Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ECONOMICS OF HARMFUL TAX COMPETITION 6-5<br />

•<br />

The fiscal regime <strong>in</strong> LTS can constra<strong>in</strong> HTS to reduce its own tax rates <strong>in</strong> order to stem <strong>the</strong><br />

loss <strong>of</strong> capital. Even if <strong>the</strong> tax base is fixed, revenues will be lower than <strong>in</strong> <strong>the</strong> unconstra<strong>in</strong>ed<br />

political equilibrium <strong>and</strong> <strong>the</strong> supply <strong>of</strong> public services will be suboptimal. Alternatively,<br />

HTS could ma<strong>in</strong>ta<strong>in</strong> <strong>the</strong> level <strong>of</strong> public services by <strong>in</strong>creas<strong>in</strong>g o<strong>the</strong>r taxes, but this approach<br />

creates adverse effects <strong>in</strong> terms <strong>of</strong> equity <strong>and</strong> efficiency.<br />

• Companies that operate <strong>in</strong> both states can arbitrage <strong>the</strong> tax differential by us<strong>in</strong>g<br />

<strong>in</strong>tracompany transactions <strong>and</strong> charges to shift <strong>in</strong>come <strong>in</strong>to LTS, at <strong>the</strong> expense <strong>of</strong> HTS.<br />

Thus, competition from <strong>the</strong> LTS causes a loss <strong>of</strong> fiscal resources for <strong>the</strong> HTS <strong>and</strong> for <strong>the</strong> regional<br />

fiscal system as a whole.<br />

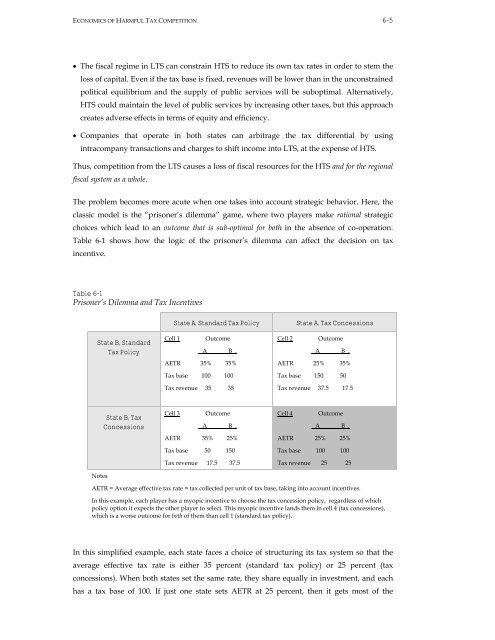

The problem becomes more acute when one takes <strong>in</strong>to account strategic behavior. Here, <strong>the</strong><br />

classic model is <strong>the</strong> “prisoner’s dilemma” game, where two players make rational strategic<br />

choices which lead to an outcome that is sub-optimal for both <strong>in</strong> <strong>the</strong> absence <strong>of</strong> co-operation.<br />

Table 6-1 shows how <strong>the</strong> logic <strong>of</strong> <strong>the</strong> prisoner’s dilemma can affect <strong>the</strong> decision on tax<br />

<strong>in</strong>centive.<br />

Table 6-1<br />

Prisoner’s Dilemma <strong>and</strong> <strong>Tax</strong> <strong>Incentives</strong><br />

State B, St<strong>and</strong>ard<br />

<strong>Tax</strong> Policy<br />

Notes<br />

State B, <strong>Tax</strong><br />

Concessions<br />

State A, St<strong>and</strong>ard <strong>Tax</strong> Policy State A, <strong>Tax</strong> Concessions<br />

Cell 1 Outcome<br />

A B .<br />

AETR 35% 35%<br />

<strong>Tax</strong> base 100 100<br />

<strong>Tax</strong> revenue 35 35<br />

Cell 3 Outcome<br />

A B .<br />

AETR 35% 25%<br />

<strong>Tax</strong> base 50 150<br />

<strong>Tax</strong> revenue 17.5 37.5<br />

Cell 2 Outcome<br />

A B .<br />

AETR 25% 35%<br />

<strong>Tax</strong> base 150 50<br />

<strong>Tax</strong> revenue 37.5 17.5<br />

Cell 4 Outcome<br />

A B .<br />

AETR 25% 25%<br />

<strong>Tax</strong> base 100 100<br />

<strong>Tax</strong> revenue 25 25<br />

AETR = Average effective tax rate = tax collected per unit <strong>of</strong> tax base, tak<strong>in</strong>g <strong>in</strong>to account <strong>in</strong>centives.<br />

In this example, each player has a myopic <strong>in</strong>centive to choose <strong>the</strong> tax concession policy, regardless <strong>of</strong> which<br />

policy option it expects <strong>the</strong> o<strong>the</strong>r player to select. This myopic <strong>in</strong>centive l<strong>and</strong>s <strong>the</strong>m <strong>in</strong> cell 4 (tax concessions),<br />

which is a worse outcome for both <strong>of</strong> <strong>the</strong>m than cell 1 (st<strong>and</strong>ard tax policy).<br />

In this simplified example, each state faces a choice <strong>of</strong> structur<strong>in</strong>g its tax system so that <strong>the</strong><br />

average effective tax rate is ei<strong>the</strong>r 35 percent (st<strong>and</strong>ard tax policy) or 25 percent (tax<br />

concessions). When both states set <strong>the</strong> same rate, <strong>the</strong>y share equally <strong>in</strong> <strong>in</strong>vestment, <strong>and</strong> each<br />

has a tax base <strong>of</strong> 100. If just one state sets AETR at 25 percent, <strong>the</strong>n it gets most <strong>of</strong> <strong>the</strong>