SPecIAL - Alu-web.de

SPecIAL - Alu-web.de

SPecIAL - Alu-web.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

E c o n o M i c s<br />

Major trends in the European aluminium industry<br />

This paper is based on a presentation<br />

given by Patrick <strong>de</strong> Schrynmakers,<br />

Secretary General of the<br />

European <strong>Alu</strong>minium Association<br />

(EAA), during a press conference<br />

at the <strong>Alu</strong>minium tra<strong>de</strong> fair in<br />

Essen on 24 September 2008. It<br />

highlights some major trends in<br />

the European aluminium industry.<br />

EAA represents the whole of the<br />

European aluminium value chain<br />

– from bauxite, alumina, electrolytic<br />

metal, recycled aluminium<br />

as well as aluminium lamination,<br />

extrusion and wire drawing.<br />

Although the industry is continuously<br />

restructuring, a number of major<br />

trends have been apparent recently:<br />

1.) The consolidation of large integrated<br />

aluminium companies and/or<br />

the creation of pure aluminium players:<br />

some recent examples in Europe<br />

are the takeover of Péchiney by Alcan<br />

in 2003 and the split of Hydro’s<br />

oil and aluminium activities in early<br />

2007. But much more spectacular<br />

is the emergence of large integrated<br />

companies from Asia: the Indian company<br />

Hindalco took over Novelis (the<br />

former rolling assets of Alcan); in addition<br />

to its strong upstream position,<br />

China’s Chinalco is consolidating<br />

most large Chinese rolling mills.<br />

2.) The split between upstream<br />

and downstream activities in Western<br />

countries: Rusal sold its downstream<br />

activities before merging with Sual<br />

and some of Glencore’s activities in<br />

2007. More recently, soon after having<br />

taken over Alcan, Rio Tinto announced<br />

the divestment of its two<br />

downstream business groups, i. e.<br />

Packaging and Engineered Products.<br />

3.) The subsequent emergence of<br />

large downstream players such as<br />

Aleris, which took over Corus <strong>Alu</strong>minium’s<br />

downstream assets, and Sapa<br />

Profiles, a result of the joint venture<br />

between Sapa’s profiles extrusion<br />

business and Alcoa Soft Alloy Extrusions.<br />

These trends will doubtless continue,<br />

and will not be limited to the<br />

world of aluminium, the best example<br />

being BHP Billiton’s bid for Rio Tinto<br />

Fig. 1<br />

Alcan in or<strong>de</strong>r to create a world mining<br />

and metals giant.<br />

Concerning recent <strong>de</strong>velopments<br />

on the metal front, the apparent<br />

growth of the metal inventories in Europe<br />

is mainly the result of the lack of<br />

cash resulting from the financial crisis.<br />

Investors and funds had bought<br />

significant quantities of aluminium as<br />

investments, and those quantities disappeared<br />

from the statistics, as they<br />

were hid<strong>de</strong>n stocks. However, those<br />

investors have now sold their aluminium<br />

on the official market because<br />

they nee<strong>de</strong>d cash, and as a result this<br />

has artificially blown up the official<br />

inventories, resulting in false signals<br />

of a <strong>de</strong>crease in <strong>de</strong>mand.<br />

Fig. 2<br />

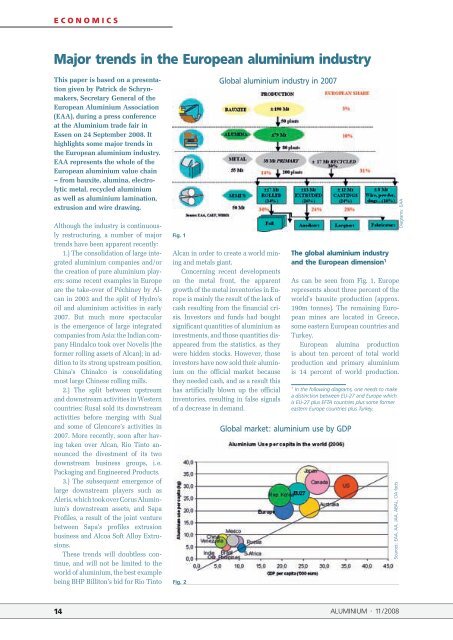

Global aluminium industry in 2007<br />

The global aluminium industry<br />

and the European dimension 1<br />

As can be seen from Fig. 1, Europe<br />

represents about three percent of the<br />

world’s bauxite production (approx.<br />

190m tonnes). The remaining European<br />

mines are located in Greece,<br />

some eastern European countries and<br />

Turkey.<br />

European alumina production<br />

is about ten percent of total world<br />

production and primary aluminium<br />

is 14 percent of world production.<br />

<br />

In the following diagrams, one needs to make<br />

a distinction between EU-27 and Europe which<br />

is EU-27 plus EFTA countries plus some former<br />

eastern Europe countries plus Turkey.<br />

Global market: aluminium use by GDP<br />

Sources: EAA, AA, JAA, ABAL, CIA facts<br />

Diagrams: EAA<br />

14 ALUMINIUM · 11/2008