Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

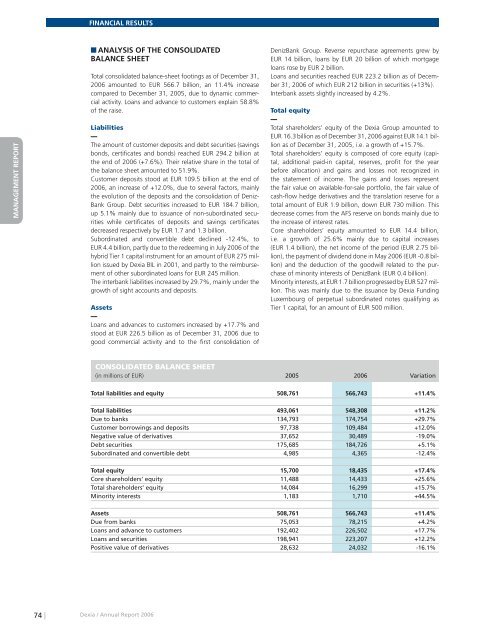

FINANCIAL RESULTS<br />

ANALYSIS OF THE CONSOLIDATED<br />

BALANCE SHEET<br />

Total consolidated balance-sheet footings as of December 31,<br />

<strong>2006</strong> amounted to EUR 566.7 billion, an 11.4% increase<br />

<strong>com</strong>pared to December 31, 2005, due to dynamic <strong>com</strong>mercial<br />

activity. Loans and advance to customers explain 58.8%<br />

of the raise.<br />

DenizBank Group. Reverse repurchase agreements grew by<br />

EUR 14 billion, loans by EUR 20 billion of which mortgage<br />

loans rose by EUR 2 billion.<br />

Loans and securities reached EUR 223.2 billion as of December<br />

31, <strong>2006</strong> of which EUR 212 billion in securities (+13%).<br />

Interbank assets slightly increased by 4.2%.<br />

Total equity<br />

MANAGEMENT REPORT<br />

COMPTES CONSOLIDÉS<br />

Liabilities<br />

The amount of customer deposits and debt securities (savings<br />

bonds, certificates and bonds) reached EUR 294.2 billion at<br />

the end of <strong>2006</strong> (+7.6%). Their relative share in the total of<br />

the balance sheet amounted to 51.9%.<br />

Customer deposits stood at EUR 109.5 billion at the end of<br />

<strong>2006</strong>, an increase of +12.0%, due to several factors, mainly<br />

the evolution of the deposits and the consolidation of Deniz-<br />

Bank Group. Debt securities increased to EUR 184.7 billion,<br />

up 5.1% mainly due to issuance of non-subordinated securities<br />

while certificates of deposits and savings certificates<br />

decreased respectively by EUR 1.7 and 1.3 billion.<br />

Subordinated and convertible debt declined -12.4%, to<br />

EUR 4.4 billion, partly due to the redeeming in July <strong>2006</strong> of the<br />

hybrid Tier 1 capital instrument for an amount of EUR 275 million<br />

issued by <strong>Dexia</strong> BIL in 2001, and partly to the reimbursement<br />

of other subordinated loans for EUR 245 million.<br />

The interbank liabilities increased by 29.7%, mainly under the<br />

growth of sight accounts and deposits.<br />

Assets<br />

Total shareholders’ equity of the <strong>Dexia</strong> Group amounted to<br />

EUR 16.3 billion as of December 31, <strong>2006</strong> against EUR 14.1 billion<br />

as of December 31, 2005, i.e. a growth of +15.7%.<br />

Total shareholders’ equity is <strong>com</strong>posed of core equity (capital,<br />

additional paid-in capital, reserves, profit for the year<br />

before allocation) and gains and losses not recognized in<br />

the statement of in<strong>com</strong>e. The gains and losses represent<br />

the fair value on available-for-sale portfolio, the fair value of<br />

cash-flow hedge derivatives and the translation reserve for a<br />

total amount of EUR 1.9 billion, down EUR 730 million. This<br />

decrease <strong>com</strong>es from the AFS reserve on bonds mainly due to<br />

the increase of interest rates.<br />

Core shareholders’ equity amounted to EUR 14.4 billion,<br />

i.e. a growth of 25.6% mainly due to capital increases<br />

(EUR 1.4 billion), the net in<strong>com</strong>e of the period (EUR 2.75 billion),<br />

the payment of dividend done in May <strong>2006</strong> (EUR -0.8 billion)<br />

and the deduction of the goodwill related to the purchase<br />

of minority interests of DenizBank (EUR 0.4 billion).<br />

Minority interests, at EUR 1.7 billion progressed by EUR 527 million.<br />

This was mainly due to the issuance by <strong>Dexia</strong> Funding<br />

Luxembourg of perpetual subordinated notes qualifying as<br />

Tier 1 capital, for an amount of EUR 500 million.<br />

COMPTES SOCIAUX<br />

Loans and advances to customers increased by +17.7% and<br />

stood at EUR 226.5 billion as of December 31, <strong>2006</strong> due to<br />

good <strong>com</strong>mercial activity and to the first consolidation of<br />

CONSOLIDATED BALANCE SHEET<br />

(in millions of EUR) 2005 <strong>2006</strong> Variation<br />

Total liabilities and equity 508,761 566,743 +11.4%<br />

Total liabilities 493,061 548,308 +11.2%<br />

Due to banks 134,793 174,754 +29.7%<br />

Customer borrowings and deposits 97,738 109,484 +12.0%<br />

Negative value of derivatives 37,652 30,489 -19.0%<br />

Debt securities 175,685 184,726 +5.1%<br />

Subordinated and convertible debt 4,985 4,365 -12.4%<br />

Total equity 15,700 18,435 +17.4%<br />

Core shareholders’ equity 11,488 14,433 +25.6%<br />

Total shareholders’ equity 14,084 16,299 +15.7%<br />

Minority interests 1,183 1,710 +44.5%<br />

Assets 508,761 566,743 +11.4%<br />

Due from banks 75,053 78,215 +4.2%<br />

Loans and advance to customers 192,402 226,502 +17.7%<br />

Loans and securities 198,941 223,207 +12.2%<br />

Positive value of derivatives 28,632 24,032 -16.1%<br />

74 |<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong>