development report 2012 - UMAR

development report 2012 - UMAR

development report 2012 - UMAR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Development Report <strong>2012</strong><br />

Development by the priorities of SDS – A competitive economy and faster economic growth<br />

33<br />

Throughout the period of SDS implementation,<br />

the main weaknesses in Slovenian market services<br />

remain under<strong>development</strong> and the low productivity<br />

of knowledge-intensive services which, due to the<br />

high degree of connectedness with other sectors, have<br />

great potential for improving the competitiveness<br />

of the entire economy. In addition to the large<br />

share of services in the structure of value added and<br />

employment, rapid technological advances, which<br />

bring new specialised services and service integrations<br />

into the business processes of other activities, have<br />

increased the importance of the direct impact of these<br />

services on economic efficiency. Services, particularly<br />

<strong>development</strong>-related and business services, support<br />

innovation processes in manufacturing by transferring<br />

knowledge and thus enhance product differentiation<br />

and quality and, consequently, also their value<br />

added and competitive market position. The lag of<br />

manufacturing behind the EU average in terms of value<br />

added per employee is significant and is decreasing only<br />

slowly 58 . On the other hand, it should not be overlooked<br />

that manufacturing companies in developed countries<br />

also increasingly provide market services they have<br />

developed in order to provide their customers with<br />

integral solutions. This expands the range of highly<br />

specialised knowledge-intensive services and brings their<br />

producers financial and marketing benefits and strategic<br />

advantages, as complementary services provide the<br />

buyers of products with value added services (European<br />

Competitiveness Report 2011, 2011). For this reason, a<br />

further strengthening of knowledge-intensive services<br />

is essential for increasing economic effectiveness and<br />

competitiveness.<br />

1.3.2. Financial services<br />

In 2011, the conditions in the financial sector continued<br />

to deteriorate, causing the gap in the <strong>development</strong> of<br />

Slovenia’s financial sector in comparison with the EU<br />

average to increase again. The smallest <strong>development</strong><br />

gap in financial services was recorded in the insurance<br />

industry. Like in the EU, the insurance premiums in<br />

relation to GDP remained at the previous year’s level.<br />

Slovenia achieved less than two thirds of the EU average.<br />

The banks continued to reduce the volume of their<br />

investments, which was reflected in a further decline in<br />

loans to Slovenian businesses, which rank among the<br />

most highly indebted businesses in the euro area. In our<br />

opinion, the <strong>development</strong> gap in this area, measured<br />

in terms of relative total bank assets, slightly increased<br />

last year; moreover, the indicator shows that Slovenia’s<br />

economic <strong>development</strong> lags behind some comparable<br />

EU Member States. The largest <strong>development</strong> gap is in<br />

capital markets, which was the least developed segment<br />

in Slovenia’s financial system before the outbreak of<br />

the financial crisis. Its importance for the provision of<br />

58<br />

See Chapter 1.2. Increasing competitiveness and promoting<br />

entrepreneurial activity<br />

fresh sources of financing is negligible and it has not<br />

even contributed to the transparency of ownership<br />

consolidation of businesses. The worsening of the<br />

financial crisis and low capital market liquidity have<br />

further considerably increased the <strong>development</strong> gap.<br />

The Ljubljana Stock Exchange market capitalisation<br />

decreased dramatically and there was an even stronger<br />

decline in turnover, which puts the Ljubljana Stock<br />

Exchange among the least liquid capital markets in the<br />

EU.<br />

The problems with limited banking resources<br />

deteriorated further in 2011. The extremely<br />

unfavourable fiscal trends in some euro area countries<br />

and anticipations of another slump in the EU economy<br />

substantially increased uncertainty in the international<br />

financial markets. At the end of 2010, the guarantee<br />

schemes for bank borrowing abroad expired. All this<br />

considerably restricted the possibilities and access to<br />

foreign financing so that the banks relied heavily on<br />

domestic financing, which was rather scarce. Under<br />

unfavourable labour market conditions, inflows of<br />

household deposits halved, and the government has<br />

a very limited option to provide further financing to<br />

the Slovenian banking sector as a result of the severe<br />

deterioration in public finances. Consequently, the<br />

pressures associated with the refinancing of bank debt<br />

are rapidly mounting. The banks repay a part of their<br />

liabilities from existing reserves, by reducing their<br />

lending activity and partly through refinancing. With the<br />

situation in the international financial market worsening<br />

each day, refinancing deadlines are getting shorter,<br />

causing bank liabilities to fall due almost simultaneously.<br />

At the beginning of 2011, one fifth of the bank liabilities<br />

towards foreign banks matured within one year; at the<br />

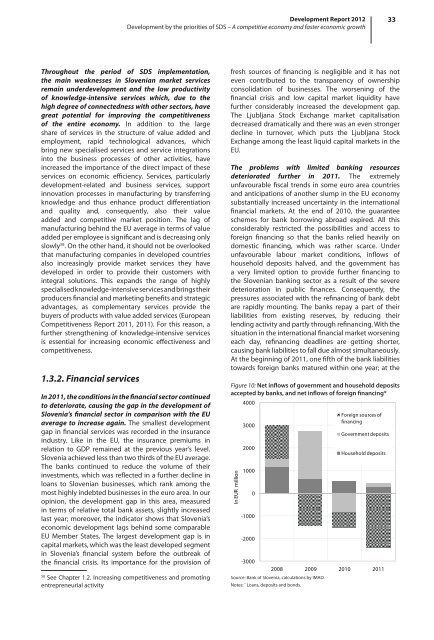

Figure 10: Net inflows of government and household deposits<br />

accepted by banks, and net inflows of foreign financing*<br />

In EUR million<br />

4000<br />

3000<br />

2000<br />

1000<br />

0<br />

-1000<br />

-2000<br />

-3000<br />

2008 2009 2010 2011<br />

Source: Bank of Slovenia, calculations by IMAD.<br />

Notes: * Loans, deposits and bonds.<br />

Foreign sources of<br />

financing<br />

Government deposits<br />

Household deposits