development report 2012 - UMAR

development report 2012 - UMAR

development report 2012 - UMAR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

74 Development Report <strong>2012</strong><br />

Development by the priorities of SDS – Integration of measures to achieve sustainable <strong>development</strong><br />

transport volumes (by 7.9%), which resulted in a drop in<br />

the share of road freight transport to 82.3% 244 . Based on<br />

data for the first three quarters of 2011, we estimate that<br />

the share of road freight transport in 2011 continued<br />

to decline (to 81.3%) 245 . Before 2010, the share of road<br />

transport continued to increase steadily, an unfavourable<br />

<strong>development</strong> in terms of sustainable transportation. In<br />

2010, the share of road freight transport in EU Member<br />

States decreased on average (to 76.5%), but the increase<br />

in freight volumes was less than in Slovenia. The modal<br />

split of freight transport in Slovenia is less favourable<br />

than the EU average, and freight transport volumes are<br />

extremely high due to Slovenia’s transit position. In 2010,<br />

Slovenian road transport operators transported 98%<br />

more tonne-kilometres 246 per inhabitant than the EU<br />

average, and the volume of rail transport per inhabitant<br />

was similarly above the EU average (114% higher). The<br />

growth in freight transport volumes was particularly<br />

high after Slovenia’s accession to the EU and the latter’s<br />

subsequent enlargement, while the unfavourable<br />

structure was stimulated by low prices for motor fuels<br />

and tolls for cargo vehicles before the onset of the crisis,<br />

and more modern road infrastructure than railway<br />

infrastructure.<br />

In public passenger transport, the trend of reduced bus<br />

transportation continued in 2010 and 2011. In 2008,<br />

public passenger traffic in Slovenia constituted only<br />

13.8% of the total passenger transport, which is much<br />

less than in the majority of EU Member States 247 . The<br />

high level of individualised forms of transport in Slovenia<br />

is corroborated by a higher share of passenger vehicles<br />

per inhabitant (Slovenia: 521 cars per 1,000 inhabitants,<br />

EU: 473 cars per 1,000 inhabitants), despite below<br />

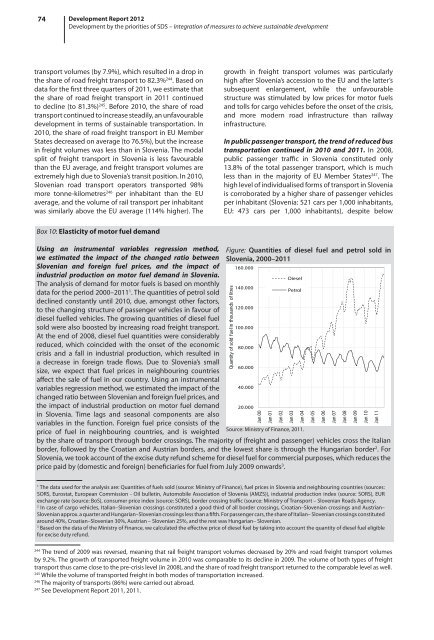

Box 10: Elasticity of motor fuel demand<br />

Using an instrumental variables regression method,<br />

we estimated the impact of the changed ratio between<br />

Slovenian and foreign fuel prices, and the impact of<br />

industrial production on motor fuel demand in Slovenia.<br />

The analysis of demand for motor fuels is based on monthly<br />

data for the period 2000–2011 1 . The quantities of petrol sold<br />

declined constantly until 2010, due, amongst other factors,<br />

to the changing structure of passenger vehicles in favour of<br />

diesel fuelled vehicles. The growing quantities of diesel fuel<br />

sold were also boosted by increasing road freight transport.<br />

At the end of 2008, diesel fuel quantities were considerably<br />

reduced, which coincided with the onset of the economic<br />

crisis and a fall in industrial production, which resulted in<br />

a decrease in foreign trade flows. Due to Slovenia’s small<br />

size, we expect that fuel prices in neighbouring countries<br />

affect the sale of fuel in our country. Using an instrumental<br />

variables regression method, we estimated the impact of the<br />

changed ratio between Slovenian and foreign fuel prices, and<br />

the impact of industrial production on motor fuel demand<br />

in Slovenia. Time lags and seasonal components are also<br />

variables in the function. Foreign fuel price consists of the<br />

price of fuel in neighbouring countries, and is weighted<br />

Figure: Quantities of diesel fuel and petrol sold in<br />

Slovenia, 2000–2011<br />

160.000<br />

140.000<br />

120.000<br />

100.000<br />

by the share of transport through border crossings. The majority of (freight and passenger) vehicles cross the Italian<br />

border, followed by the Croatian and Austrian borders, and the lowest share is through the Hungarian border 2 . For<br />

Slovenia, we took account of the excise duty refund scheme for diesel fuel for commercial purposes, which reduces the<br />

price paid by (domestic and foreign) beneficiaries for fuel from July 2009 onwards 3 .<br />

Quantity of sold fuel in thousands of litres<br />

80.000<br />

60.000<br />

40.000<br />

20.000<br />

Diesel<br />

Petrol<br />

Jan 00<br />

Jan 01<br />

Jan 02<br />

Jan 03<br />

Jan 04<br />

Jan 05<br />

Jan 06<br />

Jan 07<br />

Jan 08<br />

Jan 09<br />

Jan 10<br />

Jan 11<br />

Source: Ministry of Finance, 2011.<br />

1<br />

The data used for the analysis are: Quantities of fuels sold (source: Ministry of Finance), fuel prices in Slovenia and neighbouring countries (sources:<br />

SORS, Eurostat, European Commission - Oil bulletin, Automobile Association of Slovenia (AMZS)), industrial production index (source: SORS), EUR<br />

exchange rate (source: BoS), consumer price index (source: SORS), border crossing traffic (source: Ministry of Transport – Slovenian Roads Agency.<br />

2<br />

In case of cargo vehicles, Italian–Slovenian crossings constituted a good third of all border crossings, Croatian–Slovenian crossings and Austrian–<br />

Slovenian approx. a quarter and Hungarian–Slovenian crossings less than a fifth. For passenger cars, the share of Italian– Slovenian crossings constituted<br />

around 40%, Croatian–Slovenian 30%, Austrian – Slovenian 25%, and the rest was Hungarian– Slovenian.<br />

3<br />

Based on the data of the Ministry of Finance, we calculated the effective price of diesel fuel by taking into account the quantity of diesel fuel eligible<br />

for excise duty refund.<br />

244<br />

The trend of 2009 was reversed, meaning that rail freight transport volumes decreased by 20% and road freight transport volumes<br />

by 9.2%. The growth of transported freight volume in 2010 was comparable to its decline in 2009. The volume of both types of freight<br />

transport thus came close to the pre-crisis level (in 2008), and the share of road freight transport returned to the comparable level as well.<br />

245<br />

While the volume of transported freight in both modes of transportation increased.<br />

246<br />

The majority of transports (86%) were carried out abroad.<br />

247<br />

See Development Report 2011, 2011.