development report 2012 - UMAR

development report 2012 - UMAR

development report 2012 - UMAR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

24 Development Report <strong>2012</strong><br />

Development by the priorities of SDS – A competitive economy and faster economic growth<br />

Box 3: Net international investment position as a percentage of GDP (external imbalance indicator in the<br />

excessive imbalance procedure at EU level)<br />

The net financial position or the situation in international investments is an indicator that facilitates analysis of<br />

balance-of-payment flows and situations, and serves as a dynamic insight in several factors behind macroeconomic<br />

(external) imbalances. The net financial position shows the situation in the total balance of claims and liabilities that<br />

the domestic economy has towards foreign countries at the end of each year, using a structure which is equal to the<br />

structure of the balance-of-payments financial account. Apart from debt instruments, which are included in the gross<br />

external claims and the gross external debt (the difference between the two shows the country’s net external debt), the<br />

net financial position also includes claims and liabilities relating to ownership relations. For this reason, this constitutes<br />

a more adequate criterion for detecting external imbalances such as net external debt. A net international debt position<br />

may deteriorate due to major current account deficits and/or changes in values which, along with the ever increasing<br />

integration of countries into international capital flows, are becoming very important factors in the net international<br />

financial position.<br />

The indicative threshold, which alerts to a potential imbalance in the economy at issue when breached, was set by<br />

the Commission at -35% of GDP. Slovenia slightly exceeded this value during the period 2009–2010. This threshold has<br />

been significantly breached above all by the countries that stand at the forefront of the debt crisis, reaching between<br />

-90% to -110% of GDP (Portugal, Ireland, Greece and Spain).<br />

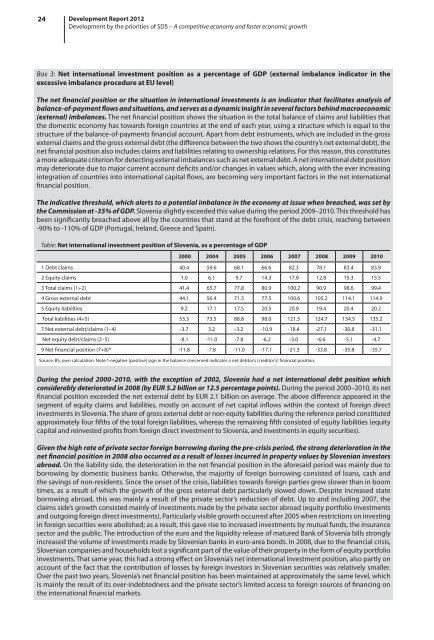

Table: Net international investment position of Slovenia, as a percentage of GDP<br />

2000 2004 2005 2006 2007 2008 2009 2010<br />

1 Debt claims 40.4 59.6 68.1 66.6 82.3 78.1 83.4 83.9<br />

2 Equity claims 1.0 6.1 9.7 14.3 17.9 12.8 15.3 15.5<br />

3 Total claims (1+2) 41.4 65.7 77.8 80.9 100.2 90.9 98.6 99.4<br />

4 Gross external debt 44.1 56.4 71.3 77.5 100.6 105.2 114.1 114.9<br />

5 Equity liabilities 9.2 17.1 17.5 20.5 20.9 19.4 20.4 20.2<br />

Total liabilities (4+5) 53.3 73.5 88.8 98.0 121.5 124.7 134.5 135.2<br />

7 Net external debt/claims (1–4) -3.7 3.2 -3.2 -10.9 -18.4 -27.1 -30.8 -31.1<br />

Net equity debt/claims (2–5) -8.1 -11.0 -7.8 -6.2 -3.0 -6.6 -5.1 -4.7<br />

9 Net financial position (7+8)* -11.8 -7.8 -11.0 -17.1 -21.3 -33.8 -35.8 -35.7<br />

Source: BS, own calculation. Note:*-negative (positive) sign in the balance concerned indicates a net debtor's (creditor's) financial position.<br />

During the period 2000–2010, with the exception of 2002, Slovenia had a net international debt position which<br />

considerably deteriorated in 2008 (by EUR 5.2 billion or 12.5 percentage points). During the period 2000–2010, its net<br />

financial position exceeded the net external debt by EUR 2.1 billion on average. The above difference appeared in the<br />

segment of equity claims and liabilities, mostly on account of net capital inflows within the context of foreign direct<br />

investments in Slovenia. The share of gross external debt or non-equity liabilities during the reference period constituted<br />

approximately four fifths of the total foreign liabilities, whereas the remaining fifth consisted of equity liabilities (equity<br />

capital and reinvested profits from foreign direct investment to Slovenia, and investments in equity securities).<br />

Given the high rate of private sector foreign borrowing during the pre-crisis period, the strong deterioration in the<br />

net financial position in 2008 also occurred as a result of losses incurred in property values by Slovenian investors<br />

abroad. On the liability side, the deterioration in the net financial position in the aforesaid period was mainly due to<br />

borrowing by domestic business banks. Otherwise, the majority of foreign borrowing consisted of loans, cash and<br />

the savings of non-residents. Since the onset of the crisis, liabilities towards foreign parties grew slower than in boom<br />

times, as a result of which the growth of the gross external debt particularly slowed down. Despite increased state<br />

borrowing abroad, this was mainly a result of the private sector’s reduction of debt. Up to and including 2007, the<br />

claims side’s growth consisted mainly of investments made by the private sector abroad (equity portfolio investments<br />

and outgoing foreign direct investments). Particularly visible growth occurred after 2005 when restrictions on investing<br />

in foreign securities were abolished; as a result, this gave rise to increased investments by mutual funds, the insurance<br />

sector and the public. The introduction of the euro and the liquidity release of matured Bank of Slovenia bills strongly<br />

increased the volume of investments made by Slovenian banks in euro-area bonds. In 2008, due to the financial crisis,<br />

Slovenian companies and households lost a significant part of the value of their property in the form of equity portfolio<br />

investments. That same year, this had a strong effect on Slovenia’s net international investment position, also partly on<br />

account of the fact that the contribution of losses by foreign investors in Slovenian securities was relatively smaller.<br />

Over the past two years, Slovenia’s net financial position has been maintained at approximately the same level, which<br />

is mainly the result of its over-indebtedness and the private sector’s limited access to foreign sources of financing on<br />

the international financial markets.