Company Valuation Under IFRS : Interpreting and Forecasting ...

Company Valuation Under IFRS : Interpreting and Forecasting ...

Company Valuation Under IFRS : Interpreting and Forecasting ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Company</strong> valuation under <strong>IFRS</strong><br />

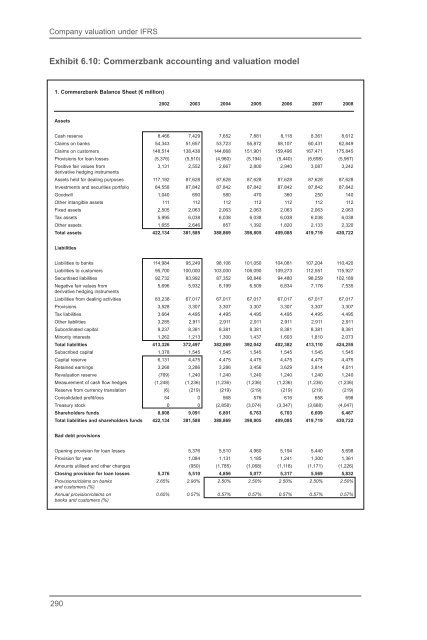

Exhibit 6.10: Commerzbank accounting <strong>and</strong> valuation model<br />

1. Commerzbank Balance Sheet (€ million)<br />

2002 2003 2004 2005 2006 2007 2008<br />

Assets<br />

Cash reserve 8,466 7,429 7,652 7,881 8,118 8,361 8,612<br />

Claims on banks 54,343 51,657 53,723 55,872 58,107 60,431 62,849<br />

Claims on customers 148,514 138,438 144,668 151,901 159,496 167,471 175,845<br />

Provisions for loan losses (5,376) (5,510) (4,960) (5,194) (5,440) (5,698) (5,967)<br />

Positive fair values from 3,131 2,552 2,667 2,800 2,940 3,087 3,242<br />

derivative hedging instruments<br />

Assets held for dealing purposes 117,192 87,628 87,628 87,628 87,628 87,628 87,628<br />

Investments <strong>and</strong> securities portfolio 84,558 87,842 87,842 87,842 87,842 87,842 87,842<br />

Goodwill 1,040 690 580 470 360 250 140<br />

Other intangible assets 111 112 112 112 112 112 112<br />

Fixed assets 2,505 2,063 2,063 2,063 2,063 2,063 2,063<br />

Tax assets 5,995 6,038 6,038 6,038 6,038 6,038 6,038<br />

Other assets 1,655 2,646 857 1,392 1,820 2,133 2,320<br />

Total assets 422,134 381,585 388,869 398,805 409,085 419,719 430,722<br />

Liabilities<br />

Liabilities to banks 114,984 95,249 98,106 101,050 104,081 107,204 110,420<br />

Liabilities to customers 95,700 100,000 103,000 106,090 109,273 112,551 115,927<br />

Securitised liabilities 92,732 83,992 87,352 90,846 94,480 98,259 102,189<br />

Negative fair values from 5,696 5,932 6,199 6,509 6,834 7,176 7,535<br />

derivative hedging instruments<br />

Liabilities from dealing activities 83,238 67,017 67,017 67,017 67,017 67,017 67,017<br />

Provisions 3,528 3,307 3,307 3,307 3,307 3,307 3,307<br />

Tax liabilities 3,664 4,495 4,495 4,495 4,495 4,495 4,495<br />

Other liabilities 3,285 2,911 2,911 2,911 2,911 2,911 2,911<br />

Subordinated capital 9,237 8,381 8,381 8,381 8,381 8,381 8,381<br />

Minority interests 1,262 1,213 1,300 1,437 1,603 1,810 2,073<br />

Total liabilities 413,326 372,497 382,069 392,042 402,382 413,110 424,255<br />

Subscribed capital 1,378 1,545 1,545 1,545 1,545 1,545 1,545<br />

Capital reserve 6,131 4,475 4,475 4,475 4,475 4,475 4,475<br />

Retained earnings 3,268 3,286 3,286 3,456 3,629 3,814 4,011<br />

Revaluation reserve (769) 1,240 1,240 1,240 1,240 1,240 1,240<br />

Measurement of cash flow hedges (1,248) (1,236) (1,236) (1,236) (1,236) (1,236) (1,236)<br />

Reserve from currency translation (6) (219) (219) (219) (219) (219) (219)<br />

Consolidated profit/loss 54 0 568 576 616 658 698<br />

Treasury stock 0 0 (2,858) (3,074) (3,347) (3,668) (4,047)<br />

Shareholders funds 8,808 9,091 6,801 6,763 6,703 6,609 6,467<br />

Total liabilities <strong>and</strong> shareholders funds 422,134 381,588 388,869 398,805 409,085 419,719 430,722<br />

Bad debt provisions<br />

Opening provision for loan losses 5,376 5,510 4,960 5,194 5,440 5,698<br />

Provision for year 1,084 1,131 1,185 1,241 1,300 1,361<br />

Amounts utilised <strong>and</strong> other changes (950) (1,785) (1,068) (1,118) (1,171) (1,226)<br />

Closing provision for loan losses 5,376 5,510 4,856 5,077 5,317 5,569 5,832<br />

Provisions/claims on banks 2.65% 2.90% 2.50% 2.50% 2.50% 2.50% 2.50%<br />

<strong>and</strong> customers (%)<br />

Annual provision/claims on 0.65% 0.57% 0.57% 0.57% 0.57% 0.57% 0.57%<br />

banks <strong>and</strong> customers (%)<br />

290