development report 2012 - UMAR

development report 2012 - UMAR

development report 2012 - UMAR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22 Development Report <strong>2012</strong><br />

Development by the priorities of SDS – A competitive economy and faster economic growth<br />

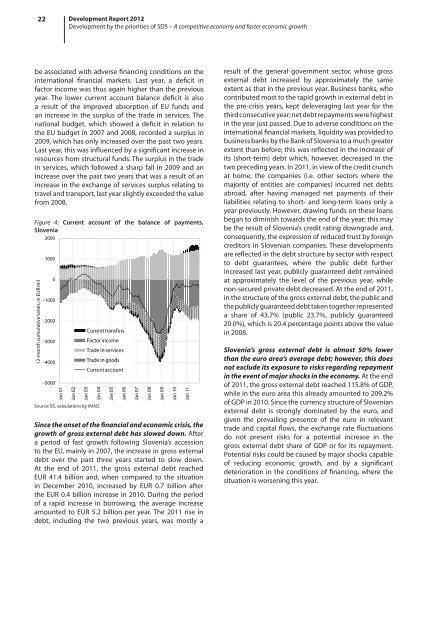

be associated with adverse financing conditions on the<br />

international financial markets. Last year, a deficit in<br />

factor income was thus again higher than the previous<br />

year. The lower current account balance deficit is also<br />

a result of the improved absorption of EU funds and<br />

an increase in the surplus of the trade in services. The<br />

national budget, which showed a deficit in relation to<br />

the EU budget in 2007 and 2008, recorded a surplus in<br />

2009, which has only increased over the past two years.<br />

Last year, this was influenced by a significant increase in<br />

resources from structural funds. The surplus in the trade<br />

in services, which followed a sharp fall in 2009 and an<br />

increase over the past two years that was a result of an<br />

increase in the exchange of services surplus relating to<br />

travel and transport, last year slightly exceeded the value<br />

from 2008.<br />

Figure 4: Current account of the balance of payments,<br />

Slovenia<br />

2000<br />

12-month cumulative totals, in EUR mil<br />

1000<br />

0<br />

-1000<br />

-2000<br />

-3000<br />

-4000<br />

-5000<br />

Jan 01<br />

Jan 02<br />

Jan 03<br />

Jan 04<br />

Source: BS, calculations by IMAD.<br />

Current transfers<br />

Factor income<br />

Trade in services<br />

Trade in goods<br />

Current account<br />

Jan 05<br />

Since the onset of the financial and economic crisis, the<br />

growth of gross external debt has slowed down. After<br />

a period of fast growth following Slovenia’s accession<br />

to the EU, mainly in 2007, the increase in gross external<br />

debt over the past three years started to slow down.<br />

At the end of 2011, the gross external debt reached<br />

EUR 41.4 billion and, when compared to the situation<br />

in December 2010, increased by EUR 0.7 billion after<br />

the EUR 0.4 billion increase in 2010. During the period<br />

of a rapid increase in borrowing, the average increase<br />

amounted to EUR 5.2 billion per year. The 2011 rise in<br />

debt, including the two previous years, was mostly a<br />

Jan 06<br />

Jan 07<br />

Jan 08<br />

Jan 09<br />

Jan 10<br />

Jan 11<br />

result of the general government sector, whose gross<br />

external debt increased by approximately the same<br />

extent as that in the previous year. Business banks, who<br />

contributed most to the rapid growth in external debt in<br />

the pre-crisis years, kept deleveraging last year for the<br />

third consecutive year; net debt repayments were highest<br />

in the year just passed. Due to adverse conditions on the<br />

international financial markets, liquidity was provided to<br />

business banks by the Bank of Slovenia to a much greater<br />

extent than before; this was reflected in the increase of<br />

its (short-term) debt which, however, decreased in the<br />

two preceding years. In 2011, in view of the credit crunch<br />

at home, the companies (i.e. other sectors where the<br />

majority of entities are companies) incurred net debts<br />

abroad, after having managed net payments of their<br />

liabilities relating to short- and long-term loans only a<br />

year previously. However, drawing funds on these loans<br />

began to diminish towards the end of the year; this may<br />

be the result of Slovenia’s credit rating downgrade and,<br />

consequently, the expression of reduced trust by foreign<br />

creditors in Slovenian companies. These <strong>development</strong>s<br />

are reflected in the debt structure by sector with respect<br />

to debt guarantees, where the public debt further<br />

increased last year, publicly guaranteed debt remained<br />

at approximately the level of the previous year, while<br />

non-secured private debt decreased. At the end of 2011,<br />

in the structure of the gross external debt, the public and<br />

the publicly guaranteed debt taken together represented<br />

a share of 43.7% (public 23.7%, publicly guaranteed<br />

20.0%), which is 20.4 percentage points above the value<br />

in 2008.<br />

Slovenia’s gross external debt is almost 50% lower<br />

than the euro area’s average debt; however, this does<br />

not exclude its exposure to risks regarding repayment<br />

in the event of major shocks in the economy. At the end<br />

of 2011, the gross external debt reached 115.8% of GDP,<br />

while in the euro area this already amounted to 209.2%<br />

of GDP in 2010. Since the currency structure of Slovenian<br />

external debt is strongly dominated by the euro, and<br />

given the prevailing presence of the euro in relevant<br />

trade and capital flows, the exchange rate fluctuations<br />

do not present risks for a potential increase in the<br />

gross external debt share of GDP or for its repayment.<br />

Potential risks could be caused by major shocks capable<br />

of reducing economic growth, and by a significant<br />

deterioration in the conditions of financing, where the<br />

situation is worsening this year.