development report 2012 - UMAR

development report 2012 - UMAR

development report 2012 - UMAR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

34 Development Report <strong>2012</strong><br />

Development by the priorities of SDS – A competitive economy and faster economic growth<br />

end of the year, 59 this share rose to more than 30% and<br />

totalled approximately EUR 4 billion, or a good quarter<br />

more than at the beginning of the year. Since refinancing<br />

pressures on the banks dramatically increased last year in<br />

the euro area as a whole, and access to interbank market<br />

financing was significantly reduced, the ECB adopted<br />

additional measures to mitigate liquidity problems and<br />

stimulate lending. The most important of these were<br />

long-term refinancing operations with a maturity of 36<br />

months in which the ECB provided almost EUR 500 billion<br />

in loans to banks in the EU at the first auction at the<br />

end of December last year. According to our estimates,<br />

Slovenian banks secured an additional EUR 900 million<br />

in long-term funds at this auction.<br />

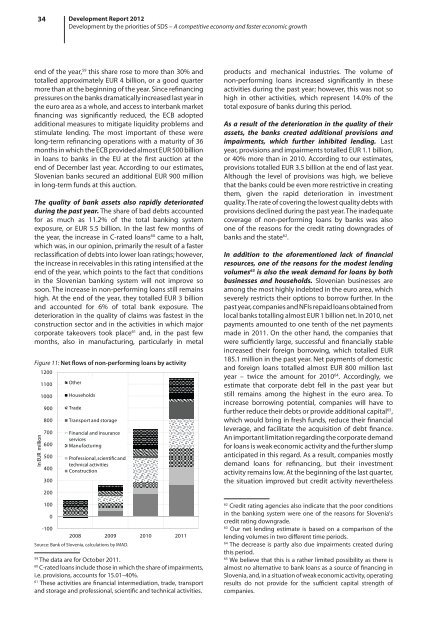

The quality of bank assets also rapidly deteriorated<br />

during the past year. The share of bad debts accounted<br />

for as much as 11.2% of the total banking system<br />

exposure, or EUR 5.5 billion. In the last few months of<br />

the year, the increase in C-rated loans 60 came to a halt,<br />

which was, in our opinion, primarily the result of a faster<br />

reclassification of debts into lower loan ratings; however,<br />

the increase in receivables in this rating intensified at the<br />

end of the year, which points to the fact that conditions<br />

in the Slovenian banking system will not improve so<br />

soon. The increase in non-performing loans still remains<br />

high. At the end of the year, they totalled EUR 3 billion<br />

and accounted for 6% of total bank exposure. The<br />

deterioration in the quality of claims was fastest in the<br />

construction sector and in the activities in which major<br />

corporate takeovers took place 61 and, in the past few<br />

months, also in manufacturing, particularly in metal<br />

Figure 11: Net flows of non-performing loans by activity<br />

In EUR million<br />

1200<br />

1100<br />

1000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

-100<br />

Other<br />

Households<br />

Trade<br />

Transport and storage<br />

Financial and insurance<br />

services<br />

Manufacturing<br />

Professional, scientific and<br />

technical activities<br />

Construction<br />

2008 2009 2010 2011<br />

Source: Bank of Slovenia, calculations by IMAD.<br />

59<br />

The data are for October 2011.<br />

60<br />

C-rated loans include those in which the share of impairments,<br />

i.e. provisions, accounts for 15.01–40%.<br />

61<br />

These activities are financial intermediation, trade, transport<br />

and storage and professional, scientific and technical activities.<br />

products and mechanical industries. The volume of<br />

non-performing loans increased significantly in these<br />

activities during the past year; however, this was not so<br />

high in other activities, which represent 14.0% of the<br />

total exposure of banks during this period.<br />

As a result of the deterioration in the quality of their<br />

assets, the banks created additional provisions and<br />

impairments, which further inhibited lending. Last<br />

year, provisions and impairments totalled EUR 1.1 billion,<br />

or 40% more than in 2010. According to our estimates,<br />

provisions totalled EUR 3.5 billion at the end of last year.<br />

Although the level of provisions was high, we believe<br />

that the banks could be even more restrictive in creating<br />

them, given the rapid deterioration in investment<br />

quality. The rate of covering the lowest quality debts with<br />

provisions declined during the past year. The inadequate<br />

coverage of non-performing loans by banks was also<br />

one of the reasons for the credit rating downgrades of<br />

banks and the state 62 .<br />

In addition to the aforementioned lack of financial<br />

resources, one of the reasons for the modest lending<br />

volumes 63 is also the weak demand for loans by both<br />

businesses and households. Slovenian businesses are<br />

among the most highly indebted in the euro area, which<br />

severely restricts their options to borrow further. In the<br />

past year, companies and NFIs repaid loans obtained from<br />

local banks totalling almost EUR 1 billion net. In 2010, net<br />

payments amounted to one tenth of the net payments<br />

made in 2011. On the other hand, the companies that<br />

were sufficiently large, successful and financially stable<br />

increased their foreign borrowing, which totalled EUR<br />

185.1 million in the past year. Net payments of domestic<br />

and foreign loans totalled almost EUR 800 million last<br />

year – twice the amount for 2010 64 . Accordingly, we<br />

estimate that corporate debt fell in the past year but<br />

still remains among the highest in the euro area. To<br />

increase borrowing potential, companies will have to<br />

further reduce their debts or provide additional capital 65 ,<br />

which would bring in fresh funds, reduce their financial<br />

leverage, and facilitate the acquisition of debt finance.<br />

An important limitation regarding the corporate demand<br />

for loans is weak economic activity and the further slump<br />

anticipated in this regard. As a result, companies mostly<br />

demand loans for refinancing, but their investment<br />

activity remains low. At the beginning of the last quarter,<br />

the situation improved but credit activity nevertheless<br />

62<br />

Credit rating agencies also indicate that the poor conditions<br />

in the banking system were one of the reasons for Slovenia's<br />

credit rating downgrade.<br />

63<br />

Our net lending estimate is based on a comparison of the<br />

lending volumes in two different time periods.<br />

64<br />

The decrease is partly also due impairments created during<br />

this period.<br />

65<br />

We believe that this is a rather limited possibility as there is<br />

almost no alternative to bank loans as a source of financing in<br />

Slovenia, and, in a situation of weak economic activity, operating<br />

results do not provide for the sufficient capital strength of<br />

companies.