Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PUBLIC/PROJECT FINANCE<br />

WORLD LEADER<br />

As for geographic development, <strong>2006</strong> was a very active year,<br />

with inter alia, <strong>Dexia</strong> obtaining a banking license in Poland<br />

last May, the opening of a representative or <strong>com</strong>mercial<br />

office in Budapest, in China, in India and of a subsidiary in<br />

Switzerland.<br />

In Japan <strong>Dexia</strong> is delighted to have been granted a banking<br />

license in November, as, in terms of volumes, this country is<br />

the deepest market for public finance in the world. The Japanese<br />

local public debt amounts to EUR 1,500 billion.<br />

A significant portion of the total new production of <strong>Dexia</strong> in<br />

<strong>2006</strong> (10% or EUR 5.7 billion) was made in countries where<br />

a banking license was obtained in 2005 or <strong>2006</strong>: <strong>Dexia</strong> Kommunalkredit<br />

Bank in Central and Eastern Europe, Canada,<br />

Mexico, Switzerland and Japan.<br />

MANAGEMENT REPORT<br />

COMPTES CONSOLIDÉS<br />

COMPTES SOCIAUX<br />

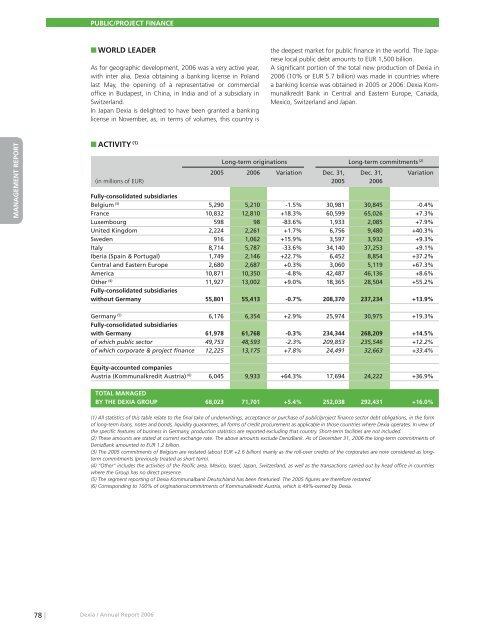

ACTIVITY (1) Long-term originations Long-term <strong>com</strong>mitments (2)<br />

2005 <strong>2006</strong> Variation Dec. 31, Dec. 31, Variation<br />

(in millions of EUR) 2005 <strong>2006</strong><br />

Fully-consolidated subsidiaries<br />

Belgium (3) 5,290 5,210 -1.5% 30,981 30,845 -0.4%<br />

France 10,832 12,810 +18.3% 60,599 65,026 +7.3%<br />

Luxembourg 598 98 -83.6% 1,933 2,085 +7.9%<br />

United Kingdom 2,224 2,261 +1.7% 6,756 9,480 +40.3%<br />

Sweden 916 1,062 +15.9% 3,597 3,932 +9.3%<br />

Italy 8,714 5,787 -33.6% 34,140 37,253 +9.1%<br />

Iberia (Spain & Portugal) 1,749 2,146 +22.7% 6,452 8,854 +37.2%<br />

Central and Eastern Europe 2,680 2,687 +0.3% 3,060 5,119 +67.3%<br />

America 10,871 10,350 -4.8% 42,487 46,136 +8.6%<br />

Other (4) 11,927 13,002 +9.0% 18,365 28,504 +55.2%<br />

Fully-consolidated subsidiaries<br />

without Germany 55,801 55,413 -0.7% 208,370 237,234 +13.9%<br />

Germany (5) 6,176 6,354 +2.9% 25,974 30,975 +19.3%<br />

Fully-consolidated subsidiaries<br />

with Germany 61,978 61,768 -0.3% 234,344 268,209 +14.5%<br />

of which public sector 49,753 48,593 -2.3% 209,853 235,546 +12.2%<br />

of which corporate & project finance 12,225 13,175 +7.8% 24,491 32,663 +33.4%<br />

Equity-accounted <strong>com</strong>panies<br />

Austria (Kommunalkredit Austria) (6) 6,045 9,933 +64.3% 17,694 24,222 +36.9%<br />

TOTAL MANAGED<br />

BY THE DEXIA GROUP 68,023 71,701 +5.4% 252,038 292,431 +16.0%<br />

(1) All statistics of this table relate to the final take of underwritings, acceptance or purchase of public/project finance sector debt obligations, in the form<br />

of long-term loans, notes and bonds, liquidity guarantees, all forms of credit procurement as applicable in those countries where <strong>Dexia</strong> operates. In view of<br />

the specific features of business in Germany, production statistics are <strong>report</strong>ed excluding that country. Short-term facilities are not included.<br />

(2) These amounts are stated at current exchange rate. The above amounts exclude DenizBank. As of December 31, <strong>2006</strong> the long-term <strong>com</strong>mitments of<br />

DenizBank amounted to EUR 1.2 billion.<br />

(3) The 2005 <strong>com</strong>mitments of Belgium are restated (about EUR +2.6 billion) mainly as the roll-over credits of the corporates are now considered as longterm<br />

<strong>com</strong>mitments (previously treated as short term).<br />

(4) “Other” includes the activities of the Pacific area, Mexico, Israel, Japan, Switzerland, as well as the transactions carried out by head office in countries<br />

where the Group has no direct presence.<br />

(5) The segment <strong>report</strong>ing of <strong>Dexia</strong> Kommunalbank Deutschland has been finetuned. The 2005 figures are therefore restated.<br />

(6) Corresponding to 100% of originations/<strong>com</strong>mitments of Kommunalkredit Austria, which is 49%-owned by <strong>Dexia</strong>.<br />

78 |<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>