Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5-14 EFFECTIVENESS AND IMPACT OF TAX INCENTIVES IN THE <strong>SADC</strong> REGION<br />

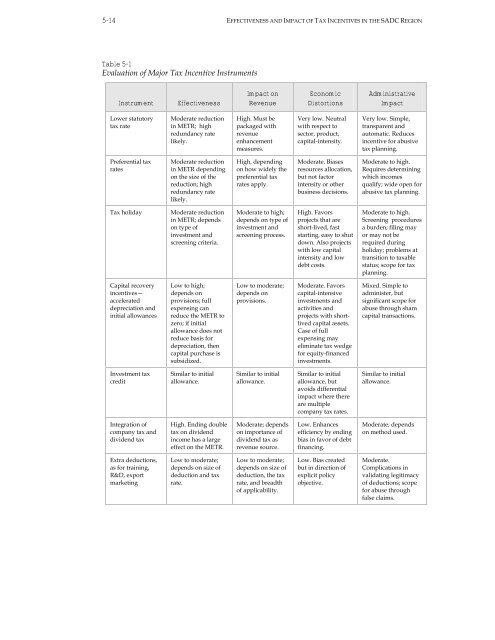

Table 5-1<br />

Evaluation <strong>of</strong> Major <strong>Tax</strong> Incentive Instruments<br />

Instrument <strong>Effectiveness</strong><br />

Lower statutory<br />

tax rate<br />

Preferential tax<br />

rates<br />

Moderate reduction<br />

<strong>in</strong> METR; high<br />

redundancy rate<br />

likely.<br />

Moderate reduction<br />

<strong>in</strong> METR depend<strong>in</strong>g<br />

on <strong>the</strong> size <strong>of</strong> <strong>the</strong><br />

reduction; high<br />

redundancy rate<br />

likely.<br />

<strong>Tax</strong> holiday Moderate reduction<br />

<strong>in</strong> METR; depends<br />

on type <strong>of</strong><br />

<strong>in</strong>vestment <strong>and</strong><br />

screen<strong>in</strong>g criteria.<br />

Capital recovery<br />

<strong>in</strong>centives—<br />

accelerated<br />

depreciation <strong>and</strong><br />

<strong>in</strong>itial allowances<br />

Investment tax<br />

credit<br />

Integration <strong>of</strong><br />

company tax <strong>and</strong><br />

dividend tax<br />

Extra deductions,<br />

as for tra<strong>in</strong><strong>in</strong>g,<br />

R&D, export<br />

market<strong>in</strong>g<br />

Low to high;<br />

depends on<br />

provisions; full<br />

expens<strong>in</strong>g can<br />

reduce <strong>the</strong> METR to<br />

zero; if <strong>in</strong>itial<br />

allowance does not<br />

reduce basis for<br />

depreciation, <strong>the</strong>n<br />

capital purchase is<br />

subsidized.<br />

Similar to <strong>in</strong>itial<br />

allowance.<br />

High. End<strong>in</strong>g double<br />

tax on dividend<br />

<strong>in</strong>come has a large<br />

effect on <strong>the</strong> METR.<br />

Low to moderate;<br />

depends on size <strong>of</strong><br />

deduction <strong>and</strong> tax<br />

rate.<br />

<strong>Impact</strong> on<br />

Revenue<br />

High. Must be<br />

packaged with<br />

revenue<br />

enhancement<br />

measures.<br />

High, depend<strong>in</strong>g<br />

on how widely <strong>the</strong><br />

preferential tax<br />

rates apply.<br />

Moderate to high;<br />

depends on type <strong>of</strong><br />

<strong>in</strong>vestment <strong>and</strong><br />

screen<strong>in</strong>g process.<br />

Low to moderate;<br />

depends on<br />

provisions.<br />

Similar to <strong>in</strong>itial<br />

allowance.<br />

Moderate; depends<br />

on importance <strong>of</strong><br />

dividend tax as<br />

revenue source.<br />

Low to moderate;<br />

depends on size <strong>of</strong><br />

deduction, <strong>the</strong> tax<br />

rate, <strong>and</strong> breadth<br />

<strong>of</strong> applicability.<br />

<strong>Economic</strong><br />

Distortions<br />

Very low. Neutral<br />

with respect to<br />

sector, product,<br />

capital-<strong>in</strong>tensity.<br />

Moderate. Biases<br />

resources allocation,<br />

but not factor<br />

<strong>in</strong>tensity or o<strong>the</strong>r<br />

bus<strong>in</strong>ess decisions.<br />

High. Favors<br />

projects that are<br />

short-lived, fast<br />

start<strong>in</strong>g, easy to shut<br />

down. Also projects<br />

with low capital<br />

<strong>in</strong>tensity <strong>and</strong> low<br />

debt costs.<br />

Moderate. Favors<br />

capital-<strong>in</strong>tensive<br />

<strong>in</strong>vestments <strong>and</strong><br />

activities <strong>and</strong><br />

projects with shortlived<br />

capital assets.<br />

Case <strong>of</strong> full<br />

expens<strong>in</strong>g may<br />

elim<strong>in</strong>ate tax wedge<br />

for equity-f<strong>in</strong>anced<br />

<strong>in</strong>vestments.<br />

Similar to <strong>in</strong>itial<br />

allowance, but<br />

avoids differential<br />

impact where <strong>the</strong>re<br />

are multiple<br />

company tax rates.<br />

Low. Enhances<br />

efficiency by end<strong>in</strong>g<br />

bias <strong>in</strong> favor <strong>of</strong> debt<br />

f<strong>in</strong>anc<strong>in</strong>g.<br />

Low. Bias created<br />

but <strong>in</strong> direction <strong>of</strong><br />

explicit policy<br />

objective.<br />

Adm<strong>in</strong>istrative<br />

<strong>Impact</strong><br />

Very low. Simple,<br />

transparent <strong>and</strong><br />

automatic. Reduces<br />

<strong>in</strong>centive for abusive<br />

tax plann<strong>in</strong>g.<br />

Moderate to high.<br />

Requires determ<strong>in</strong><strong>in</strong>g<br />

which <strong>in</strong>comes<br />

qualify; wide open for<br />

abusive tax plann<strong>in</strong>g.<br />

Moderate to high.<br />

Screen<strong>in</strong>g procedures<br />

a burden; fil<strong>in</strong>g may<br />

or may not be<br />

required dur<strong>in</strong>g<br />

holiday; problems at<br />

transition to taxable<br />

status; scope for tax<br />

plann<strong>in</strong>g.<br />

Mixed. Simple to<br />

adm<strong>in</strong>ister, but<br />

significant scope for<br />

abuse through sham<br />

capital transactions.<br />

Similar to <strong>in</strong>itial<br />

allowance.<br />

Moderate; depends<br />

on method used.<br />

Moderate.<br />

Complications <strong>in</strong><br />

validat<strong>in</strong>g legitimacy<br />

<strong>of</strong> deductions; scope<br />

for abuse through<br />

false claims.