Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TAXATION, INVESTMENT, AND GROWTH 2-5<br />

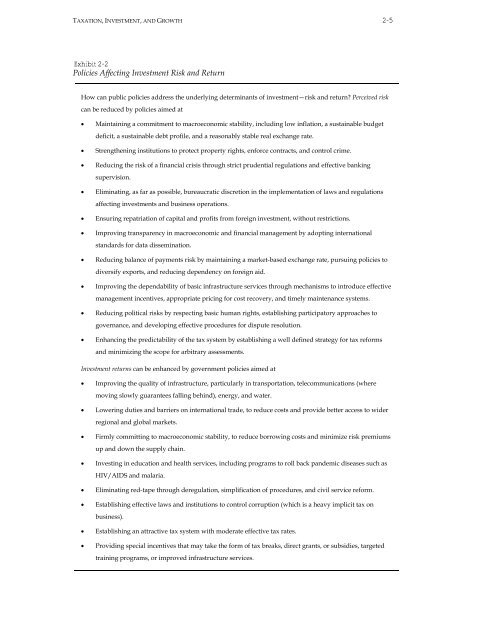

Exhibit 2-2<br />

Policies Affect<strong>in</strong>g Investment Risk <strong>and</strong> Return<br />

How can public policies address <strong>the</strong> underly<strong>in</strong>g determ<strong>in</strong>ants <strong>of</strong> <strong>in</strong>vestment—risk <strong>and</strong> return? Perceived risk<br />

can be reduced by policies aimed at<br />

• Ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g a commitment to macroeconomic stability, <strong>in</strong>clud<strong>in</strong>g low <strong>in</strong>flation, a susta<strong>in</strong>able budget<br />

deficit, a susta<strong>in</strong>able debt pr<strong>of</strong>ile, <strong>and</strong> a reasonably stable real exchange rate.<br />

• Streng<strong>the</strong>n<strong>in</strong>g <strong>in</strong>stitutions to protect property rights, enforce contracts, <strong>and</strong> control crime.<br />

• Reduc<strong>in</strong>g <strong>the</strong> risk <strong>of</strong> a f<strong>in</strong>ancial crisis through strict prudential regulations <strong>and</strong> effective bank<strong>in</strong>g<br />

supervision.<br />

• Elim<strong>in</strong>at<strong>in</strong>g, as far as possible, bureaucratic discretion <strong>in</strong> <strong>the</strong> implementation <strong>of</strong> laws <strong>and</strong> regulations<br />

affect<strong>in</strong>g <strong>in</strong>vestments <strong>and</strong> bus<strong>in</strong>ess operations.<br />

• Ensur<strong>in</strong>g repatriation <strong>of</strong> capital <strong>and</strong> pr<strong>of</strong>its from foreign <strong>in</strong>vestment, without restrictions.<br />

• Improv<strong>in</strong>g transparency <strong>in</strong> macroeconomic <strong>and</strong> f<strong>in</strong>ancial management by adopt<strong>in</strong>g <strong>in</strong>ternational<br />

st<strong>and</strong>ards for data dissem<strong>in</strong>ation.<br />

• Reduc<strong>in</strong>g balance <strong>of</strong> payments risk by ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g a market-based exchange rate, pursu<strong>in</strong>g policies to<br />

diversify exports, <strong>and</strong> reduc<strong>in</strong>g dependency on foreign aid.<br />

• Improv<strong>in</strong>g <strong>the</strong> dependability <strong>of</strong> basic <strong>in</strong>frastructure services through mechanisms to <strong>in</strong>troduce effective<br />

management <strong>in</strong>centives, appropriate pric<strong>in</strong>g for cost recovery, <strong>and</strong> timely ma<strong>in</strong>tenance systems.<br />

• Reduc<strong>in</strong>g political risks by respect<strong>in</strong>g basic human rights, establish<strong>in</strong>g participatory approaches to<br />

governance, <strong>and</strong> develop<strong>in</strong>g effective procedures for dispute resolution.<br />

• Enhanc<strong>in</strong>g <strong>the</strong> predictability <strong>of</strong> <strong>the</strong> tax system by establish<strong>in</strong>g a well def<strong>in</strong>ed strategy for tax reforms<br />

<strong>and</strong> m<strong>in</strong>imiz<strong>in</strong>g <strong>the</strong> scope for arbitrary assessments.<br />

Investment returns can be enhanced by government policies aimed at<br />

• Improv<strong>in</strong>g <strong>the</strong> quality <strong>of</strong> <strong>in</strong>frastructure, particularly <strong>in</strong> transportation, telecommunications (where<br />

mov<strong>in</strong>g slowly guarantees fall<strong>in</strong>g beh<strong>in</strong>d), energy, <strong>and</strong> water.<br />

• Lower<strong>in</strong>g duties <strong>and</strong> barriers on <strong>in</strong>ternational trade, to reduce costs <strong>and</strong> provide better access to wider<br />

regional <strong>and</strong> global markets.<br />

• Firmly committ<strong>in</strong>g to macroeconomic stability, to reduce borrow<strong>in</strong>g costs <strong>and</strong> m<strong>in</strong>imize risk premiums<br />

up <strong>and</strong> down <strong>the</strong> supply cha<strong>in</strong>.<br />

• Invest<strong>in</strong>g <strong>in</strong> education <strong>and</strong> health services, <strong>in</strong>clud<strong>in</strong>g programs to roll back p<strong>and</strong>emic diseases such as<br />

HIV/AIDS <strong>and</strong> malaria.<br />

• Elim<strong>in</strong>at<strong>in</strong>g red-tape through deregulation, simplification <strong>of</strong> procedures, <strong>and</strong> civil service reform.<br />

• Establish<strong>in</strong>g effective laws <strong>and</strong> <strong>in</strong>stitutions to control corruption (which is a heavy implicit tax on<br />

bus<strong>in</strong>ess).<br />

• Establish<strong>in</strong>g an attractive tax system with moderate effective tax rates.<br />

• Provid<strong>in</strong>g special <strong>in</strong>centives that may take <strong>the</strong> form <strong>of</strong> tax breaks, direct grants, or subsidies, targeted<br />

tra<strong>in</strong><strong>in</strong>g programs, or improved <strong>in</strong>frastructure services.