Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Annual report 2006 - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

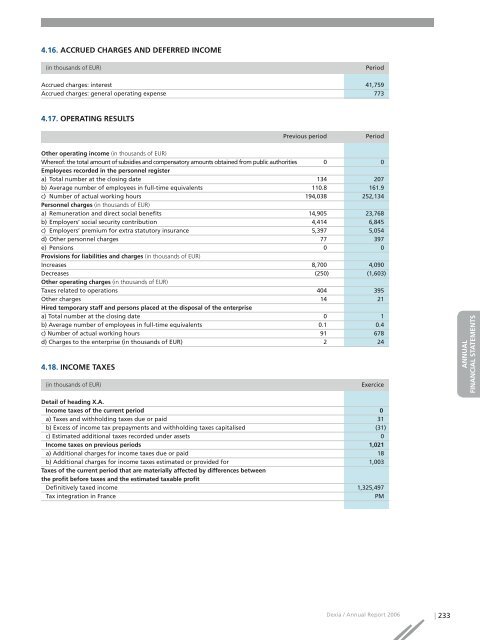

4.16. ACCRUED CHARGES AND DEFERRED INCOME<br />

(in thousands of EUR) Period<br />

Accrued charges: interest 41,759<br />

Accrued charges: general operating expense 773<br />

4.17. OPERATING RESULTS<br />

Previous period<br />

Period<br />

Other operating in<strong>com</strong>e (in thousands of EUR)<br />

Whereof: the total amount of subsidies and <strong>com</strong>pensatory amounts obtained from public authorities 0 0<br />

Employees recorded in the personnel register<br />

a) Total number at the closing date 134 207<br />

b) Average number of employees in full-time equivalents 110.8 161.9<br />

c) Number of actual working hours 194,038 252,134<br />

Personnel charges (in thousands of EUR)<br />

a) Remuneration and direct social benefits 14,905 23,768<br />

b) Employers’ social security contribution 4,414 6,845<br />

c) Employers’ premium for extra statutory insurance 5,397 5,054<br />

d) Other personnel charges 77 397<br />

e) Pensions 0 0<br />

Provisions for liabilities and charges (in thousands of EUR)<br />

Increases 8,700 4,090<br />

Decreases (250) (1,603)<br />

Other operating charges (in thousands of EUR)<br />

Taxes related to operations 404 395<br />

Other charges 14 21<br />

Hired temporary staff and persons placed at the disposal of the enterprise<br />

a) Total number at the closing date 0 1<br />

b) Average number of employees in full-time equivalents 0.1 0.4<br />

c) Number of actual working hours 91 678<br />

d) Charges to the enterprise (in thousands of EUR) 2 24<br />

4.18. INCOME TAXES<br />

(in thousands of EUR) Exercice<br />

RAPPORT DE GESTION<br />

COMPTES CONSOLIDÉS<br />

ANNUAL<br />

FINANCIAL STATEMENTS<br />

Detail of heading X.A.<br />

In<strong>com</strong>e taxes of the current period 0<br />

a) Taxes and withholding taxes due or paid 31<br />

b) Excess of in<strong>com</strong>e tax prepayments and withholding taxes capitalised (31)<br />

c) Estimated additional taxes recorded under assets 0<br />

In<strong>com</strong>e taxes on previous periods 1,021<br />

a) Additional charges for in<strong>com</strong>e taxes due or paid 18<br />

b) Additional charges for in<strong>com</strong>e taxes estimated or provided for 1,003<br />

Taxes of the current period that are materially affected by differences between<br />

the profit before taxes and the estimated taxable profit<br />

Definitively taxed in<strong>com</strong>e 1,325,497<br />

Tax integration in France<br />

PM<br />

<strong>Dexia</strong> / <strong>Annual</strong> Report <strong>2006</strong> | 233