Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

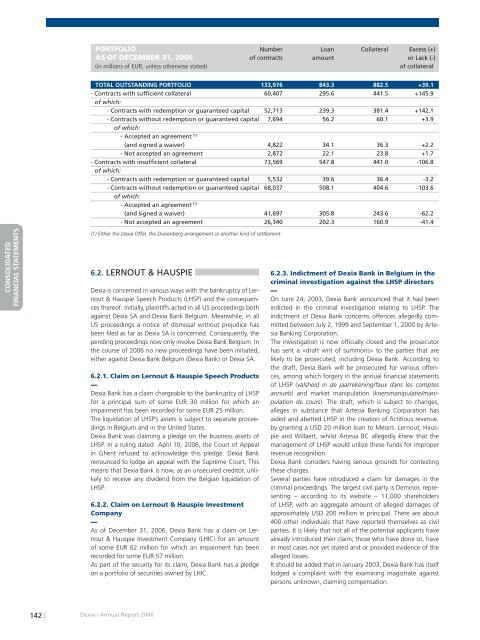

PORTFOLIO Number Loan Collateral Excess (+)<br />

AS OF DECEMBER 31, <strong>2006</strong> of contracts amount or Lack (-)<br />

(in millions of EUR, unless otherwise stated)<br />

of collateral<br />

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

COMPTES SOCIAUX<br />

TOTAL OUTSTANDING PORTFOLIO 133,976 843.3 882.5 +39.1<br />

- Contracts with sufficient collateral 60,407 295.6 441.5 +145.9<br />

of which:<br />

- Contracts with redemption or guaranteed capital 52,713 239.3 381.4 +142.1<br />

- Contracts without redemption or guaranteed capital 7,694 56.2 60.1 +3.9<br />

of which:<br />

- Accepted an agreement (1)<br />

(and signed a waiver) 4,822 34.1 36.3 +2.2<br />

- Not accepted an agreement 2,872 22.1 23.8 +1.7<br />

- Contracts with insufficient collateral 73,569 547.8 441.0 -106.8<br />

of which:<br />

- Contracts with redemption or guaranteed capital 5,532 39.6 36.4 -3.2<br />

- Contracts without redemption or guaranteed capital 68,037 508.1 404.6 -103.6<br />

of which:<br />

- Accepted an agreement (1)<br />

(and signed a waiver) 41,697 305.8 243.6 -62.2<br />

- Not accepted an agreement 26,340 202.3 160.9 -41.4<br />

(1) Either the <strong>Dexia</strong> Offer, the Duisenberg arrangement or another kind of settlement.<br />

6.2. LERNOUT & HAUSPIE<br />

<strong>Dexia</strong> is concerned in various ways with the bankruptcy of Lernout<br />

& Hauspie Speech Products (LHSP) and the consequences<br />

thereof. Initially, plaintiffs acted in all US proceedings both<br />

against <strong>Dexia</strong> SA and <strong>Dexia</strong> Bank Belgium. Meanwhile, in all<br />

US proceedings a notice of dismissal without prejudice has<br />

been filed as far as <strong>Dexia</strong> SA is concerned. Consequently, the<br />

pending proceedings now only involve <strong>Dexia</strong> Bank Belgium. In<br />

the course of <strong>2006</strong> no new proceedings have been initiated,<br />

either against <strong>Dexia</strong> Bank Belgium (<strong>Dexia</strong> Bank) or <strong>Dexia</strong> SA.<br />

6.2.1. Claim on Lernout & Hauspie Speech Products<br />

<strong>Dexia</strong> Bank has a claim chargeable to the bankruptcy of LHSP<br />

for a principal sum of some EUR 30 million for which an<br />

impairment has been recorded for some EUR 25 million.<br />

The liquidation of LHSP’s assets is subject to separate proceedings<br />

in Belgium and in the United States.<br />

<strong>Dexia</strong> Bank was claiming a pledge on the business assets of<br />

LHSP. In a ruling dated April 10, <strong>2006</strong>, the Court of Appeal<br />

in Ghent refused to acknowledge this pledge. <strong>Dexia</strong> Bank<br />

renounced to lodge an appeal with the Supreme Court. This<br />

means that <strong>Dexia</strong> Bank is now, as an unsecured creditor, unlikely<br />

to receive any dividend from the Belgian liquidation of<br />

LHSP.<br />

6.2.2. Claim on Lernout & Hauspie Investment<br />

Company<br />

As of December 31, <strong>2006</strong>, <strong>Dexia</strong> Bank has a claim on Lernout<br />

& Hauspie Investment Company (LHIC) for an amount<br />

of some EUR 62 million for which an impairment has been<br />

recorded for some EUR 57 million.<br />

As part of the security for its claim, <strong>Dexia</strong> Bank has a pledge<br />

on a portfolio of securities owned by LHIC.<br />

6.2.3. Indictment of <strong>Dexia</strong> Bank in Belgium in the<br />

criminal investigation against the LHSP directors<br />

On June 24, 2003, <strong>Dexia</strong> Bank announced that it had been<br />

indicted in the criminal investigation relating to LHSP. The<br />

indictment of <strong>Dexia</strong> Bank concerns offences allegedly <strong>com</strong>mitted<br />

between July 2, 1999 and September 1, 2000 by Artesia<br />

Banking Corporation.<br />

The investigation is now officially closed and the prosecutor<br />

has sent a «draft writ of summons» to the parties that are<br />

likely to be prosecuted, including <strong>Dexia</strong> Bank. According to<br />

the draft, <strong>Dexia</strong> Bank will be prosecuted for various offences,<br />

among which forgery in the annual financial statements<br />

of LHSP (valsheid in de jaarrekening/faux dans les <strong>com</strong>ptes<br />

annuels) and market manipulation (koersmanipulatie/manipulation<br />

de cours). The draft, which is subject to changes,<br />

alleges in substance that Artesia Banking Corporation has<br />

aided and abetted LHSP in the creation of fictitious revenue,<br />

by granting a USD 20 million loan to Messrs. Lernout, Hauspie<br />

and Willaert, whilst Artesia BC allegedly knew that the<br />

management of LHSP would utilize these funds for improper<br />

revenue recognition.<br />

<strong>Dexia</strong> Bank considers having serious grounds for contesting<br />

these charges.<br />

Several parties have introduced a claim for damages in the<br />

criminal proceedings. The largest civil party is Deminor, representing<br />

– according to its website – 11,000 shareholders<br />

of LHSP, with an aggregate amount of alleged damages of<br />

approximately USD 200 million in principal. There are about<br />

400 other individuals that have <strong>report</strong>ed themselves as civil<br />

parties. It is likely that not all of the potential applicants have<br />

already introduced their claim; those who have done so, have<br />

in most cases not yet stated and or provided evidence of the<br />

alleged losses.<br />

It should be added that in January 2003, <strong>Dexia</strong> Bank has itself<br />

lodged a <strong>com</strong>plaint with the examining magistrate against<br />

persons unknown, claiming <strong>com</strong>pensation.<br />

142 |<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>