Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

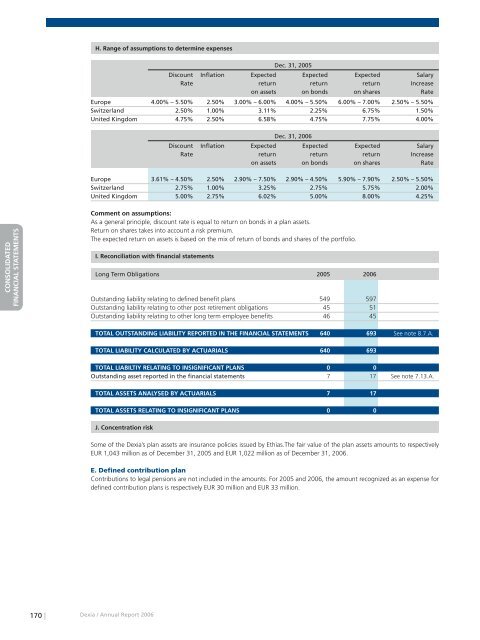

H. Range of assumptions to determine expenses<br />

Dec. 31, 2005<br />

Discount Inflation Expected Expected Expected Salary<br />

Rate return return return Increase<br />

on assets on bonds on shares Rate<br />

Europe 4.00% – 5.50% 2.50% 3.00% – 6.00% 4.00% – 5.50% 6.00% – 7.00% 2.50% – 5.50%<br />

Switzerland 2.50% 1.00% 3.11% 2.25% 6.75% 1.50%<br />

United Kingdom 4.75% 2.50% 6.58% 4.75% 7.75% 4.00%<br />

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

COMPTES SOCIAUX<br />

Dec. 31, <strong>2006</strong><br />

Discount Inflation Expected Expected Expected Salary<br />

Rate return return return Increase<br />

on assets on bonds on shares Rate<br />

Europe 3.61% – 4.50% 2.50% 2.90% – 7.50% 2.90% – 4.50% 5.90% – 7.90% 2.50% – 5.50%<br />

Switzerland 2.75% 1.00% 3.25% 2.75% 5.75% 2.00%<br />

United Kingdom 5.00% 2.75% 6.02% 5.00% 8.00% 4.25%<br />

Comment on assumptions:<br />

As a general principle, discount rate is equal to return on bonds in a plan assets.<br />

Return on shares takes into account a risk premium.<br />

The expected return on assets is based on the mix of return of bonds and shares of the portfolio.<br />

I. Reconciliation with financial statements<br />

Long Term Obligations 2005 <strong>2006</strong><br />

Outstanding liability relating to defined benefit plans 549 597<br />

Outstanding liability relating to other post retirement obligations 45 51<br />

Outstanding liability relating to other long term employee benefits 46 45<br />

TOTAL OUTSTANDING LIABILITY REPORTED IN THE FINANCIAL STATEMENTS 640 693 See note 8.7.A.<br />

TOTAL LIABILITY CALCULATED BY ACTUARIALS 640 693<br />

TOTAL LIABILTIY RELATING TO INSIGNIFICANT PLANS 0 0<br />

Outstanding asset <strong>report</strong>ed in the financial statements 7 17 See note 7.13.A.<br />

TOTAL ASSETS ANALYSED BY ACTUARIALS 7 17<br />

TOTAL ASSETS RELATING TO INSIGNIFICANT PLANS 0 0<br />

J. Concentration risk<br />

Some of the <strong>Dexia</strong>’s plan assets are insurance policies issued by Ethias.The fair value of the plan assets amounts to respectively<br />

EUR 1,043 million as of December 31, 2005 and EUR 1,022 million as of December 31, <strong>2006</strong>.<br />

E. Defined contribution plan<br />

Contributions to legal pensions are not included in the amounts. For 2005 and <strong>2006</strong>, the amount recognized as an expense for<br />

defined contribution plans is respectively EUR 30 million and EUR 33 million.<br />

170 |<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>