenue suffers.<br />

<strong>Economic</strong><br />

Distortions<br />

Low. Measures are<br />

efficiency enhanc<strong>in</strong>g<br />

because <strong>the</strong>y correct<br />

an anti-export bias.<br />

High. Favors<br />

<strong>in</strong>vestments that are<br />

<strong>in</strong>tensive <strong>in</strong><br />

imported capital<br />

goods, over those<br />

that are <strong>in</strong>tensive <strong>in</strong><br />

labor or domestic<br />

capital. H<strong>in</strong>ders<br />

development <strong>of</strong><br />

domestic capital<br />

goods <strong>in</strong>dustry.<br />

High. Favors<br />

import-<strong>in</strong>tensive<br />

<strong>in</strong>dustries <strong>and</strong><br />

producers<br />

High. Protected<br />

<strong>in</strong>vestments tend to<br />

be high cost <strong>and</strong><br />

uncompetitive,<br />

reduc<strong>in</strong>g<br />

productivity <strong>and</strong><br />

efficiency.<br />

Adm<strong>in</strong>istrative<br />

<strong>Impact</strong><br />

High. These export<br />

promotion<br />

mechanisms dem<strong>and</strong><br />

high quality<br />

adm<strong>in</strong>istration to<br />

function smoothly<br />

without widespread<br />

abuse.<br />

Moderate. The tariff<br />

differential creates<br />

<strong>in</strong>centive for<br />

misclassification <strong>of</strong><br />

imports, <strong>and</strong> dutyfree<br />

import goods<br />

also used by<br />

consumers.<br />

Moderate – see above.<br />

Moderate – see above.