Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

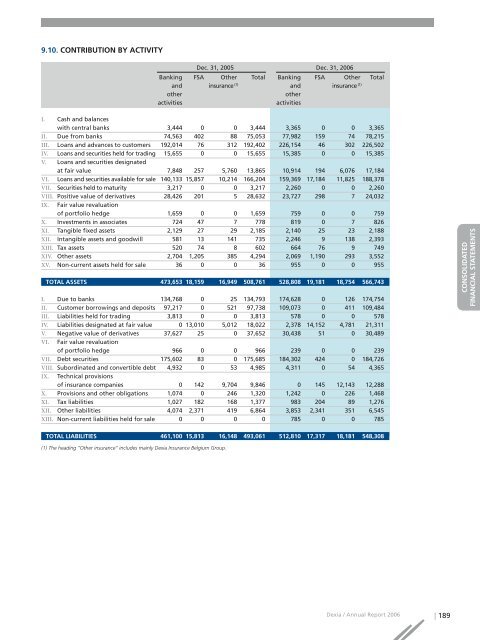

9.10. CONTRIBUTION BY ACTIVITY<br />

Dec. 31, 2005 Dec. 31, <strong>2006</strong><br />

Banking FSA Other Total Banking FSA Other Total<br />

and insurance (1) and insurance (1)<br />

other<br />

other<br />

activities<br />

activities<br />

I. Cash and balances<br />

with central banks 3,444 0 0 3,444 3,365 0 0 3,365<br />

II. Due from banks 74,563 402 88 75,053 77,982 159 74 78,215<br />

III. Loans and advances to customers 192,014 76 312 192,402 226,154 46 302 226,502<br />

IV. Loans and securities held for trading 15,655 0 0 15,655 15,385 0 0 15,385<br />

V. Loans and securities designated<br />

at fair value 7,848 257 5,760 13,865 10,914 194 6,076 17,184<br />

VI. Loans and securities available for sale 140,133 15,857 10,214 166,204 159,369 17,184 11,825 188,378<br />

VII. Securities held to maturity 3,217 0 0 3,217 2,260 0 0 2,260<br />

VIII. Positive value of derivatives 28,426 201 5 28,632 23,727 298 7 24,032<br />

IX. Fair value revaluation<br />

of portfolio hedge 1,659 0 0 1,659 759 0 0 759<br />

X. Investments in associates 724 47 7 778 819 0 7 826<br />

XI. Tangible fixed assets 2,129 27 29 2,185 2,140 25 23 2,188<br />

XII. Intangible assets and goodwill 581 13 141 735 2,246 9 138 2,393<br />

XIII. Tax assets 520 74 8 602 664 76 9 749<br />

XIV. Other assets 2,704 1,205 385 4,294 2,069 1,190 293 3,552<br />

XV. Non-current assets held for sale 36 0 0 36 955 0 0 955<br />

TOTAL ASSETS 473,653 18,159 16,949 508,761 528,808 19,181 18,754 566,743<br />

I. Due to banks 134,768 0 25 134,793 174,628 0 126 174,754<br />

II. Customer borrowings and deposits 97,217 0 521 97,738 109,073 0 411 109,484<br />

III. Liabilities held for trading 3,813 0 0 3,813 578 0 0 578<br />

IV. Liabilities designated at fair value 0 13,010 5,012 18,022 2,378 14,152 4,781 21,311<br />

V. Negative value of derivatives 37,627 25 0 37,652 30,438 51 0 30,489<br />

VI. Fair value revaluation<br />

of portfolio hedge 966 0 0 966 239 0 0 239<br />

VII. Debt securities 175,602 83 0 175,685 184,302 424 0 184,726<br />

VIII. Subordinated and convertible debt 4,932 0 53 4,985 4,311 0 54 4,365<br />

IX. Technical provisions<br />

of insurance <strong>com</strong>panies 0 142 9,704 9,846 0 145 12,143 12,288<br />

X. Provisions and other obligations 1,074 0 246 1,320 1,242 0 226 1,468<br />

XI. Tax liabilities 1,027 182 168 1,377 983 204 89 1,276<br />

XII. Other liabilities 4,074 2,371 419 6,864 3,853 2,341 351 6,545<br />

XIII. Non-current liabilities held for sale 0 0 0 0 785 0 0 785<br />

RAPPORT DE GESTION<br />

CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

COMPTES SOCIAUX<br />

TOTAL LIABILITIES 461,100 15,813 16,148 493,061 512,810 17,317 18,181 548,308<br />

(1) The heading “Other insurance“ includes mainly <strong>Dexia</strong> Insurance Belgium Group.<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 189