development report 2012 - UMAR

development report 2012 - UMAR

development report 2012 - UMAR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

28 Development Report <strong>2012</strong><br />

Development by the priorities of SDS – A competitive economy and faster economic growth<br />

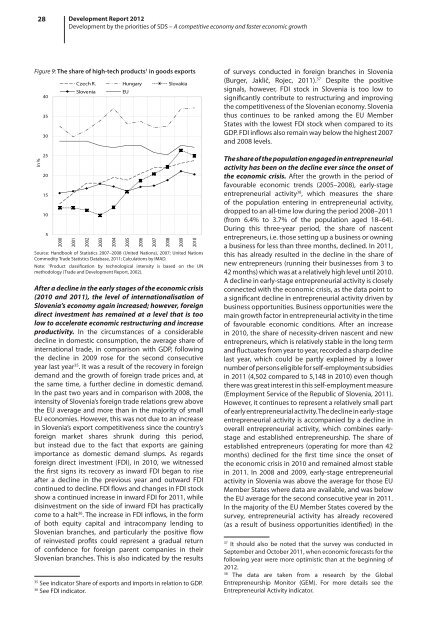

Figure 9: The share of high-tech products 1 in goods exports<br />

In %<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

2000<br />

2001<br />

Czech R. Hungary Slovakia<br />

Slovenia<br />

EU<br />

2002<br />

2003<br />

2004<br />

Source: Handbook of Statistics 2007–2008 (United Nations), 2007; United Nations<br />

Commodity Trade Statistics Database, 2011; Calculations by IMAD.<br />

Note: 1<br />

Product classification by technological intensity is based on the UN<br />

methodology (Trade and Development Report, 2002).<br />

After a decline in the early stages of the economic crisis<br />

(2010 and 2011), the level of internationalisation of<br />

Slovenia’s economy again increased; however, foreign<br />

direct investment has remained at a level that is too<br />

low to accelerate economic restructuring and increase<br />

productivity. In the circumstances of a considerable<br />

decline in domestic consumption, the average share of<br />

international trade, in comparison with GDP, following<br />

the decline in 2009 rose for the second consecutive<br />

year last year 35 . It was a result of the recovery in foreign<br />

demand and the growth of foreign trade prices and, at<br />

the same time, a further decline in domestic demand.<br />

In the past two years and in comparison with 2008, the<br />

intensity of Slovenia’s foreign trade relations grew above<br />

the EU average and more than in the majority of small<br />

EU economies. However, this was not due to an increase<br />

in Slovenia’s export competitiveness since the country’s<br />

foreign market shares shrunk during this period,<br />

but instead due to the fact that exports are gaining<br />

importance as domestic demand slumps. As regards<br />

foreign direct investment (FDI), in 2010, we witnessed<br />

the first signs its recovery as inward FDI began to rise<br />

after a decline in the previous year and outward FDI<br />

continued to decline. FDI flows and changes in FDI stock<br />

show a continued increase in inward FDI for 2011, while<br />

disinvestment on the side of inward FDI has practically<br />

come to a halt 36 . The increase in FDI inflows, in the form<br />

of both equity capital and intracompany lending to<br />

Slovenian branches, and particularly the positive flow<br />

of reinvested profits could represent a gradual return<br />

of confidence for foreign parent companies in their<br />

Slovenian branches. This is also indicated by the results<br />

35<br />

See indicator Share of exports and imports in relation to GDP.<br />

36<br />

See FDI indicator.<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

of surveys conducted in foreign branches in Slovenia<br />

(Burger, Jaklič, Rojec, 2011). 37 Despite the positive<br />

signals, however, FDI stock in Slovenia is too low to<br />

significantly contribute to restructuring and improving<br />

the competitiveness of the Slovenian economy. Slovenia<br />

thus continues to be ranked among the EU Member<br />

States with the lowest FDI stock when compared to its<br />

GDP. FDI inflows also remain way below the highest 2007<br />

and 2008 levels.<br />

The share of the population engaged in entrepreneurial<br />

activity has been on the decline ever since the onset of<br />

the economic crisis. After the growth in the period of<br />

favourable economic trends (2005–2008), early-stage<br />

entrepreneurial activity 38 , which measures the share<br />

of the population entering in entrepreneurial activity,<br />

dropped to an all-time low during the period 2008–2011<br />

(from 6.4% to 3.7% of the population aged 18–64).<br />

During this three-year period, the share of nascent<br />

entrepreneurs, i.e. those setting up a business or owning<br />

a business for less than three months, declined. In 2011,<br />

this has already resulted in the decline in the share of<br />

new entrepreneurs (running their businesses from 3 to<br />

42 months) which was at a relatively high level until 2010.<br />

A decline in early-stage entrepreneurial activity is closely<br />

connected with the economic crisis, as the data point to<br />

a significant decline in entrepreneurial activity driven by<br />

business opportunities. Business opportunities were the<br />

main growth factor in entrepreneurial activity in the time<br />

of favourable economic conditions. After an increase<br />

in 2010, the share of necessity-driven nascent and new<br />

entrepreneurs, which is relatively stable in the long term<br />

and fluctuates from year to year, recorded a sharp decline<br />

last year, which could be partly explained by a lower<br />

number of persons eligible for self-employment subsidies<br />

in 2011 (4,502 compared to 5,148 in 2010) even though<br />

there was great interest in this self-employment measure<br />

(Employment Service of the Republic of Slovenia, 2011).<br />

However, it continues to represent a relatively small part<br />

of early entrepreneurial activity. The decline in early-stage<br />

entrepreneurial activity is accompanied by a decline in<br />

overall entrepreneurial activity, which combines earlystage<br />

and established entrepreneurship. The share of<br />

established entrepreneurs (operating for more than 42<br />

months) declined for the first time since the onset of<br />

the economic crisis in 2010 and remained almost stable<br />

in 2011. In 2008 and 2009, early-stage entrepreneurial<br />

activity in Slovenia was above the average for those EU<br />

Member States where data are available, and was below<br />

the EU average for the second consecutive year in 2011.<br />

In the majority of the EU Member States covered by the<br />

survey, entrepreneurial activity has already recovered<br />

(as a result of business opportunities identified) in the<br />

37<br />

It should also be noted that the survey was conducted in<br />

September and October 2011, when economic forecasts for the<br />

following year were more optimistic than at the beginning of<br />

<strong>2012</strong>.<br />

38<br />

The data are taken from a research by the Global<br />

Entrepreneurship Monitor (GEM). For more details see the<br />

Entrepreneurial Activity indicator.