Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

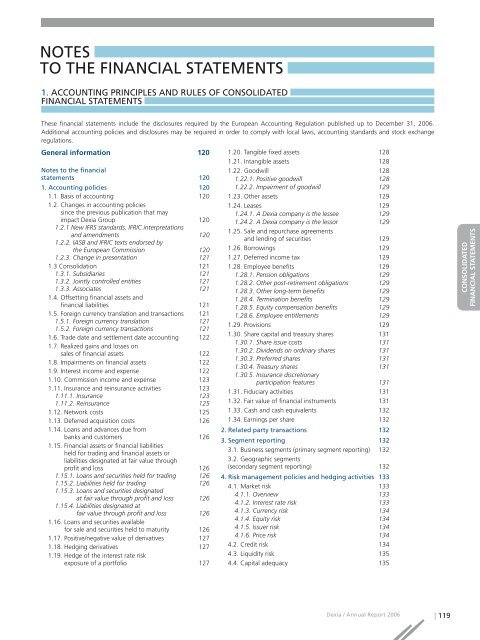

NOTES<br />

TO THE FINANCIAL STATEMENTS<br />

1. ACCOUNTING PRINCIPLES AND RULES OF CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

These financial statements include the disclosures required by the European Accounting Regulation published up to December 31, <strong>2006</strong>.<br />

Additional accounting policies and disclosures may be required in order to <strong>com</strong>ply with local laws, accounting standards and stock exchange<br />

regulations.<br />

General information 120<br />

Notes to the financial<br />

statements 120<br />

1. Accounting policies 120<br />

1.1. Basis of accounting 120<br />

1.2. Changes in accounting policies<br />

since the previous publication that may<br />

impact <strong>Dexia</strong> Group 120<br />

1.2.1 New IFRS standards, IFRIC interpretations<br />

and amendments 120<br />

1.2.2. IASB and IFRIC texts endorsed by<br />

the European Commission 120<br />

1.2.3. Change in presentation 121<br />

1.3 Consolidation 121<br />

1.3.1. Subsidiaries 121<br />

1.3.2. Jointly controlled entities 121<br />

1.3.3. Associates 121<br />

1.4. Offsetting financial assets and<br />

financial liabilities 121<br />

1.5. Foreign currency translation and transactions 121<br />

1.5.1. Foreign currency translation 121<br />

1.5.2. Foreign currency transactions 121<br />

1.6. Trade date and settlement date accounting 122<br />

1.7. Realized gains and losses on<br />

sales of financial assets 122<br />

1.8. Impairments on financial assets 122<br />

1.9. Interest in<strong>com</strong>e and expense 122<br />

1.10. Commission in<strong>com</strong>e and expense 123<br />

1.11. Insurance and reinsurance activities 123<br />

1.11.1. Insurance 123<br />

1.11.2. Reinsurance 125<br />

1.12. Network costs 125<br />

1.13. Deferred acquisition costs 126<br />

1.14. Loans and advances due from<br />

banks and customers 126<br />

1.15. Financial assets or financial liabilities<br />

held for trading and financial assets or<br />

liabilities designated at fair value through<br />

profit and loss 126<br />

1.15.1. Loans and securities held for trading 126<br />

1.15.2. Liabilities held for trading 126<br />

1.15.3. Loans and securities designated<br />

at fair value through profit and loss 126<br />

1.15.4. Liabilities designated at<br />

fair value through profit and loss 126<br />

1.16. Loans and securities available<br />

for sale and securities held to maturity 126<br />

1.17. Positive/negative value of derivatives 127<br />

1.18. Hedging derivatives 127<br />

1.19. Hedge of the interest rate risk<br />

exposure of a portfolio 127<br />

1.20. Tangible fixed assets 128<br />

1.21. Intangible assets 128<br />

1.22. Goodwill 128<br />

1.22.1. Positive goodwill 128<br />

1.22.2. Impairment of goodwill 129<br />

1.23. Other assets 129<br />

1.24. Leases 129<br />

1.24.1. A <strong>Dexia</strong> <strong>com</strong>pany is the lessee 129<br />

1.24.2. A <strong>Dexia</strong> <strong>com</strong>pany is the lessor 129<br />

1.25. Sale and repurchase agreements<br />

and lending of securities 129<br />

1.26. Borrowings 129<br />

1.27. Deferred in<strong>com</strong>e tax 129<br />

1.28. Employee benefits 129<br />

1.28.1. Pension obligations 129<br />

1.28.2. Other post-retirement obligations 129<br />

1.28.3. Other long-term benefits 129<br />

1.28.4. Termination benefits 129<br />

1.28.5. Equity <strong>com</strong>pensation benefits 129<br />

1.28.6. Employee entitlements 129<br />

1.29. Provisions 129<br />

1.30. Share capital and treasury shares 131<br />

1.30.1. Share issue costs 131<br />

1.30.2. Dividends on ordinary shares 131<br />

1.30.3. Preferred shares 131<br />

1.30.4. Treasury shares 131<br />

1.30.5. Insurance discretionary<br />

participation features 131<br />

1.31. Fiduciary activities 131<br />

1.32. Fair value of financial instruments 131<br />

1.33. Cash and cash equivalents 132<br />

1.34. Earnings per share 132<br />

2. Related party transactions 132<br />

3. Segment <strong>report</strong>ing 132<br />

3.1. Business segments (primary segment <strong>report</strong>ing) 132<br />

3.2. Geographic segments<br />

(secondary segment <strong>report</strong>ing) 132<br />

4. Risk management policies and hedging activities 133<br />

4.1. Market risk 133<br />

4.1.1. Overview 133<br />

4.1.2. Interest rate risk 133<br />

4.1.3. Currency risk 134<br />

4.1.4. Equity risk 134<br />

4.1.5. Issuer risk 134<br />

4.1.6. Price risk 134<br />

4.2. Credit risk 134<br />

4.3. Liquidity risk 135<br />

4.4. Capital adequacy 135<br />

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

COMPTES SOCIAUX<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 119