Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

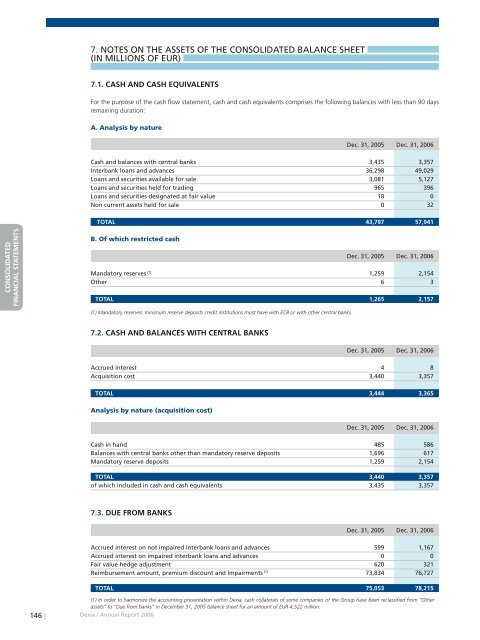

7. NOTES ON THE ASSETS OF THE CONSOLIDATED BALANCE SHEET<br />

(IN MILLIONS OF EUR)<br />

7.1. CASH AND CASH EQUIVALENTS<br />

For the purpose of the cash flow statement, cash and cash equivalents <strong>com</strong>prises the following balances with less than 90 days<br />

remaining duration:<br />

A. Analysis by nature<br />

RAPPORT DE GESTION<br />

Dec. 31, 2005 Dec. 31, <strong>2006</strong><br />

Cash and balances with central banks 3,435 3,357<br />

Interbank loans and advances 36,298 49,029<br />

Loans and securities available for sale 3,081 5,127<br />

Loans and securities held for trading 965 396<br />

Loans and securities designated at fair value 18 0<br />

Non current assets held for sale 0 32<br />

TOTAL 43,797 57,941<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

B. Of which restricted cash<br />

Dec. 31, 2005 Dec. 31, <strong>2006</strong><br />

Mandatory reserves (1) 1,259 2,154<br />

Other 6 3<br />

TOTAL 1,265 2,157<br />

(1) Mandatory reserves: minimum reserve deposits credit institutions must have with ECB or with other central banks.<br />

COMPTES SOCIAUX<br />

7.2. CASH AND BALANCES WITH CENTRAL BANKS<br />

Dec. 31, 2005 Dec. 31, <strong>2006</strong><br />

Accrued interest 4 8<br />

Acquisition cost 3,440 3,357<br />

TOTAL 3,444 3,365<br />

Analysis by nature (acquisition cost)<br />

Dec. 31, 2005 Dec. 31, <strong>2006</strong><br />

Cash in hand 485 586<br />

Balances with central banks other than mandatory reserve deposits 1,696 617<br />

Mandatory reserve deposits 1,259 2,154<br />

TOTAL 3,440 3,357<br />

of which included in cash and cash equivalents 3,435 3,357<br />

7.3. DUE FROM BANKS<br />

Dec. 31, 2005 Dec. 31, <strong>2006</strong><br />

Accrued interest on not impaired interbank loans and advances 599 1,167<br />

Accrued interest on impaired interbank loans and advances 0 0<br />

Fair value hedge adjustment 620 321<br />

Reimbursement amount, premium discount and impairments (1) 73,834 76,727<br />

TOTAL 75,053 78,215<br />

146 |<br />

(1) In order to harmonize the accounting presentation within <strong>Dexia</strong>, cash collaterals of some <strong>com</strong>panies of the Group have been reclassified from “Other<br />

assets“ to “Due from banks“ in December 31, 2005 balance sheet for an amount of EUR 4,522 million.<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>