Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PERSONAL FINANCIAL SERVICES<br />

UNDERLYING (1) RESULTS<br />

Personal Financial Services posted another satisfying year<br />

despite the <strong>com</strong>petitive environment in Belgium, particularly<br />

around the middle of the year in the area of mortgages. Cost<br />

discipline, good <strong>com</strong>mercial activity and the more advantageous<br />

effective tax rate altogether brought a satisfactory rise<br />

of net in<strong>com</strong>e – Group share (+13.1%). The additional EUR<br />

58 million net earnings produced this year came mainly from<br />

Belgium (EUR 34 million or +11%), Luxembourg (EUR 18 million<br />

or +14%) and Turkey (EUR 4 million in one quarter only,<br />

i.e. +68% on the pro forma 2005).<br />

Total in<strong>com</strong>e for the full year reached EUR 2,319 million, an<br />

increase of EUR 48 million or +2.1% on 2005. This increase<br />

came from a contrasted environment, both in terms of<br />

geography and nature of activities. In<strong>com</strong>e grew in Luxembourg<br />

(EUR +31 million), in Turkey (EUR +13 million pro forma,<br />

bearing in mind that the contribution was for one quarter<br />

only), and countries other than Belgium (EUR +13 million),<br />

whilst it went down in Belgium (EUR -9 million). The slight<br />

decline in Belgium (-0.5% of the country’s revenue base) was<br />

caused by the following factors:<br />

• on the customer asset side, increased volumes generated<br />

higher revenues which have been slightly mitigated by a low<br />

margin reduction overall, some products be<strong>com</strong>ing more profitable<br />

and others less;<br />

• sight accounts performed very well, pulled both by volume<br />

increases and higher margins;<br />

• on the loan side the situation deteriorated as a consequence<br />

of the negative effect of refunding on the average<br />

margin on mortgages outstanding, and also because of the<br />

narrow spreads on originations during the months of intense<br />

<strong>com</strong>petition.<br />

(1) As described on page 70.<br />

Costs rose slightly to EUR 1,627 million, a EUR 19 million<br />

increase, or 1.2%, which in effect means negative growth in<br />

real terms. <strong>Dexia</strong> Bank Belgium continued to reduce the number<br />

of its branches, which now stand at 1,019 in Belgium, with<br />

18 branches closed in the second half of the year. The positive<br />

effects of the integration of Artesia BC being now largely met<br />

and even exceeded, the bank is now seeking efficiency gains,<br />

mainly in back office operations. It should be noted that the sale<br />

of the London based private banking operations has caused a<br />

EUR 3 million cost increase which will disappear as from 2007.<br />

Gross operating in<strong>com</strong>e reached EUR 692 million, up 4.4%<br />

in one year. The cost-in<strong>com</strong>e ratio continues to improve, from<br />

70.8% in 2005 pro forma to 70.2% in <strong>2006</strong>.<br />

The cost of risk remained at a very low level, to EUR 32 million<br />

in <strong>2006</strong>.<br />

Tax expense was down 20.2%, to EUR 151 million, mainly<br />

thanks to the lower effective tax rate.<br />

The return on economic equity (ROEE) continued to<br />

improve from 24.6% in 2005 to a very robust 28.8% for the<br />

full year <strong>2006</strong>.<br />

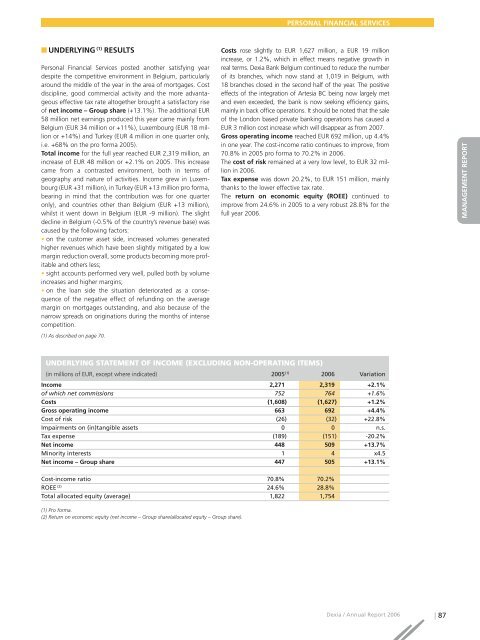

UNDERLYING STATEMENT OF INCOME (EXCLUDING NON-OPERATING ITEMS)<br />

(in millions of EUR, except where indicated) 2005 (1) <strong>2006</strong> Variation<br />

In<strong>com</strong>e 2,271 2,319 +2.1%<br />

of which net <strong>com</strong>missions 752 764 +1.6%<br />

Costs (1,608) (1,627) +1.2%<br />

Gross operating in<strong>com</strong>e 663 692 +4.4%<br />

Cost of risk (26) (32) +22.8%<br />

Impairments on (in)tangible assets 0 0 n.s.<br />

Tax expense (189) (151) -20.2%<br />

Net in<strong>com</strong>e 448 509 +13.7%<br />

Minority interests 1 4 x4.5<br />

Net in<strong>com</strong>e – Group share 447 505 +13.1%<br />

MANAGEMENT REPORT<br />

COMPTES CONSOLIDÉS<br />

COMPTES SOCIAUX<br />

Cost-in<strong>com</strong>e ratio 70.8% 70.2%<br />

ROEE (2) 24.6% 28.8%<br />

Total allocated equity (average) 1,822 1,754<br />

(1) Pro forma.<br />

(2) Return on economic equity (net in<strong>com</strong>e – Group share/allocated equity – Group share).<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 87