Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

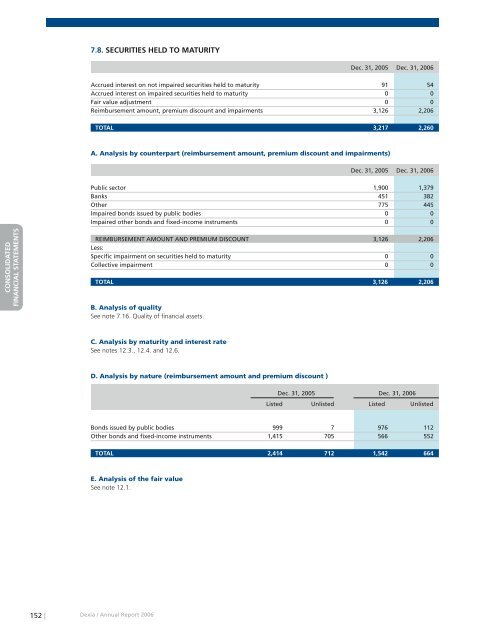

7.8. SECURITIES HELD TO MATURITY<br />

Dec. 31, 2005 Dec. 31, <strong>2006</strong><br />

Accrued interest on not impaired securities held to maturity 91 54<br />

Accrued interest on impaired securities held to maturity 0 0<br />

Fair value adjustment 0 0<br />

Reimbursement amount, premium discount and impairments 3,126 2,206<br />

TOTAL 3,217 2,260<br />

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

COMPTES SOCIAUX<br />

A. Analysis by counterpart (reimbursement amount, premium discount and impairments)<br />

Dec. 31, 2005 Dec. 31, <strong>2006</strong><br />

Public sector 1,900 1,379<br />

Banks 451 382<br />

Other 775 445<br />

Impaired bonds issued by public bodies 0 0<br />

Impaired other bonds and fixed-in<strong>com</strong>e instruments 0 0<br />

REIMBURSEMENT AMOUNT AND PREMIUM DISCOUNT 3,126 2,206<br />

Less:<br />

Specific impairment on securities held to maturity 0 0<br />

Collective impairment 0 0<br />

TOTAL 3,126 2,206<br />

B. Analysis of quality<br />

See note 7.16. Quality of financial assets.<br />

C. Analysis by maturity and interest rate<br />

See notes 12.3., 12.4. and 12.6.<br />

D. Analysis by nature (reimbursement amount and premium discount )<br />

Dec. 31, 2005 Dec. 31, <strong>2006</strong><br />

Listed Unlisted Listed Unlisted<br />

Bonds issued by public bodies 999 7 976 112<br />

Other bonds and fixed-in<strong>com</strong>e instruments 1,415 705 566 552<br />

TOTAL 2,414 712 1,542 664<br />

E. Analysis of the fair value<br />

See note 12.1.<br />

152 |<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>