Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4-2 EFFECTIVENESS AND IMPACT OF TAX INCENTIVES IN THE <strong>SADC</strong> REGION<br />

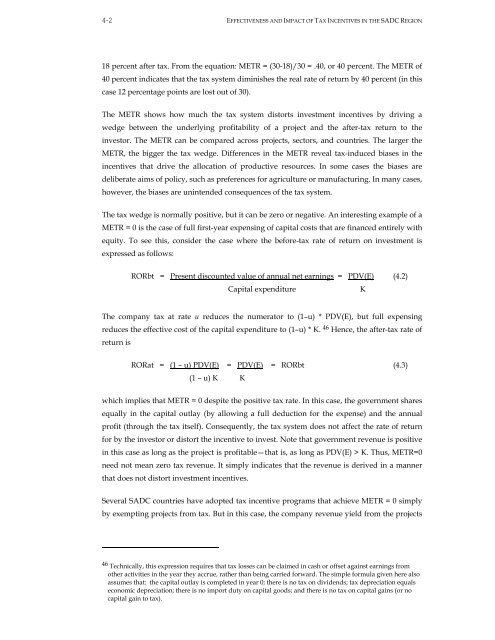

18 percent after tax. From <strong>the</strong> equation: METR = (30-18)/30 = .40, or 40 percent. The METR <strong>of</strong><br />

40 percent <strong>in</strong>dicates that <strong>the</strong> tax system dim<strong>in</strong>ishes <strong>the</strong> real rate <strong>of</strong> return by 40 percent (<strong>in</strong> this<br />

case 12 percentage po<strong>in</strong>ts are lost out <strong>of</strong> 30).<br />

The METR shows how much <strong>the</strong> tax system distorts <strong>in</strong>vestment <strong>in</strong>centives by driv<strong>in</strong>g a<br />

wedge between <strong>the</strong> underly<strong>in</strong>g pr<strong>of</strong>itability <strong>of</strong> a project <strong>and</strong> <strong>the</strong> after-tax return to <strong>the</strong><br />

<strong>in</strong>vestor. The METR can be compared across projects, sectors, <strong>and</strong> countries. The larger <strong>the</strong><br />

METR, <strong>the</strong> bigger <strong>the</strong> tax wedge. Differences <strong>in</strong> <strong>the</strong> METR reveal tax-<strong>in</strong>duced biases <strong>in</strong> <strong>the</strong><br />

<strong>in</strong>centives that drive <strong>the</strong> allocation <strong>of</strong> productive resources. In some cases <strong>the</strong> biases are<br />

deliberate aims <strong>of</strong> policy, such as preferences for agriculture or manufactur<strong>in</strong>g. In many cases,<br />

however, <strong>the</strong> biases are un<strong>in</strong>tended consequences <strong>of</strong> <strong>the</strong> tax system.<br />

The tax wedge is normally positive, but it can be zero or negative. An <strong>in</strong>terest<strong>in</strong>g example <strong>of</strong> a<br />

METR = 0 is <strong>the</strong> case <strong>of</strong> full first-year expens<strong>in</strong>g <strong>of</strong> capital costs that are f<strong>in</strong>anced entirely with<br />

equity. To see this, consider <strong>the</strong> case where <strong>the</strong> before-tax rate <strong>of</strong> return on <strong>in</strong>vestment is<br />

expressed as follows:<br />

RORbt = Present discounted value <strong>of</strong> annual net earn<strong>in</strong>gs = PDV(E) (4.2)<br />

Capital expenditure K<br />

The company tax at rate u reduces <strong>the</strong> numerator to (1–u) * PDV(E), but full expens<strong>in</strong>g<br />

reduces <strong>the</strong> effective cost <strong>of</strong> <strong>the</strong> capital expenditure to (1–u) * K. 46 Hence, <strong>the</strong> after-tax rate <strong>of</strong><br />

return is<br />

RORat = (1 – u) PDV(E) = PDV(E) = RORbt (4.3)<br />

(1 – u) K K<br />

which implies that METR = 0 despite <strong>the</strong> positive tax rate. In this case, <strong>the</strong> government shares<br />

equally <strong>in</strong> <strong>the</strong> capital outlay (by allow<strong>in</strong>g a full deduction for <strong>the</strong> expense) <strong>and</strong> <strong>the</strong> annual<br />

pr<strong>of</strong>it (through <strong>the</strong> tax itself). Consequently, <strong>the</strong> tax system does not affect <strong>the</strong> rate <strong>of</strong> return<br />

for by <strong>the</strong> <strong>in</strong>vestor or distort <strong>the</strong> <strong>in</strong>centive to <strong>in</strong>vest. Note that government revenue is positive<br />

<strong>in</strong> this case as long as <strong>the</strong> project is pr<strong>of</strong>itable—that is, as long as PDV(E) > K. Thus, METR=0<br />

need not mean zero tax revenue. It simply <strong>in</strong>dicates that <strong>the</strong> revenue is derived <strong>in</strong> a manner<br />

that does not distort <strong>in</strong>vestment <strong>in</strong>centives.<br />

Several <strong>SADC</strong> countries have adopted tax <strong>in</strong>centive programs that achieve METR = 0 simply<br />

by exempt<strong>in</strong>g projects from tax. But <strong>in</strong> this case, <strong>the</strong> company revenue yield from <strong>the</strong> projects<br />

46 Technically, this expression requires that tax losses can be claimed <strong>in</strong> cash or <strong>of</strong>fset aga<strong>in</strong>st earn<strong>in</strong>gs from<br />

o<strong>the</strong>r activities <strong>in</strong> <strong>the</strong> year <strong>the</strong>y accrue, ra<strong>the</strong>r than be<strong>in</strong>g carried forward. The simple formula given here also<br />

assumes that: <strong>the</strong> capital outlay is completed <strong>in</strong> year 0; <strong>the</strong>re is no tax on dividends; tax depreciation equals<br />

economic depreciation; <strong>the</strong>re is no import duty on capital goods; <strong>and</strong> <strong>the</strong>re is no tax on capital ga<strong>in</strong>s (or no<br />

capital ga<strong>in</strong> to tax).