Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7-4 EFFECTIVENESS AND IMPACT OF TAX INCENTIVES IN THE <strong>SADC</strong> REGION<br />

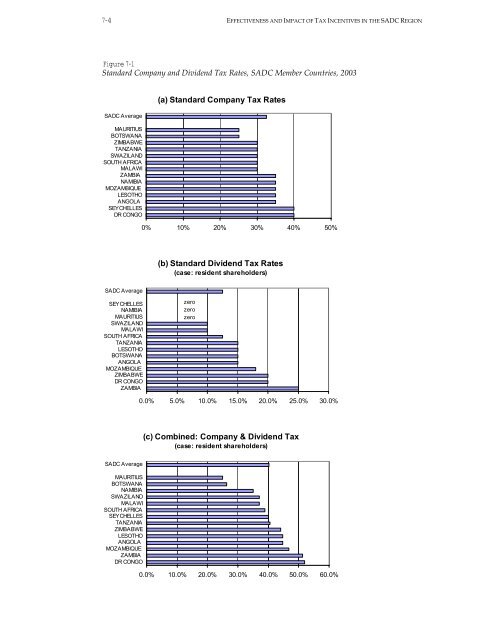

Figure 7-1<br />

St<strong>and</strong>ard Company <strong>and</strong> Dividend <strong>Tax</strong> Rates, <strong>SADC</strong> Member Countries, 2003<br />

<strong>SADC</strong> Average<br />

MAURITIUS<br />

BOTSWANA<br />

ZIMBABWE<br />

TANZANIA<br />

SWAZILAND<br />

SOUTH AFRICA<br />

MALAWI<br />

ZAMBIA<br />

NAMIBIA<br />

MOZAMBIQUE<br />

LESOTHO<br />

ANGOLA<br />

SEYCHELLES<br />

DR CONGO<br />

<strong>SADC</strong> Average<br />

SEYCHELLES<br />

NAMIBIA<br />

MAURITIUS<br />

SWAZILAND<br />

MALAWI<br />

SOUTH AFRICA<br />

TANZANIA<br />

LESOTHO<br />

BOTSWANA<br />

ANGOLA<br />

MOZAMBIQUE<br />

ZIMBABWE<br />

DR CONGO<br />

ZAMBIA<br />

<strong>SADC</strong> Average<br />

MAURITIUS<br />

BOTSWANA<br />

NAMIBIA<br />

SWAZILAND<br />

MALAWI<br />

SOUTH AFRICA<br />

SEYCHELLES<br />

TANZANIA<br />

ZIMBABWE<br />

LESOTHO<br />

ANGOLA<br />

MOZAMBIQUE<br />

ZAMBIA<br />

DR CONGO<br />

(a) St<strong>and</strong>ard Company <strong>Tax</strong> Rates<br />

0% 10% 20% 30% 40% 50%<br />

(b) St<strong>and</strong>ard Dividend <strong>Tax</strong> Rates<br />

(case: resident shareholders)<br />

zero<br />

zero<br />

zero<br />

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0%<br />

(c) Comb<strong>in</strong>ed: Company & Dividend <strong>Tax</strong><br />

(case: resident shareholders)<br />

0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0%