Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

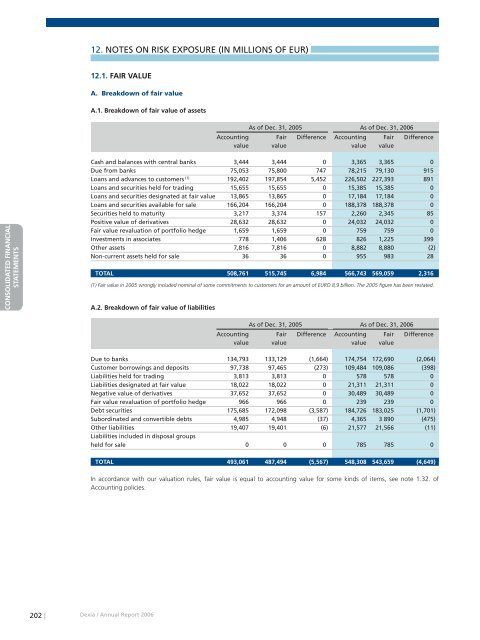

12. NOTES ON RISK EXPOSURE (IN MILLIONS OF EUR)<br />

12.1. FAIR VALUE<br />

A. Breakdown of fair value<br />

A.1. Breakdown of fair value of assets<br />

RAPPORT DE GESTION<br />

CONSOLIDATED FINANCIAL<br />

STATEMENTS<br />

COMPTES SOCIAUX<br />

As of Dec. 31, 2005 As of Dec. 31, <strong>2006</strong><br />

Accounting Fair Difference Accounting Fair Difference<br />

value value value value<br />

Cash and balances with central banks 3,444 3,444 0 3,365 3,365 0<br />

Due from banks 75,053 75,800 747 78,215 79,130 915<br />

Loans and advances to customers (1) 192,402 197,854 5,452 226,502 227,393 891<br />

Loans and securities held for trading 15,655 15,655 0 15,385 15,385 0<br />

Loans and securities designated at fair value 13,865 13,865 0 17,184 17,184 0<br />

Loans and securities available for sale 166,204 166,204 0 188,378 188,378 0<br />

Securities held to maturity 3,217 3,374 157 2,260 2,345 85<br />

Positive value of derivatives 28,632 28,632 0 24,032 24,032 0<br />

Fair value revaluation of portfolio hedge 1,659 1,659 0 759 759 0<br />

Investments in associates 778 1,406 628 826 1,225 399<br />

Other assets 7,816 7,816 0 8,882 8,880 (2)<br />

Non-current assets held for sale 36 36 0 955 983 28<br />

TOTAL 508,761 515,745 6,984 566,743 569,059 2,316<br />

(1) Fair value in 2005 wrongly included nominal of some <strong>com</strong>mitments to customers for an amount of EURO 8,9 billion. The 2005 figure has been restated.<br />

A.2. Breakdown of fair value of liabilities<br />

As of Dec. 31, 2005 As of Dec. 31, <strong>2006</strong><br />

Accounting Fair Difference Accounting Fair Difference<br />

value value value value<br />

Due to banks 134,793 133,129 (1,664) 174,754 172,690 (2,064)<br />

Customer borrowings and deposits 97,738 97,465 (273) 109,484 109,086 (398)<br />

Liabilities held for trading 3,813 3,813 0 578 578 0<br />

Liabilities designated at fair value 18,022 18,022 0 21,311 21,311 0<br />

Negative value of derivatives 37,652 37,652 0 30,489 30,489 0<br />

Fair value revaluation of portfolio hedge 966 966 0 239 239 0<br />

Debt securities 175,685 172,098 (3,587) 184,726 183,025 (1,701)<br />

Subordinated and convertible debts 4,985 4,948 (37) 4,365 3 890 (475)<br />

Other liabilities 19,407 19,401 (6) 21,577 21,566 (11)<br />

Liabilities included in disposal groups<br />

held for sale 0 0 0 785 785 0<br />

TOTAL 493,061 487,494 (5,567) 548,308 543,659 (4,649)<br />

In accordance with our valuation rules, fair value is equal to accounting value for some kinds of items, see note 1.32. of<br />

Accounting policies.<br />

202 |<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>