Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RISK MANAGEMENT<br />

Even though the operational Asset and Liability Management<br />

remains decentralized in <strong>Dexia</strong>’s three major entities, ALM<br />

risks are supervised and managed globally by the <strong>Dexia</strong> Group<br />

ALM Committee, which includes the members of the Management<br />

Board. The ALM Committee monitors the overall<br />

consistency of the Group’s Asset and Liability Management<br />

process, decides on the methodologies and the risk measurement<br />

guidelines, notably on the investment of shareholders’<br />

equity and on internal transfer pricing mechanisms and also<br />

decides on investment strategies in local entities (interest,<br />

forex, equities).<br />

In addition, the Management Board is kept periodically<br />

informed of ALM main risks and positions.<br />

CURRENCY RISK<br />

Currency risk is the risk of loss resulting from changes in<br />

exchange rates.<br />

TRADING<br />

<strong>Dexia</strong> is an active participant in currency markets and carries<br />

currency risk from these trading activities, conducted primarily<br />

in the Treasury and Financial Markets business line. These trading<br />

exposures are subject to VaR (Value at Risk) and are included<br />

in the VaR mentioned on page 208 of this annual <strong>report</strong>.<br />

NON-TRADING<br />

<strong>Dexia</strong>'s <strong>report</strong>ing currency is the euro but its assets, liabilities,<br />

in<strong>com</strong>e and expense are denominated in many currencies<br />

with significant amounts in USD. Reported profits and<br />

losses are exchanged at each closing date into euro or into<br />

the <strong>com</strong>pany's functional currency, reducing the exchange<br />

rate exposure.<br />

Within its Assets & Liabilities Committee, <strong>Dexia</strong> proactively<br />

decides on the opportunity to hegde expected foreign currency<br />

risks in its results in the main currencies (mainly in USD).<br />

HOLDINGS<br />

<strong>Dexia</strong> analyzes the opportunity to hedge all or part of the<br />

currency risk relating to participation investments in foreign<br />

currencies.<br />

In <strong>2006</strong>, <strong>Dexia</strong> hedged the payment of the acquisition of<br />

DenizBank in foreign currencies, i.e. the payment in USD of<br />

the amount due to the majority shareholder and the payment<br />

in TRY of the amount due to the minority shareholders in<br />

accordance with the mandatory tender offer. The holding in<br />

DenizBank is not hedged due to the cost of the transaction.<br />

LIQUIDITY MANAGEMENT<br />

<strong>Dexia</strong> adopts a sound and prudent policy on liquidity management.<br />

The balance between its available funding sources<br />

and their use is carefully managed and supervised. In practice,<br />

particular attention goes to:<br />

• assessing the adequacy of expected new lending production<br />

(in terms of maturity and amount) as opposed to available<br />

resources;<br />

• assuring <strong>Dexia</strong>’s liquidity, within distressed market circumstances.<br />

The first question is addressed in the annual planning process.<br />

Each year, the forecasts for the new lending production<br />

are <strong>com</strong>pared with the funding capacity. The purpose is to<br />

preserve an acceptable liquidity gap profile for the Group. In<br />

order to reflect the funding cost of the transactions originated<br />

by the business lines more accurately, whether they require<br />

funding or bring funding, the Group has improved its analytical<br />

accounting process. The purpose of this kind of “internal<br />

market“ for liquidity is to provide the right incentive to the<br />

business lines to achieve a natural match between the lending<br />

and the funding capacities.<br />

The second question is addressed by assessing <strong>Dexia</strong>’s liquidity<br />

profile under various distressed liquidity scenarios. The<br />

results and impacts observed under the different scenarios<br />

are analyzed and subsequently translated into a set of limits<br />

and ratios. The <strong>Dexia</strong> liquidity framework is conceived in<br />

such a way that by virtue of its liquidity reserve (notably the<br />

Credit Spread Portfolio), <strong>Dexia</strong> can withstand a total squeeze<br />

of funding and a stress on deposits for one year whilst maintaining<br />

its lending activity. The liquidity position is monitored<br />

and controlled from one day up to several months. Hence<br />

great care is paid to the forecast of expected liquidity needs in<br />

the main currencies as well as to the estimate of the liquidity<br />

reserve. Special attention is also paid to the Group’s off-balance-sheet<br />

liquidity <strong>com</strong>mitments.<br />

Given their importance, all the main issues regarding the<br />

liquidity of the Group are directly managed by the Group’s<br />

ALM Committee, which includes all the members of the<br />

Management Board.<br />

A global liquidity contingency plan is part of the guidelines<br />

and is tested on a regular basis.<br />

MANAGEMENT REPORT<br />

COMPTES CONSOLIDÉS<br />

COMPTES SOCIAUX<br />

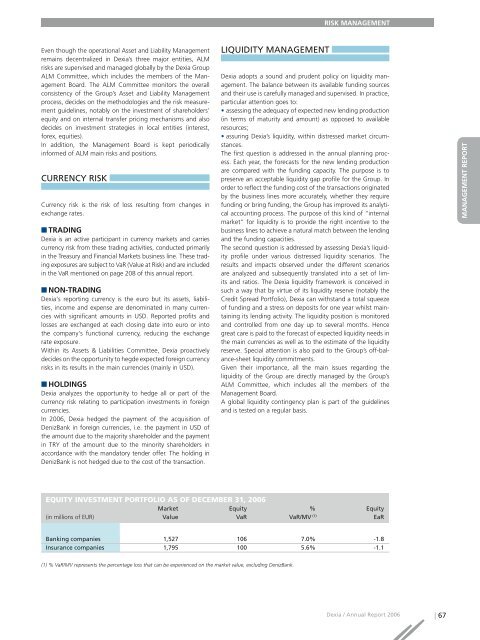

EQUITY INVESTMENT PORTFOLIO AS OF DECEMBER 31, <strong>2006</strong><br />

Market Equity % Equity<br />

(in millions of EUR) Value VaR VaR/MV (1) EaR<br />

Banking <strong>com</strong>panies 1,527 106 7.0% -1.8<br />

Insurance <strong>com</strong>panies 1,795 100 5.6% -1.1<br />

(1) % VaR/MV represents the percentage loss that can be experienced on the market value, excluding DenizBank.<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 67