Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

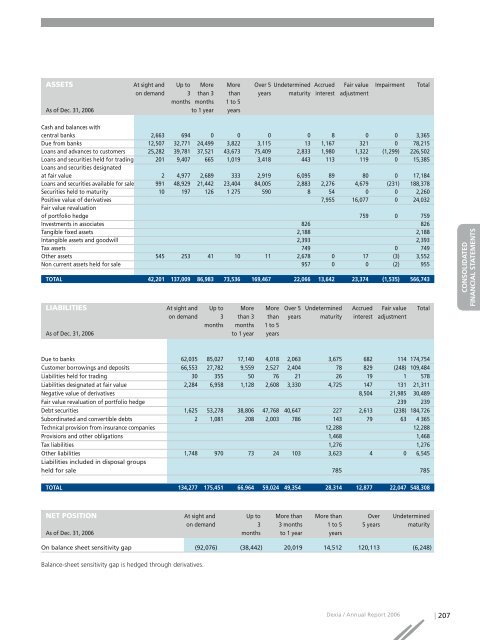

ASSETS At sight and Up to More More Over 5 Undetermined Accrued Fair value Impairment Total<br />

on demand 3 than 3 than years maturity interest adjustment<br />

months months 1 to 5<br />

As of Dec. 31, <strong>2006</strong> to 1 year years<br />

Cash and balances with<br />

central banks 2,663 694 0 0 0 0 8 0 0 3,365<br />

Due from banks 12,507 32,771 24,499 3,822 3,115 13 1,167 321 0 78,215<br />

Loans and advances to customers 25,282 39,781 37,521 43,673 75,409 2,833 1,980 1,322 (1,299) 226,502<br />

Loans and securities held for trading 201 9,407 665 1,019 3,418 443 113 119 0 15,385<br />

Loans and securities designated<br />

at fair value 2 4,977 2,689 333 2,919 6,095 89 80 0 17,184<br />

Loans and securities available for sale 991 48,929 21,442 23,404 84,005 2,883 2,276 4,679 (231) 188,378<br />

Securities held to maturity 10 197 126 1 275 590 8 54 0 0 2,260<br />

Positive value of derivatives 7,955 16,077 0 24,032<br />

Fair value revaluation<br />

of portfolio hedge 759 0 759<br />

Investments in associates 826 826<br />

Tangible fixed assets 2,188 2,188<br />

Intangible assets and goodwill 2,393 2,393<br />

Tax assets 749 0 749<br />

Other assets 545 253 41 10 11 2,678 0 17 (3) 3,552<br />

Non current assets held for sale 957 0 0 (2) 955<br />

TOTAL 42,201 137,009 86,983 73,536 169,467 22,066 13,642 23,374 (1,535) 566,743<br />

LIABILITIES At sight and Up to More More Over 5 Undetermined Accrued Fair value Total<br />

on demand 3 than 3 than years maturity interest adjustment<br />

months months 1 to 5<br />

As of Dec. 31, <strong>2006</strong> to 1 year years<br />

Due to banks 62,035 85,027 17,140 4,018 2,063 3,675 682 114 174,754<br />

Customer borrowings and deposits 66,553 27,782 9,559 2,527 2,404 78 829 (248) 109,484<br />

Liabilities held for trading 30 355 50 76 21 26 19 1 578<br />

Liabilities designated at fair value 2,284 6,958 1,128 2,608 3,330 4,725 147 131 21,311<br />

Negative value of derivatives 8,504 21,985 30,489<br />

Fair value revaluation of portfolio hedge 239 239<br />

Debt securities 1,625 53,278 38,806 47,768 40,647 227 2,613 (238) 184,726<br />

Subordinated and convertible debts 2 1,081 208 2,003 786 143 79 63 4 365<br />

Technical provision from insurance <strong>com</strong>panies 12,288 12,288<br />

Provisions and other obligations 1,468 1,468<br />

Tax liabilities 1,276 1,276<br />

Other liabilities 1,748 970 73 24 103 3,623 4 0 6,545<br />

Liabilities included in disposal groups<br />

held for sale 785 785<br />

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

COMPTES SOCIAUX<br />

TOTAL 134,277 175,451 66,964 59,024 49,354 28,314 12,877 22,047 548,308<br />

NET POSITION At sight and Up to More than More than Over Undetermined<br />

on demand 3 3 months 1 to 5 5 years maturity<br />

As of Dec. 31, <strong>2006</strong> months to 1 year years<br />

On balance sheet sensitivity gap (92,076) (38,442) 20,019 14,512 120,113 (6,248)<br />

Balance-sheet sensitivity gap is hedged through derivatives.<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 207