Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

Effectiveness and Economic Impact of Tax Incentives in the SADC ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

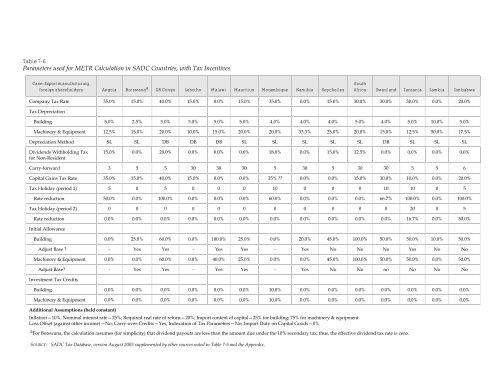

Table 7-6<br />

Parameters used for METR Calculation <strong>in</strong> <strong>SADC</strong> Countries, with <strong>Tax</strong> <strong>Incentives</strong><br />

Case: Export manufactur<strong>in</strong>g,<br />

foreign shareholders Angola Botswana a DR Congo Lesotho Malawi Mauritius Mozambique Namibia Seychelles<br />

Company <strong>Tax</strong> Rate 35.0% 15.0% 40.0% 15.0% 0.0% 15.0%<br />

<strong>Tax</strong> Depreciation<br />

Build<strong>in</strong>g<br />

South<br />

Africa Swazil<strong>and</strong> Tanzania Zambia Zimbabwe<br />

35.0% 0.0% 15.0% 30.0% 30.0% 30.0% 0.0% 20.0%<br />

5.0% 2.5% 5.0% 5.0% 5.0% 5.0% 4.0% 4.0% 4.0% 5.0% 4.0% 5.0% 10.0% 5.0%<br />

Mach<strong>in</strong>ery & Equipment 12.5% 15.0% 20.0% 10.0% 15.0% 20.0%<br />

20.0% 33.3% 25.0% 20.0% 15.0% 12.5% 50.0% 17.5%<br />

Depreciation Method SL SL DB DB DB SL SL SL SL SL DB SL SL SL<br />

Dividends Withhold<strong>in</strong>g <strong>Tax</strong><br />

for Non-Resident<br />

Carry-forward<br />

15.0%<br />

0.0% 20.0% 0.0% 0.0% 0.0% 18.0% 0.0% 15.0% 12.5% 0.0% 0.0% 0.0% 0.0%<br />

3 5 5 30 30 30 5 30 5 30 30 5 5 6<br />

Capital Ga<strong>in</strong>s <strong>Tax</strong> Rate 35.0% 15.0% 40.0% 15.0% 0.0% 0.0%<br />

35% ?? 0.0% 0.0% 15.0% 30.0% 10.0% 0.0% 20.0%<br />

<strong>Tax</strong> Holiday (period 1) 5 0 5 0 0 0 10 0 0 0 10 10 0 5<br />

Rate reduction<br />

50.0% 0.0% 100.0% 0.0% 0.0% 0.0% 60.0% 0.0% 0.0% 0.0% 66.7% 100.0% 0.0% 100.0%<br />

<strong>Tax</strong> Holiday (period 2) 0 0 0 0 0 0 0 0 0 0 0 20 0 5<br />

Rate reduction<br />

Initial Allowance<br />

Build<strong>in</strong>g<br />

0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 16.7% 0.0% 50.0%<br />

0.0% 25.0% 60.0% 0.0% 100.0% 25.0% 0.0% 20.0% 45.0% 100.0% 50.0% 50.0% 10.0% 50.0%<br />

Adjust Base ? - Yes Yes - Yes Yes - Yes No No No Yes No No<br />

Mach<strong>in</strong>ery & Equipment 0.0% 0.0% 60.0% 0.0% 40.0% 25.0%<br />

0.0% 0.0% 45.0% 100.0% 50.0% 50.0% 0.0% 50.0%<br />

Adjust Base? - Yes Yes - Yes Yes - Yes No No no No No No<br />

Investment <strong>Tax</strong> Credits<br />

Build<strong>in</strong>g<br />

0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 10.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%<br />

Mach<strong>in</strong>ery & Equipment 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%<br />

10.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%<br />

Additional Assumptions (held constant)<br />

Inflation—10%, Nom<strong>in</strong>al <strong>in</strong>terest rate—25%; Required real rate <strong>of</strong> return—20%; Import content <strong>of</strong> capital—25% for build<strong>in</strong>g; 75% for mach<strong>in</strong>ery & equipment<br />

Loss Offset (aga<strong>in</strong>st o<strong>the</strong>r <strong>in</strong>come)—No; Carry-over-Credits—Yes; Indexation <strong>of</strong> <strong>Tax</strong> Parameters—No; Import Duty on Capital Goods—0%<br />

aFor Botswana, <strong>the</strong> calculation assumes (for simplicity) that dividend payouts are less than <strong>the</strong> amount due under <strong>the</strong> 10% secondary tax; thus, <strong>the</strong> effective dividend tax rate is zero.<br />

SOURCE: <strong>SADC</strong> <strong>Tax</strong> Database, version August 2003 supplemented by o<strong>the</strong>r sources noted <strong>in</strong> Table 7-5 <strong>and</strong> <strong>the</strong> Appendix.