Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TREASURY AND FINANCIAL MARKETS<br />

TREASURY AND FINANCIAL<br />

MARKETS (TFM)<br />

<strong>2006</strong> was the first year of TFM’s new organization, set on<br />

three business pillars:<br />

• Fixed In<strong>com</strong>e which is involved in all credit spread activities;<br />

• Market Engineering and Trading which regroup all <strong>com</strong>petences<br />

in the sectors of interest rates, forex and equities;<br />

• Group Treasury which is in charge of the financial management<br />

of <strong>Dexia</strong> balance sheet.<br />

This new organization aims at increasing the number of<br />

financial market products offered to the different customers<br />

of <strong>Dexia</strong> (public finance, retail and private banking), develop<br />

TFM’s own clientele and manage <strong>Dexia</strong> Group and the entities<br />

balance sheets. Of note, <strong>Dexia</strong> Capital Markets has been<br />

D E<br />

A<br />

rewarded for its efficiency in <strong>2006</strong> and has been designated<br />

as “best lead manager of regional/ municipal bonds“ by<br />

its peers, in the EuroWeek magazine of January 2007. This<br />

award is good recognition of the increasing position of <strong>Dexia</strong><br />

on intermediation’s field, the quality of its products and the<br />

involved teams in TFM and PPF.<br />

A new long-term strategy for TFM (TFM+) was launched with<br />

a view to increasing the contribution of this activity in <strong>Dexia</strong><br />

revenue stream. TFM+ aims at using all of <strong>Dexia</strong>’s strengths: its<br />

very good knowledge of certain asset classes, its origination<br />

capacity, and its know-how in balance sheet management.<br />

For this purpose, the IT system in all dealing rooms is in the<br />

process of being harmonized, allowing a better front-to-back<br />

approach and more integrated transactions.<br />

ACTIVITY<br />

Following the high level reached in <strong>2006</strong>, Group Treasury<br />

activities were again very buoyant in <strong>2006</strong>, supporting the<br />

growth of the Group’s balance sheet. The long-term bonds<br />

issued represented a total of EUR 29.9 billion for the full year<br />

<strong>2006</strong> (against EUR 29.7 billion in 2005). EUR 18.6 billion bear<br />

the AAA signature of <strong>Dexia</strong> Municipal Agency (DMA) or <strong>Dexia</strong><br />

Kommunalbank Deutschland. The private placements represented<br />

50% of the total issuance volumes in <strong>2006</strong>, of which<br />

70% through the AAA issuers, despite a rather difficult market<br />

environment in the fourth quarter for the AA issuers. The<br />

public placement activity remained important in <strong>2006</strong>, with<br />

almost 28% of the total issuances of the Group. In this area,<br />

DMA made a warmly wel<strong>com</strong>ed <strong>com</strong>eback on USD transactions<br />

by top quality investors, leading to a second issue which<br />

was largely oversubscribed. The retail-oriented bond activity<br />

accounts for nearly 20% of the total issuances of the Group,<br />

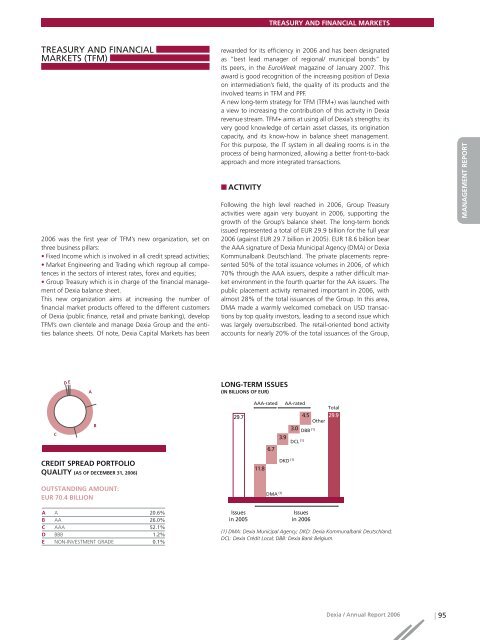

LONG-TERM ISSUES<br />

(IN BILLIONS OF EUR)<br />

MANAGEMENT REPORT<br />

COMPTES CONSOLIDÉS<br />

COMPTES SOCIAUX<br />

C<br />

B<br />

29.7<br />

AAA-rated AA-rated<br />

Total<br />

4.5 29.9<br />

Other<br />

3.0 DBB (1)<br />

3.9<br />

DCL (1)<br />

6.7<br />

CREDIT SPREAD PORTFOLIO<br />

QUALITY (AS OF DECEMBER 31, <strong>2006</strong>)<br />

OUTSTANDING AMOUNT:<br />

EUR 70.4 BILLION<br />

11.8<br />

DMA (1)<br />

DKD (1)<br />

A A 20.6%<br />

B AA 26.0%<br />

C AAA 52.1%<br />

D BBB 1.2%<br />

E NON-INVESTMENT GRADE 0.1%<br />

Issues<br />

in 2005<br />

Issues<br />

in <strong>2006</strong><br />

(1) DMA: <strong>Dexia</strong> Municipal Agency; DKD: <strong>Dexia</strong> Kommunalbank Deutschland;<br />

DCL: <strong>Dexia</strong> Crédit Local; DBB: <strong>Dexia</strong> Bank Belgium.<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 95