Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PERSONAL FINANCIAL SERVICES<br />

MANAGEMENT REPORT<br />

• the debit cards with personalized pictures were very successful:<br />

200,000 applications since their launch in June <strong>2006</strong>.<br />

<strong>Dexia</strong>’s personalized cards were the first issued on the Belgian<br />

market.<br />

• “<strong>Dexia</strong> Direct Net”: more than 500,000 customers are now<br />

handling their banking transactions via the internet. The<br />

number of contracts has risen by 50% in <strong>2006</strong>.<br />

Since <strong>2006</strong> <strong>Dexia</strong> has been making intensive preparations for<br />

the forth<strong>com</strong>ing introduction of the unified payment system<br />

known as the Single Euro Payments Area (SEPA) in 2008.<br />

Private Banking<br />

<strong>2006</strong> was again a good year for Private Banking. Total customer<br />

assets reached EUR 45.4 billion, up 12.5%, double digit<br />

growth being experienced in many products. For instance, the<br />

cash management activity was up 24.3% and the structured<br />

products were up 12.5%. Mutual funds were a little weaker<br />

as a consequence of the negative market effect in the second<br />

quarter of <strong>2006</strong>, but nevertheless recorded a very satisfying<br />

5.7% increase.<br />

Customers particularly appreciated bond issues tailored to<br />

meet their needs in terms of duration and return rates.<br />

A dedicated call center – “<strong>Dexia</strong> Direct Private” – for customers<br />

willing to manage their funds by themselves was put in<br />

place. This service provides access to accurate and up to date<br />

market information.<br />

Customer liabilities<br />

With the overall positive climate of <strong>2006</strong> reinforcing household<br />

confidence, loans to retail and private customers saw a<br />

significant 11.8% increase, to EUR 30.9 billion. The rise in<br />

private banking was even greater (+21.5% to EUR 3.3 billion).<br />

Mortgage loan activity, which benefited from a stronger<br />

client appetite as a result of increasing confidence, rose by<br />

13.6% to EUR 18.6 billion. The fourth quarter witnessed a<br />

return to a more normal <strong>com</strong>petitive environment. Consumer<br />

loans amounted to EUR 2.5 billion at the end of <strong>2006</strong>, a 9.8%<br />

growth.<br />

COMPTES CONSOLIDÉS<br />

COMPTES SOCIAUX<br />

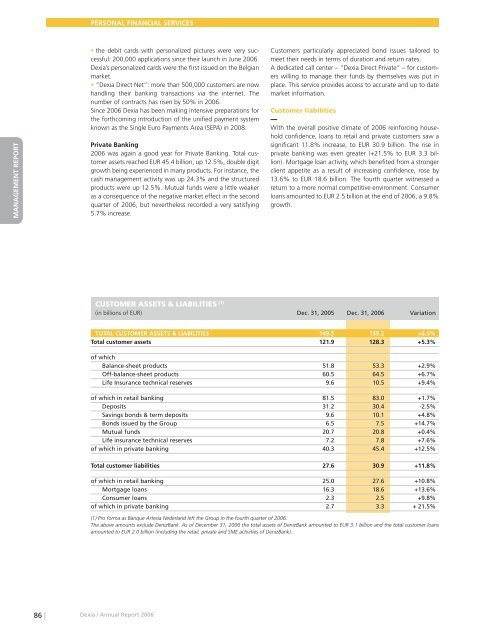

CUSTOMER ASSETS & LIABILITIES (1)<br />

(in billions of EUR) Dec. 31, 2005 Dec. 31, <strong>2006</strong> Variation<br />

TOTAL CUSTOMER ASSETS & LIABILITIES 149.5 159.2 +6.5%<br />

Total customer assets 121.9 128.3 +5.3%<br />

of which<br />

Balance-sheet products 51.8 53.3 +2.9%<br />

Off-balance-sheet products 60.5 64.5 +6.7%<br />

Life Insurance technical reserves 9.6 10.5 +9.4%<br />

of which in retail banking 81.5 83.0 +1.7%<br />

Deposits 31.2 30.4 -2.5%<br />

Savings bonds & term deposits 9.6 10.1 +4.8%<br />

Bonds issued by the Group 6.5 7.5 +14.7%<br />

Mutual funds 20.7 20.8 +0.4%<br />

Life insurance technical reserves 7.2 7.8 +7.6%<br />

of which in private banking 40.3 45.4 +12.5%<br />

Total customer liabilities 27.6 30.9 +11.8%<br />

of which in retail banking 25.0 27.6 +10.8%<br />

Mortgage loans 16.3 18.6 +13.6%<br />

Consumer loans 2.3 2.5 +9.8%<br />

of which in private banking 2.7 3.3 + 21.5%<br />

(1) Pro forma as Banque Artesia Nederland left the Group in the fourth quarter of <strong>2006</strong>.<br />

The above amounts exclude DenizBank. As of December 31, <strong>2006</strong> the total assets of DenizBank amounted to EUR 3.1 billion and the total customer loans<br />

amounted to EUR 2.0 billion (including the retail, private and SME activities of DenizBank).<br />

86 |<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>