Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

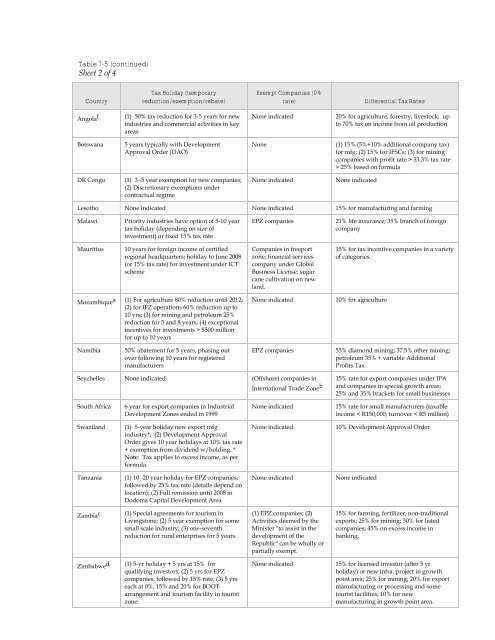

Table 7-5 (cont<strong>in</strong>ued)<br />

Sheet 2 <strong>of</strong> 4<br />

Country<br />

<strong>Tax</strong> Holiday (temporary<br />

reduction/exemption/rebate)<br />

Angola f (1) 50% tax reduction for 3-5 years for new<br />

<strong>in</strong>dustries <strong>and</strong> commercial activities <strong>in</strong> key<br />

areas<br />

Botswana 5 years typically with Development<br />

Approval Order (DAO)<br />

DR Congo (1) 3 -5 year exemption for new companies;<br />

(2) Discretionary exemptions under<br />

contractual regime<br />

Exempt Companies (0%<br />

rate) Differential <strong>Tax</strong> Rates<br />

None <strong>in</strong>dicated 20% for agriculture, forestry, livestock; up<br />

to 70% tax on <strong>in</strong>come from oil production<br />

None (1) 15% (5%+10% additional company tax)<br />

for mfg; (2) 15% for IFSCs; (3) for m<strong>in</strong><strong>in</strong>g<br />

companies with pr<strong>of</strong>it rate > 33.3% tax rate<br />

> 25% based on formula<br />

None <strong>in</strong>dicated None <strong>in</strong>dicated<br />

Lesotho None <strong>in</strong>dicated None <strong>in</strong>dicated 15% for manufactur<strong>in</strong>g <strong>and</strong> farm<strong>in</strong>g<br />

Malawi Priority <strong>in</strong>dustries have option <strong>of</strong> 5-10 year<br />

tax holiday (depend<strong>in</strong>g on size <strong>of</strong><br />

<strong>in</strong>vestment) or fixed 15% tax rate<br />

Mauritius 10 years for foreign <strong>in</strong>come <strong>of</strong> certified<br />

regional headquarters; holiday to June 2008<br />

(or 15% tax rate) for <strong>in</strong>vestment under ICT<br />

scheme<br />

Mozambique a (1) For agriculture 80% reduction until 2012;<br />

(2) for IFZ operations 60% reduction up to<br />

10 yrs; (3) for m<strong>in</strong><strong>in</strong>g <strong>and</strong> petroleum 25%<br />

reduction for 5 <strong>and</strong> 8 years; (4) exceptional<br />

<strong>in</strong>centives for <strong>in</strong>vestments > $500 million<br />

for up to 10 years<br />

Namibia 50% abatement for 5 years, phas<strong>in</strong>g out<br />

over follow<strong>in</strong>g 10 years for registered<br />

manufacturers<br />

EPZ companies 21% life <strong>in</strong>surance; 35% branch <strong>of</strong> foreign<br />

company<br />

Companies <strong>in</strong> freeport<br />

zone; f<strong>in</strong>ancial services<br />

company under Global<br />

Bus<strong>in</strong>ess License; sugar<br />

cane cultivation on new<br />

l<strong>and</strong>.<br />

None <strong>in</strong>dicated 10% for agriculture<br />

Seychelles None <strong>in</strong>dicated (Offshore) companies <strong>in</strong><br />

International Trade Zone b<br />

South Africa 6 year for export companies <strong>in</strong> Industrial<br />

Development Zones ended <strong>in</strong> 1999<br />

Swazil<strong>and</strong> (1) 5-year holiday new export mfg<br />

<strong>in</strong>dustry*; (2) Development Approval<br />

Order gives 10 year holidays at 10% tax rate<br />

+ exemption from dividend w/hold<strong>in</strong>g. *<br />

Note: <strong>Tax</strong> applies to excess <strong>in</strong>come, as per<br />

formula.<br />

Tanzania (1) 10 -20 year holiday for EPZ companies,<br />

followed by 25% tax rate (details depend on<br />

location); (2) Full remission until 2008 <strong>in</strong><br />

Dodoma Capital Development Area<br />

Zambia c (1) Special agreements for tourism <strong>in</strong><br />

Liv<strong>in</strong>gstone; (2) 5 year exemption for some<br />

small scale <strong>in</strong>dustry; (3) one-seventh<br />

reduction for rural enterprises for 5 years.<br />

Zimbabwe d (1) 5-yr holiday + 5 yrs at 15% for<br />

qualify<strong>in</strong>g <strong>in</strong>vestors; (2) 5 yrs for EPZ<br />

companies, followed by 15% rate; (3) 5 yrs<br />

each at 0%, 15% <strong>and</strong> 20% for BOOT<br />

arrangement <strong>and</strong> tourism facility <strong>in</strong> tourist<br />

zone:<br />

15% for tax <strong>in</strong>centive companies <strong>in</strong> a variety<br />

<strong>of</strong> categories.<br />

EPZ companies 55% diamond m<strong>in</strong><strong>in</strong>g; 37.5% o<strong>the</strong>r m<strong>in</strong><strong>in</strong>g;<br />

petroleum 35% + variable Additional<br />

Pr<strong>of</strong>its <strong>Tax</strong><br />

15% rate for export companies under IPA<br />

<strong>and</strong> companies <strong>in</strong> special growth areas;<br />

25% <strong>and</strong> 35% brackets for small bus<strong>in</strong>esses<br />

None <strong>in</strong>dicated 15% rate for small manufacturers (taxable<br />

<strong>in</strong>come < R150,000; turnover < R5 million)<br />

None <strong>in</strong>dicated 10% Development Approval Order<br />

None <strong>in</strong>dicated None <strong>in</strong>dicated<br />

(1) EPZ companies; (2)<br />

Activities deemed by <strong>the</strong><br />

M<strong>in</strong>ister "to assist <strong>in</strong> <strong>the</strong><br />

development <strong>of</strong> <strong>the</strong><br />

Republic" can be wholly or<br />

partially exempt.<br />

15% for farm<strong>in</strong>g, fertilizer, non-traditional<br />

exports; 25% for m<strong>in</strong><strong>in</strong>g; 30% for listed<br />

companies; 45% on excess <strong>in</strong>come <strong>in</strong><br />

bank<strong>in</strong>g.<br />

None <strong>in</strong>dicated 15% for licensed <strong>in</strong>vestor (after 5 yr<br />

holiday) or new <strong>in</strong>fra. project <strong>in</strong> growth<br />

po<strong>in</strong>t area; 25% for m<strong>in</strong><strong>in</strong>g; 20% for export<br />

manufactur<strong>in</strong>g or process<strong>in</strong>g <strong>and</strong> some<br />

tourist facilities; 10% for new<br />

manufactur<strong>in</strong>g <strong>in</strong> growth po<strong>in</strong>t area.