Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

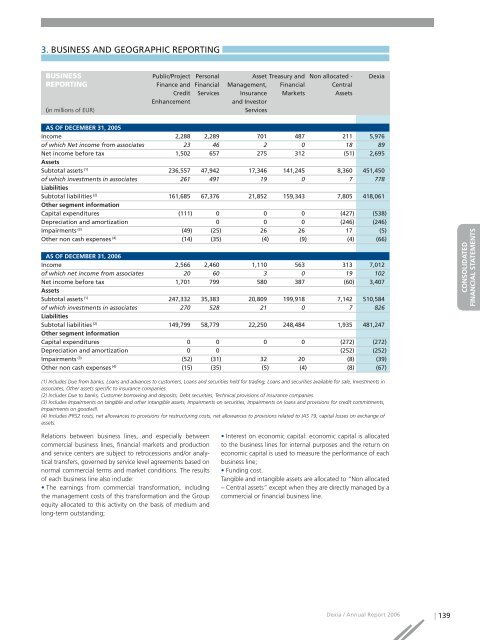

3. BUSINESS AND GEOGRAPHIC REPORTING<br />

BUSINESS Public/Project Personal Asset Treasury and Non allocated - <strong>Dexia</strong><br />

REPORTING Finance and Financial Management, Financial Central<br />

Credit Services Insurance Markets Assets<br />

Enhancement<br />

and Investor<br />

(in millions of EUR)<br />

Services<br />

AS OF DECEMBER 31, 2005<br />

In<strong>com</strong>e 2,288 2,289 701 487 211 5,976<br />

of which Net in<strong>com</strong>e from associates 23 46 2 0 18 89<br />

Net in<strong>com</strong>e before tax 1,502 657 275 312 (51) 2,695<br />

Assets<br />

Subtotal assets (1) 236,557 47,942 17,346 141,245 8,360 451,450<br />

of which investments in associates 261 491 19 0 7 778<br />

Liabilities<br />

Subtotal liabilities (2) 161,685 67,376 21,852 159,343 7,805 418,061<br />

Other segment information<br />

Capital expenditures (111) 0 0 0 (427) (538)<br />

Depreciation and amortization 0 0 0 (246) (246)<br />

Impairments (3) (49) (25) 26 26 17 (5)<br />

Other non cash expenses (4) (14) (35) (4) (9) (4) (66)<br />

AS OF DECEMBER 31, <strong>2006</strong><br />

In<strong>com</strong>e 2,566 2,460 1,110 563 313 7,012<br />

of which net in<strong>com</strong>e from associates 20 60 3 0 19 102<br />

Net in<strong>com</strong>e before tax 1,701 799 580 387 (60) 3,407<br />

Assets<br />

Subtotal assets (1) 247,332 35,383 20,809 199,918 7,142 510,584<br />

of which investments in associates 270 528 21 0 7 826<br />

Liabilities<br />

Subtotal liabilities (2) 149,799 58,779 22,250 248,484 1,935 481,247<br />

Other segment information<br />

Capital expenditures 0 0 0 0 (272) (272)<br />

Depreciation and amortization 0 0 (252) (252)<br />

Impairments (3) (52) (31) 32 20 (8) (39)<br />

Other non cash expenses (4) (15) (35) (5) (4) (8) (67)<br />

(1) Includes Due from banks, Loans and advances to customers, Loans and securities held for trading, Loans and securities available for sale, Investments in<br />

associates, Other assets specific to insurance <strong>com</strong>panies.<br />

(2) Includes Due to banks, Customer borrowing and deposits, Debt securities, Technical provisions of insurance <strong>com</strong>panies.<br />

(3) Includes Impairments on tangible and other intangible assets, Impairments on securities, Impairments on loans and provisions for credit <strong>com</strong>mitments,<br />

Impairments on goodwill.<br />

(4) Includes IFRS2 costs, net allowances to provisions for restructuring costs, net allowances to provisions related to IAS 19, capital losses on exchange of<br />

assets.<br />

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

COMPTES SOCIAUX<br />

Relations between business lines, and especially between<br />

<strong>com</strong>mercial business lines, financial markets and production<br />

and service centers are subject to retrocessions and/or analytical<br />

transfers, governed by service level agreements based on<br />

normal <strong>com</strong>mercial terms and market conditions. The results<br />

of each business line also include:<br />

• The earnings from <strong>com</strong>mercial transformation, including<br />

the management costs of this transformation and the Group<br />

equity allocated to this activity on the basis of medium and<br />

long-term outstanding;<br />

• Interest on economic capital: economic capital is allocated<br />

to the business lines for internal purposes and the return on<br />

economic capital is used to measure the performance of each<br />

business line;<br />

• Funding cost.<br />

Tangible and intangible assets are allocated to “Non allocated<br />

– Central assets“ except when they are directly managed by a<br />

<strong>com</strong>mercial or financial business line.<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 139