Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TREASURY AND FINANCIAL MARKETS<br />

UNDERLYING (1) RESULTS<br />

Treasury and Financial Markets (TFM) had once again a very<br />

good year in <strong>2006</strong>. The net in<strong>com</strong>e – Group share reached<br />

EUR 308 million, up 11.2% on 2005, which was a record year.<br />

Fixed In<strong>com</strong>e activities (of which mainly the Credit Spread Portfolio)<br />

was the main contributor to TFM’s net in<strong>com</strong>e (73%),<br />

the balance being equally split between Market Engineering<br />

and Trading (MET) (13%) and Treasury (14%).<br />

Total in<strong>com</strong>e for the full year <strong>2006</strong> amounted to EUR 561<br />

million, up 11.5%. This very good progression stems mainly<br />

from the MET segment, with a EUR +54 million growth as<br />

<strong>com</strong>pared to 2005. The Public Finance Market Engineering,<br />

the Personal Financial Services Engineering (PFSE), Foreign<br />

Exchange and Equities activities performed particularly well.<br />

Of note, a part of this in<strong>com</strong>e growth has to be analyzed<br />

in parallel with the increase of the tax expense, as explained<br />

below. The Fixed In<strong>com</strong>e segment contributed for EUR +22 million<br />

with notably Credit Spread Portfolio achieving a very<br />

successful year. Finally, the Treasury segment experienced a<br />

negative contribution due to the interest rates movement<br />

during the year <strong>2006</strong>.<br />

Costs remained unchanged <strong>com</strong>pared to 2005 to EUR 176 million.<br />

This very good achievement is related to the equity-brokerage<br />

activities in France, which were restructured in 2005,<br />

bringing down the cost base in <strong>2006</strong>. It is worth mentioning<br />

that this activity came back to profitability in <strong>2006</strong>. Without<br />

this effect, the costs would have increased slightly due<br />

to some IT expenses and recruitments. Thus, the underlying<br />

cost-in<strong>com</strong>e ratio decreased from 34.8% in 2005 to 31.5%<br />

in <strong>2006</strong>.<br />

(1) As described on page 70.<br />

As a consequence, the gross operating in<strong>com</strong>e amounted<br />

to EUR 384 million, a very robust increase by 17.3%. Of note,<br />

the quarter-on-quarter trend is also very good with a 19.5%<br />

increase.<br />

Cost of risk remained at a historic low level close to zero.<br />

Tax expense amounted to EUR 71 million for the full year<br />

<strong>2006</strong>, up 53.6% in one year. The rise is more than half<br />

explained by the increase of gross operating in<strong>com</strong>e, and for<br />

the largest remaining part by MET’s arbitrage strategies. To<br />

recall, those strategies embed cash and derivative instruments<br />

whose value changes can cause simultaneously revenue and<br />

tax increases if they go in one direction, or revenue and tax<br />

reductions if they go in the opposite direction. The impacts<br />

in <strong>2006</strong> were a EUR 11 million tax progression linked to a<br />

EUR 17 million revenue increase within the Equities and PFSE<br />

activities.<br />

The return on economic equity (ROEE) declined slightly to<br />

stand at the satisfactory level of 22.0%.<br />

MANAGEMENT REPORT<br />

COMPTES CONSOLIDÉS<br />

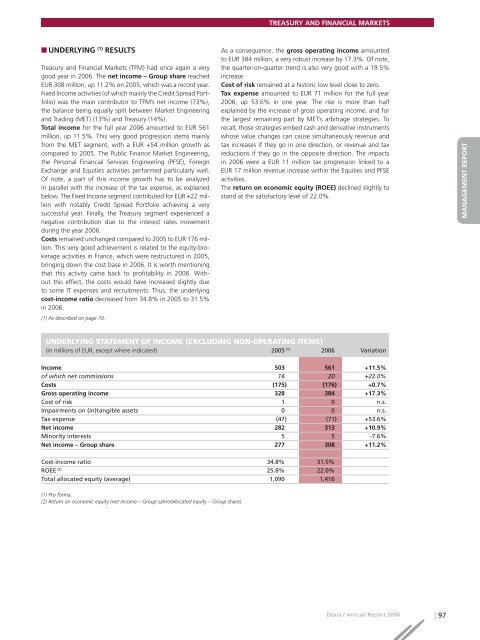

UNDERLYING STATEMENT OF INCOME (EXCLUDING NON-OPERATING ITEMS)<br />

(in millions of EUR, except where indicated) 2005 (1) <strong>2006</strong> Variation<br />

In<strong>com</strong>e 503 561 +11.5%<br />

of which net <strong>com</strong>missions 16 20 +22.0%<br />

Costs (175) (176) +0.7%<br />

Gross operating in<strong>com</strong>e 328 384 +17.3%<br />

Cost of risk 1 0 n.s.<br />

Impairments on (in)tangible assets 0 0 n.s.<br />

Tax expense (47) (71) +53.6%<br />

Net in<strong>com</strong>e 282 313 +10.9%<br />

Minority interests 5 5 -7.6%<br />

Net in<strong>com</strong>e – Group share 277 308 +11.2%<br />

COMPTES SOCIAUX<br />

Cost-in<strong>com</strong>e ratio 34.8% 31.5%<br />

ROEE (2) 25.8% 22.0%<br />

Total allocated equity (average) 1,090 1,416<br />

(1) Pro forma.<br />

(2) Return on economic equity (net in<strong>com</strong>e – Group sahre/allocated equity – Group share).<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 97