Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Customer Relationships: EUR 62 million<br />

This intangible asset has been valued with the Multi-Period<br />

Excess Earnings Method.<br />

Excess earnings can be defined as the difference between the<br />

net operating cash flow after tax attributable to the existing<br />

customers at the acquisition date and the required cost of<br />

invested capital on all the other assets (contributory assets such<br />

as fixed assets, core deposits, trade name, assembled workforce)<br />

used in order to maintain the customer relationship.<br />

Value is estimated through the sum of the discounted future<br />

excess earnings attributable to these customers over the<br />

remaining lifespan of the customer relationship.<br />

The useful life of this intangible asset has been estimated to<br />

8 years.<br />

Impact of unallocated goodwill as of October 17, <strong>2006</strong><br />

The tax rate in Turkey being 20%, the net of tax amount of<br />

identified intangible assets amounts to EUR 191 million, or<br />

TRY 352 million.<br />

The remaining unallocated goodwill then stands at EUR 1,310<br />

million, or TRY 2,411 million.<br />

As from this date, the value of all assets and liabilities, including<br />

identified intangible assets and unallocated goodwill, will<br />

vary with the TRY exchange rate.<br />

As this calculation has been done based on financial statements<br />

with accounting rules and methods which are not yet<br />

fully harmonized with <strong>Dexia</strong> accounting principles their value<br />

may still change within the twelve months after the business<br />

<strong>com</strong>bination.<br />

Financing of the purchase of DenizBank<br />

To finance the acquisition of DenizBank, <strong>Dexia</strong> proceeded<br />

with a share capital increase (EUR 1,2 billion), issued EUR<br />

500 million of Perpetual Non-cumulative Guaranted Securities<br />

qualifying as Regulatory Tier 1 capital and sold some stakes in<br />

participations. Details of those transactions are <strong>report</strong>ed in the<br />

related notes to the financial statements.<br />

DenizBank group contributed to net in<strong>com</strong>e attributable to<br />

<strong>Dexia</strong> shareholders for EUR 32 million for the period from October<br />

17 to December 31, <strong>2006</strong>.<br />

Acquisition of minority interests of DenizBank due to a<br />

mandatory tender offer.<br />

<strong>Dexia</strong> had no call options nor written puts towards the minority<br />

shareholders at the moment of the business <strong>com</strong>bination.<br />

By taking the control of DenizBank, <strong>Dexia</strong> was required by Turkish<br />

law to launch a mandatory tender offer on the remaining<br />

shares of DenizBank listed on the Istanbul Stock Exchange. Compliant<br />

to this law the timing, conditions and the fixing of the price<br />

were taken out of the control of <strong>Dexia</strong> management. There was<br />

no certainty about the result of this tender, as the remaining<br />

shareholders had the choice to bring, or not, their shares to<br />

the tender.<br />

The tender started on December 4, <strong>2006</strong> and closed on December<br />

22, <strong>2006</strong>. The price was paid in TRY and <strong>Dexia</strong> hedged the risk of<br />

fluctuation of the purchase price in TRY until the payment.<br />

At the end of the tender, the shareholding of <strong>Dexia</strong> stood then<br />

at 99.74%. This percentage remained unchanged since December<br />

31, <strong>2006</strong>.<br />

The price paid for the shares acquired in the mandatory tender<br />

offer has been <strong>com</strong>pared with the percentage of equity<br />

acquired as of December 31, <strong>2006</strong>.<br />

The purchase of minority interests was considered as a transaction<br />

between shareholders and the difference between the<br />

price paid and the equity acquired has been recorded as a<br />

movement between Group equity and minority interests since<br />

<strong>Dexia</strong> is applying the economic entity model.<br />

This accounting treatment is disclosed in the <strong>Dexia</strong> accounting<br />

rules (see point 1.22.1. – Positive Goodwill) and has been consistently<br />

applied since the conversion of <strong>Dexia</strong> to IFRS.<br />

In order to allow the <strong>com</strong>parison with <strong>com</strong>panies having used<br />

an alternative accounting treatment, the following additional<br />

information is provided:<br />

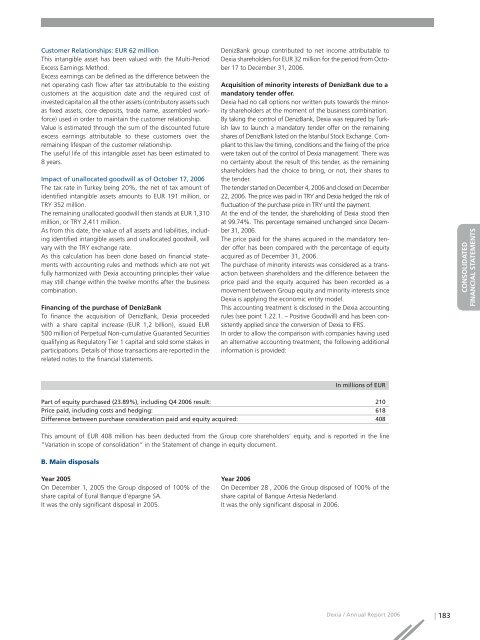

In millions of EUR<br />

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

COMPTES SOCIAUX<br />

Part of equity purchased (23.89%), including Q4 <strong>2006</strong> result: 210<br />

Price paid, including costs and hedging: 618<br />

Difference between purchase consideration paid and equity acquired: 408<br />

This amount of EUR 408 million has been deducted from the Group core shareholders’ equity, and is <strong>report</strong>ed in the line<br />

“Variation in scope of consolidation“ in the Statement of change in equity document.<br />

B. Main disposals<br />

Year 2005<br />

On December 1, 2005 the Group disposed of 100% of the<br />

share capital of Eural Banque d’épargne SA.<br />

It was the only significant disposal in 2005.<br />

Year <strong>2006</strong><br />

On December 28 , <strong>2006</strong> the Group disposed of 100% of the<br />

share capital of Banque Artesia Nederland.<br />

It was the only significant disposal in <strong>2006</strong>.<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 183