Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

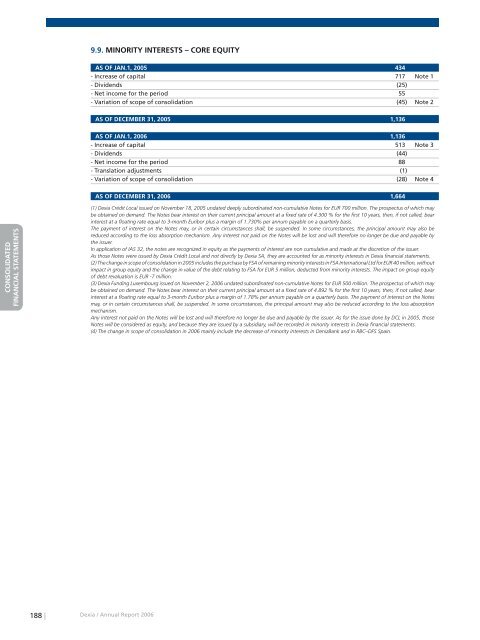

9.9. MINORITY INTERESTS – CORE EQUITY<br />

AS OF JAN.1, 2005 434<br />

- Increase of capital 717 Note 1<br />

- Dividends (25)<br />

- Net in<strong>com</strong>e for the period 55<br />

- Variation of scope of consolidation (45) Note 2<br />

AS OF DECEMBER 31, 2005 1,136<br />

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

COMPTES SOCIAUX<br />

AS OF JAN.1, <strong>2006</strong> 1,136<br />

- Increase of capital 513 Note 3<br />

- Dividends (44)<br />

- Net in<strong>com</strong>e for the period 88<br />

- Translation adjustments (1)<br />

- Variation of scope of consolidation (28) Note 4<br />

AS OF DECEMBER 31, <strong>2006</strong> 1,664<br />

(1) <strong>Dexia</strong> Crédit Local issued on November 18, 2005 undated deeply subordinated non-cumulative Notes for EUR 700 million. The prospectus of which may<br />

be obtained on demand. The Notes bear interest on their current principal amount at a fixed rate of 4.300 % for the first 10 years, then, if not called, bear<br />

interest at a floating rate equal to 3-month Euribor plus a margin of 1.730% per annum payable on a quarterly basis.<br />

The payment of interest on the Notes may, or in certain circumstances shall, be suspended. In some circumstances, the principal amount may also be<br />

reduced according to the loss absorption mechanism. Any interest not paid on the Notes will be lost and will therefore no longer be due and payable by<br />

the issuer.<br />

In application of IAS 32, the notes are recognized in equity as the payments of interest are non cumulative and made at the discretion of the issuer.<br />

As those Notes were issued by <strong>Dexia</strong> Crédit Local and not directly by <strong>Dexia</strong> SA, they are accounted for as minority interests in <strong>Dexia</strong> financial statements.<br />

(2) The change in scope of consolidation in 2005 includes the purchase by FSA of remaining minority interests in FSA International Ltd for EUR 40 million, without<br />

impact in group equity and the change in value of the debt relating to FSA for EUR 5 million, deducted from minority interests. The impact on group equity<br />

of debt revaluation is EUR -7 million.<br />

(3) <strong>Dexia</strong> Funding Luxembourg issued on November 2, <strong>2006</strong> undated subordinated non-cumulative Notes for EUR 500 million. The prospectus of which may<br />

be obtained on demand. The Notes bear interest on their current principal amount at a fixed rate of 4.892 % for the first 10 years, then, if not called, bear<br />

interest at a floating rate equal to 3-month Euribor plus a margin of 1.78% per annum payable on a quarterly basis. The payment of interest on the Notes<br />

may, or in certain circumstances shall, be suspended. In some circumstances, the principal amount may also be reduced according to the loss absorption<br />

mechanism.<br />

Any interest not paid on the Notes will be lost and will therefore no longer be due and payable by the issuer. As for the issue done by DCL in 2005, those<br />

Notes will be considered as equity, and because they are issued by a subsidiary, will be recorded in minority interests in <strong>Dexia</strong> financial statements.<br />

(4) The change in scope of consolidation in <strong>2006</strong> mainly include the decrease of minority interests in DenizBank and in RBC–DFS Spain.<br />

188 |<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>