development report 2012 - UMAR

development report 2012 - UMAR

development report 2012 - UMAR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Development Report <strong>2012</strong><br />

Development by the priorities of SDS – A competitive economy and faster economic growth<br />

25<br />

1.2. Increasing competitiveness<br />

and promoting entrepreneurial<br />

<strong>development</strong><br />

The Slovenian economy’s export competitiveness<br />

has deteriorated considerably since the onset of the<br />

economic crisis (2008). During the period between<br />

the beginning of 2008 and the third quarter of 2011,<br />

Slovenia lost approximately 15.6% of its export market<br />

share on the world market of goods and 7.5% in its<br />

largest trading partners 20 . This loss accounted for a good<br />

half of the increases made during the preceding sevenyear<br />

period of incessant growth 21 . The contraction of<br />

export market shares at the beginning of the crisis was<br />

characteristic of all EU Member States. However, Slovenia<br />

was ranked in the group of countries with the largest<br />

contraction on the world market 22 . During the period<br />

2008–2009, a drop in market shares was alleviated by the<br />

incentives for purchasing motor vehicles proposed by<br />

some EU Member States, which resulted in an increase<br />

in Slovenian exports and, consequently, an increase in<br />

the market share of motor vehicles on foreign markets<br />

(mainly in France and Germany). In 2010, when incentives<br />

for purchasing motor vehicles in the majority of its<br />

trading partners came to an end 23 , the drop in Slovenia’s<br />

foreign market share grew deeper (‐10%). That year,<br />

Slovenia came close to approaching the threshold of the<br />

excessive imbalances detection mechanism at EU level,<br />

which concerning the market share indicator, in addition<br />

to goods, includes also services 24 . Apart from motor<br />

vehicles, the reduction of shares on the foreign markets<br />

in 2010, as was the case in 2008–2009, also existed<br />

with the majority of other important Slovenian export<br />

product groups 25 . The data available for the first nine<br />

months of 2011 point to a stagnation in market shares<br />

on the world market and to slight growth recorded with<br />

its key trading partners. What is encouraging, however,<br />

is the high growth recorded in two of its most important<br />

trading partners: Germany and Croatia.<br />

20<br />

These comprise thirteen countries: Germany, Italy, Austria,<br />

France, United Kingdom, Poland, Hungary, Czech Republic,<br />

Croatia, Bosnia and Herzegovina, Russia, the United States and<br />

Macedonia.<br />

21<br />

The loss in its largest trade partners accounted for a quarter of<br />

the increase for the period 2000–2007.<br />

22<br />

During the period 2008–2009, a drop in its export market<br />

share meant Slovenia ranked eighth among 17 EU Member<br />

States; in 2010, a deterioration in its export competitiveness<br />

meant Slovenia ranked fourth among EU Member States. .<br />

23<br />

In France, incentives for purchasing motor vehicles gradually<br />

stopped (through reducing financial compensation) by the end<br />

of 2010. Some larger Member States, although less important<br />

importers of motor vehicles from Slovenia, offered these<br />

incentives throughout the whole year (the Netherlands) or part<br />

of 2010 (United Kingdom, Spain).<br />

24<br />

For more details, see Box 2: Excessive Imbalance Procedure<br />

at EU level.<br />

25<br />

See indicator Market share.<br />

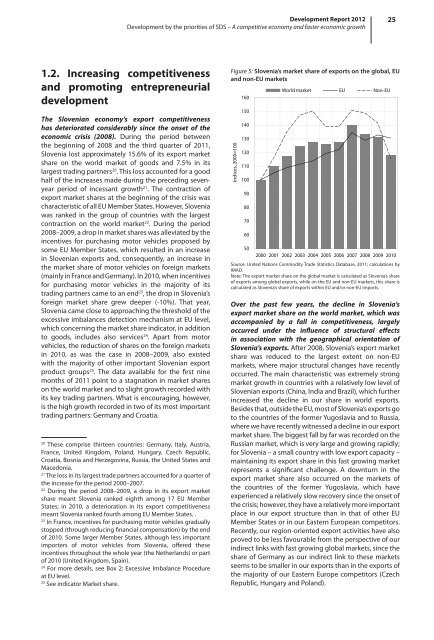

Figure 5: Slovenia’s market share of exports on the global, EU<br />

and non-EU markets<br />

Indices, 2000=100<br />

160<br />

150<br />

140<br />

130<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

World market EU Non-EU<br />

50<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Source: United Nations Commodity Trade Statistics Database, 2011; calculations by<br />

IMAD.<br />

Note: The export market share on the global market is calculated as Slovenia’s share<br />

of exports among global exports, while on the EU and non-EU markets, this share is<br />

calculated as Slovenia’s share of exports within EU and/or non-EU imports.<br />

Over the past few years, the decline in Slovenia’s<br />

export market share on the world market, which was<br />

accompanied by a fall in competitiveness, largely<br />

occurred under the influence of structural effects<br />

in association with the geographical orientation of<br />

Slovenia’s exports. After 2008, Slovenia’s export market<br />

share was reduced to the largest extent on non-EU<br />

markets, where major structural changes have recently<br />

occurred. The main characteristic was extremely strong<br />

market growth in countries with a relatively low level of<br />

Slovenian exports (China, India and Brazil), which further<br />

increased the decline in our share in world exports.<br />

Besides that, outside the EU, most of Slovenia’s exports go<br />

to the countries of the former Yugoslavia and to Russia,<br />

where we have recently witnessed a decline in our export<br />

market share. The biggest fall by far was recorded on the<br />

Russian market, which is very large and growing rapidly;<br />

for Slovenia – a small country with low export capacity –<br />

maintaining its export share in this fast growing market<br />

represents a significant challenge. A downturn in the<br />

export market share also occurred on the markets of<br />

the countries of the former Yugoslavia, which have<br />

experienced a relatively slow recovery since the onset of<br />

the crisis; however, they have a relatively more important<br />

place in our export structure than in that of other EU<br />

Member States or in our Eastern European competitors.<br />

Recently, our region-oriented export activities have also<br />

proved to be less favourable from the perspective of our<br />

indirect links with fast growing global markets, since the<br />

share of Germany as our indirect link to these markets<br />

seems to be smaller in our exports than in the exports of<br />

the majority of our Eastern Europe competitors (Czech<br />

Republic, Hungary and Poland).